- Anthony Scaramucci believes Solana may flip Ethereum by means of sooner development, not ETH decline.

- Solana generated practically $1.5 billion in community income over the previous 12 months.

- The flippening stays unsure, however momentum is clearly constructing into 2026.

Crypto markets took their fair proportion of bruises in 2025, leaving buyers cautious as 2026 approaches. Nonetheless, recent narratives are beginning to floor, and one of many loudest comes from SkyBridge Capital founder Anthony Scaramucci. His declare that Solana may ultimately flip Ethereum has reignited a long-running debate about velocity, scale, and real-world utilization. The query now could be whether or not this concept is simply discuss, or one thing that might truly materialize within the 12 months forward.

Why Scaramucci Thinks Solana Has the Edge

In a latest interview, Scaramucci laid out his case for Solana with out dismissing Ethereum outright. He argued that Solana’s explosive exercise development, low charges, and developer-friendly atmosphere give it a structural benefit. Based on him, Solana already processes extra exercise than dozens of different chains mixed, all whereas preserving prices minimal and efficiency excessive.

Importantly, Scaramucci framed the flippening not as Ethereum failing, however Solana rising sooner. He pointed to staking incentives, robust tokenomics, and merchandise like liquid staking ETFs as extra causes Solana continues to draw long-term capital.

Community Utilization and Income Are Backing the Narrative

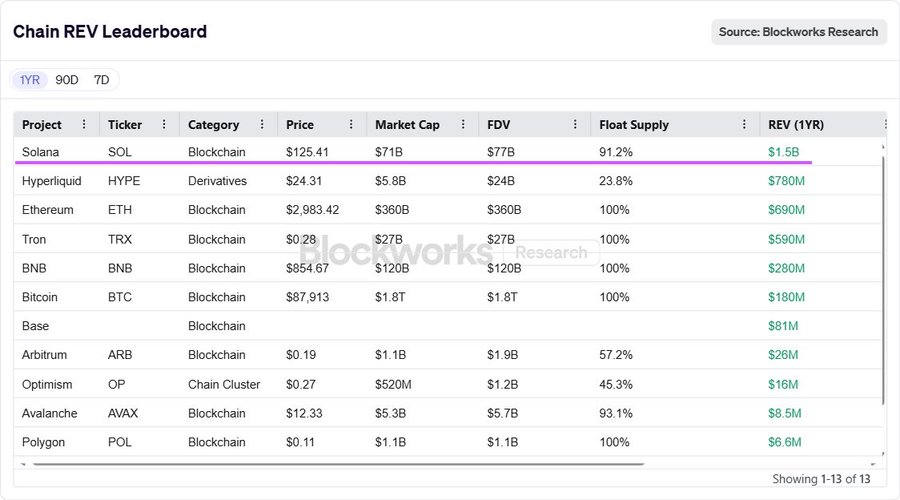

Past opinions, Solana’s onchain knowledge is beginning to flip heads. Based on figures shared by CryptoRUs, Solana generated practically $1.5 billion in community income over the previous 12 months. That whole reportedly exceeded the mixed income of Ethereum and different main opponents throughout the identical interval, a notable shift in how worth is being captured onchain.

The income surge reinforces the concept Solana’s “low charges, excessive throughput” mannequin isn’t nearly person expertise. At scale, fixed exercise can nonetheless translate into significant top-line numbers, even with out costly transaction prices.

What This Means for 2026

Flipping Ethereum stays a tall order. Ethereum nonetheless dominates DeFi, developer mindshare, and institutional integration. However Solana’s momentum, significantly in utilization and income, suggests it’s now not simply an alternate chain using hype cycles. If present traits persist, 2026 may see the hole slim additional, even when a full flip doesn’t occur instantly.

For now, the Solana-versus-Ethereum debate seems much less like hypothesis and extra like a query of execution. Whether or not Solana can maintain development by means of risky markets will possible determine how lifelike this narrative turns into.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.