- A BlackRock-linked pockets despatched $101M in BTC and $22M in ETH to Coinbase Prime

- U.S. spot Bitcoin ETFs noticed $348M in internet outflows on Dec. 31

- BlackRock’s IBIT led the withdrawals however nonetheless holds over $67B in BTC

A pockets labeled as belonging to BlackRock transferred 1,134 Bitcoin value roughly $101 million and seven,255 Ethereum valued at about $22 million to Coinbase Prime on Wednesday, in response to on-chain knowledge from Arkham Intelligence. Coinbase Prime serves because the institutional custody and buying and selling arm of the change, generally utilized by giant asset managers and ETF issuers.

The timing of the transfers has drawn consideration as they coincide with renewed outflows throughout U.S.-listed crypto exchange-traded merchandise.

Bitcoin and Ethereum ETF Outflows Decide Up Into 12 months-Finish

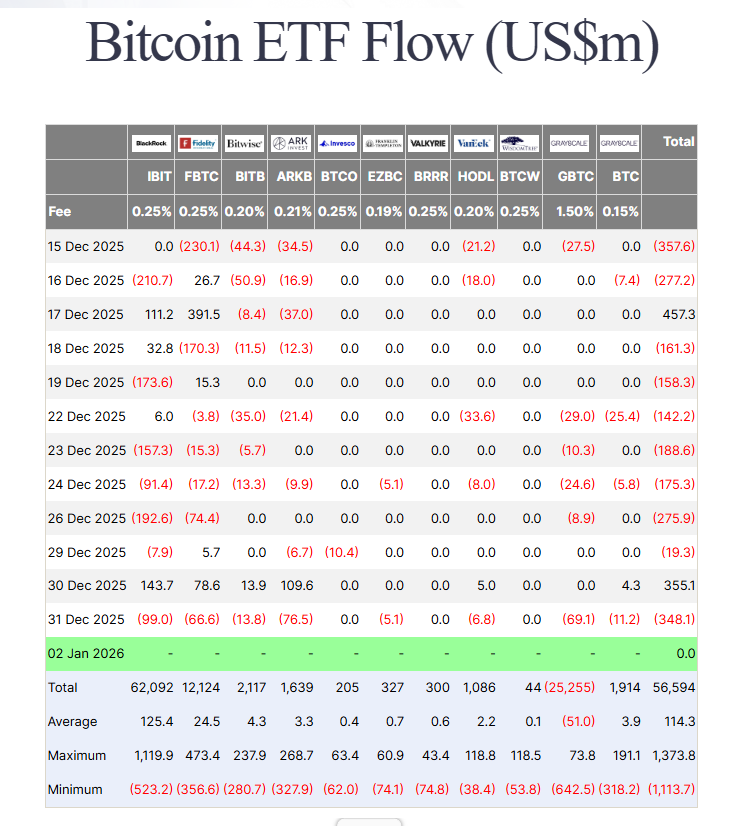

In response to knowledge from Farside Buyers, U.S. spot Bitcoin ETFs returned to internet outflows on December 31, shedding a mixed $348 million as markets wrapped up 2025. BlackRock’s iShares Bitcoin Belief (IBIT) accounted for $99 million of that complete, main withdrawals for the day.

Regardless of the outflows, IBIT stays the dominant spot Bitcoin ETF. The fund at the moment holds 770,791 BTC, valued at roughly $67.4 billion, giving it a commanding lead over rivals in each belongings below administration and market share.

What These Transfers Could Sign

Transfers to Coinbase Prime don’t essentially point out fast promoting. Institutional flows typically replicate portfolio rebalancing, ETF share redemptions, or inner custody actions tied to creation and redemption exercise. Nonetheless, the size of the transfers highlights how actively giant managers are managing publicity amid shifting market situations.

With ETF flows turning adverse into year-end, merchants will probably be watching intently to see whether or not institutional demand stabilizes or continues to melt in early 2026.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.