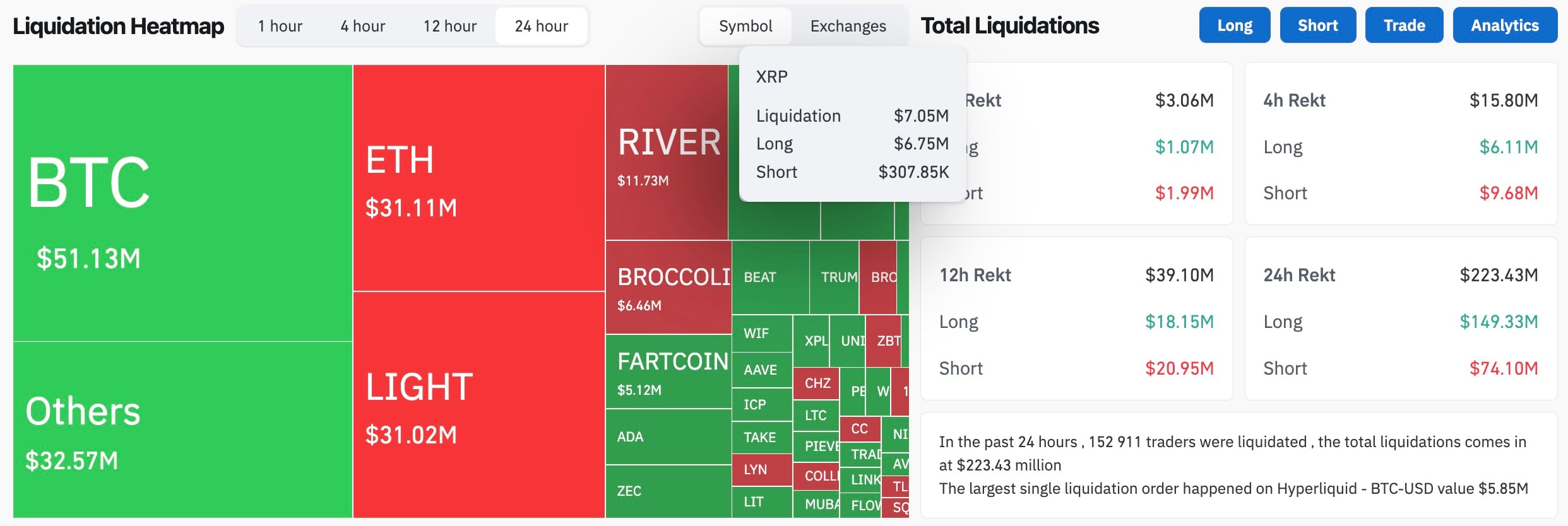

The primary buying and selling day of 2026 began with leverage getting punished throughout majors and smaller tokens on the identical time, which is why the liquidation map appears to be like like a mixture of large blocks and peculiar micro-stories residing subsequent to Bitcoin and Ethereum.

Over the previous 24 hours, complete liquidations reached $230.78 million, with $151.90 million in lengthy liquidations versus $78.88 million in shorts. The biggest single liquidation occurred on Hyperliquid, a BTC/USD place price $5.85 million.

TL;DR

- XRP posted a 2,198% liquidation imbalance with $7.05 million complete liquidations, virtually all from longs.

- Tether disclosed a $780 million Bitcoin purchase tied to eight,888.888888 BTC, bringing its pockets complete to 96,370 BTC.

- Meme coin BROCCOLI714 on Binance crashed 88% after a quick spike above $0.15, tied to a hacker-linked story involving a market-maker account.

XRP kicks off 2026 with 2,198% liquidation imbalance

XRP’s headline quantity comes from how one-sided the wipeout was. CoinGlass information for XRP exhibits $7.05 million in liquidations, with $6.75 million attributed to longs and solely $307,850 to shorts. That’s the sort of ratio that results in an “imbalance” story, as a result of it’s a directional hit that targets one aspect of positioning.

The XRP/USDT chart exhibits what meaning. Trying on the larger image, we are able to see a dip into the $1.82 space earlier than a rebound towards the $1.85 zone. This traces up with the concept the market pressured lengthy liquidations throughout the drop after which allowed the worth to get well as soon as leverage was cleared.

From a sensible standpoint, $1.82 is the latest draw back excessive, $1.85 per XRP is the present resolution zone, and the $1.88 to $1.90 space above is the place earlier promoting waves had been seen.

The explanation liquidation imbalance issues isn’t as a result of it predicts course by itself, however as a result of it tells us the market simply eliminated a little bit of one-sided publicity, which modifications what it takes to maneuver the worth subsequent.

Tether (USDT) unveils $780 million Bitcoin acquisition

The second theme is a reserve story with numbers that crypto speculators and long-term holders each watch, as a result of it’s a uncommon case the place the largest stablecoin issuer places arduous BTC quantities in entrance of the market. It was Tether, who withdrew 8,889 BTC from Bitfinex right now, and now the corporate holds 96,370 BTC valued at $8.5 billion.

The publish by CEO Paolo Ardoino says that Tether acquired 8,888.888888 BTC in This autumn, 2025. That’s the determine tied to the $780 million headline. In the event you divide the gorgeous quantity by 8,888.888888 BTC, you get about $87,750 per BTC — that’s according to the late-December costs we noticed throughout the market.

The necessary factor for the story is that Tether retains displaying Bitcoin as a essential a part of its reserve technique, and it’s doing it with numbers sufficiently big to make a splash as a macro-style headline, even on a day when liquidations are in every single place.

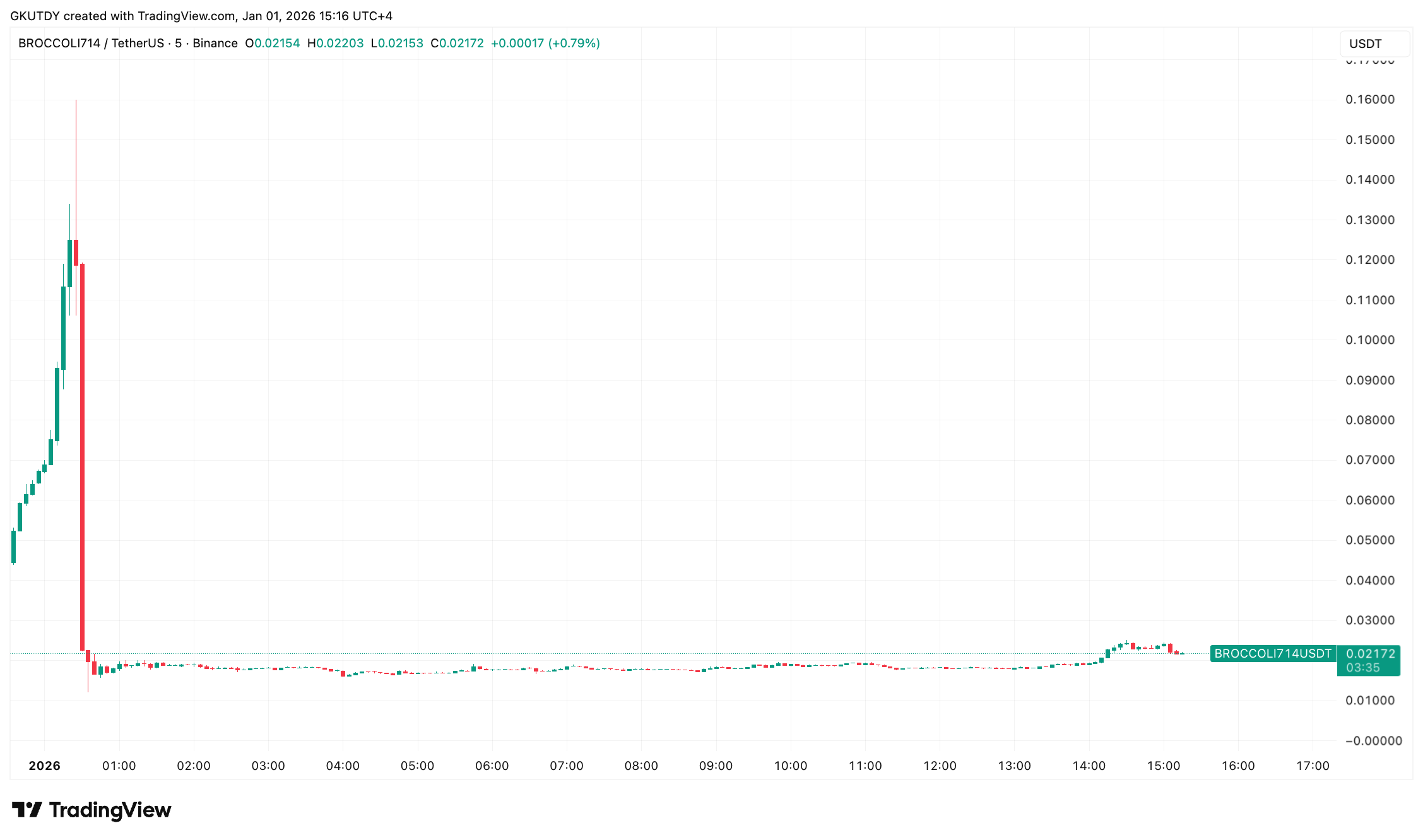

Binance meme coin BROCCOLI714 loses 88% after hacker hit

Binance meme coin BROCCOLI714 misplaced 88% after a hacker-linked incident, turning a fast-rising ticker into the day’s loudest microcap wipeout.

The additional twist is that BROCCOLI714 was one of many Broccoli-themed tokens that caught fireplace after Binance founder Changpeng Zhao referenced his canine’s title “Broccoli,” which helped the token get consideration quick and made the collapse journey even sooner throughout Binance-focused feeds.

The sell-off is being tied to a state of affairs the place an attacker gained entry to market-maker accounts on Binance and tried to maneuver compromised funds by means of coordinated exercise in a low-liquidity token.

The alleged sequence is straightforward: purchase spot utilizing the stolen funds, use different accounts to position futures trades, then route worth by means of coordinated trades between accounts. BROCCOLI714’s skinny order e-book made it a sensible automobile for a fast worth push and a violent reversal.

On the TradingView chart, BROCCOLI714 was buying and selling again round $0.019 after the sooner burst above $0.15 changed into a straight drop after which a flat, low-level grind. That “up quick, down sooner” sample is how an 88% crash headline will get born in minutes, particularly in a skinny e-book.

The liquidation map exhibits that there’s $6.46 million for BROCCOLI714, which means that the reversal didn’t simply scare spot patrons away — it pressured leveraged positions out at velocity.

Crypto market outlook

Within the meantime, the temper on crypto timelines is nearly aggressively bullish with the “time to purchase,” “this yr shall be inexperienced” and “macro is screaming bull run” posts throughout X.

Day one doesn’t should be spent watching each candle tick. And judging by right now’s report tales, skipping the screens for the opener can imply one fewer day obtainable for disappointments.

- XRP: watch the vary at $1.8493-$1.8552 and hold $1.82 because the draw back line if $1.85 fails to carry.

- Bitcoin (BTC): look ahead to acceptance above about $87,750 because the Tether This autumn purchase reference, or a return beneath that degree if it rejects.