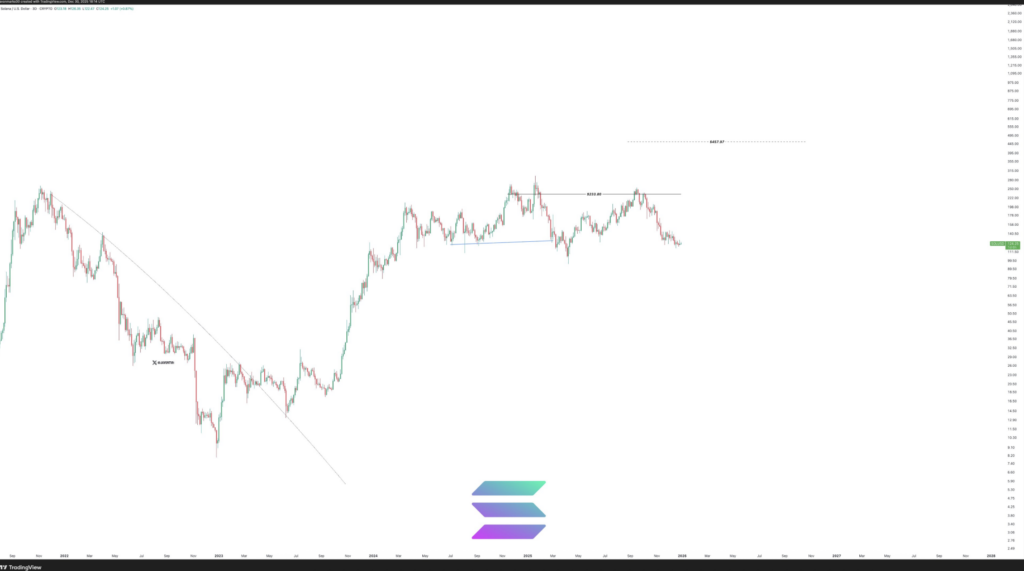

- Solana is consolidating after finishing a 1,350% cycle advance, not exhibiting indicators of structural breakdown.

- The $233.8 zone stays a key resistance, performing as a profit-taking and digestion space reasonably than a market high.

- Lengthy-term development construction stays intact so long as SOL holds above the $120–$123 macro assist zone.

Solana’s value motion has shifted gears. After finishing certainly one of its strongest cycle advances to this point, the asset is not racing greater, but it surely additionally isn’t breaking down. As an alternative, SOL has settled right into a managed consolidation section, with merchants now targeted on clearly outlined resistance overhead and long-term assist beneath.

The broader construction nonetheless issues right here. Solana beforehand climbed from its cycle low close to $16.12 all the best way to the $233.8 area, a transfer that delivered roughly a 1,350% growth. That stage wasn’t random both. Analysts had marked it properly prematurely as a projected resistance zone, not a remaining peak.

Javon Marks famous on X that SOL tagged this goal with placing accuracy. When value hits a stage like that after such a future, hesitation is regular. Revenue-taking, hedging, and positioning changes normally comply with, and Solana is not any exception.

Resistance Close to $233.8 Triggers Orderly Distribution

Since reaching the $233.8 zone, Solana hasn’t collapsed. That’s an essential element. As an alternative of a pointy reversal, value motion has cooled into sideways motion, suggesting digestion reasonably than exhaustion.

Every push into that resistance has drawn promoting stress, reinforcing the extent’s significance. Nonetheless, the reactions have been managed. Analysts describe this habits as distribution inside power, not a breakdown of development. In high-liquidity property, main cycle advances typically pause at projected ranges earlier than trying additional progress.

On decrease timeframes, this exhibits up as compressed ranges and overlapping candles. Momentum has slowed, however volatility hasn’t exploded. Consumers proceed to step in on dips, whereas sellers preserve rallies capped, creating a good equilibrium that feels extra like saved vitality than give up.

The $120 Zone Anchors Solana’s Bigger Cycle Construction

Zooming out, Solana’s macro construction stays intact. Worth continues to respect a rising trendline that traces again to the 2023 lows. That trendline intersects with the $120–$123 area, turning it right into a vital assist zone.

This space isn’t simply technical ornament. A number of historic reactions have confirmed it as a requirement zone, and it additionally strains up with prior horizontal assist. Add in its place close to the midpoint of the broader cycle vary, and the extent positive aspects much more weight.

So long as SOL holds above $120, the higher-low construction survives. That retains the bullish cycle framework alive, even when value continues to consolidate. A decisive break beneath that area would change the narrative. Till then, the market seems to be testing demand, not abandoning the development.

Briefly, Solana isn’t exhibiting indicators of panic or failure. It’s pausing, measuring itself, and ready for the subsequent resolution. Whether or not that resolves greater or decrease will rely upon how value behaves round these clearly outlined ranges.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.