Bitcoin continues to grind sideways under the $90K degree, displaying indicators of compression after weeks of chop. Whereas there was no important bullish breakout but, the worth is urgent in opposition to key native resistances. Patrons try to reclaim management, however the lack of follow-through makes this a pivotal space to observe.

Bitcoin Worth Evaluation: The Each day Chart

On the every day chart, BTC stays trapped inside a descending channel, testing the higher boundary as soon as once more close to the crucial $90K degree. The 100-day and 200-day shifting averages positioned above $95K act as main dynamic resistance ranges, and consumers have but to reclaim them.

Regardless of current bounce makes an attempt, momentum has been fading. RSI is climbing however continues to be across the impartial territory, indicating that there’s room for a transfer larger. If consumers fail to interrupt above the $90K zone and the upper boundary of the channel, one other go to to the $80K assist zone stays doubtless. Till that breakout occurs, that is nonetheless a bearish market construction.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, the asset has been consolidating in a short-term channel. A number of rejections from the $90K degree, positioned on the center of the channel, have fashioned a mid-range ceiling. In the meantime, larger lows forming steadily under this zone present that consumers are slowly stepping in.

The RSI can be pushing larger, displaying bullish momentum constructing whereas nonetheless not being overbought. If a clear breakout above $90K happens with energy, it opens up the best way for a transfer towards the first resistance zone at $95K. Then again, failure on the $90K zone may imply one other sweep again towards $86K and even a breakdown of the channel that would pave the best way for a deeper drop towards the $80K space.

On-Chain Evaluation

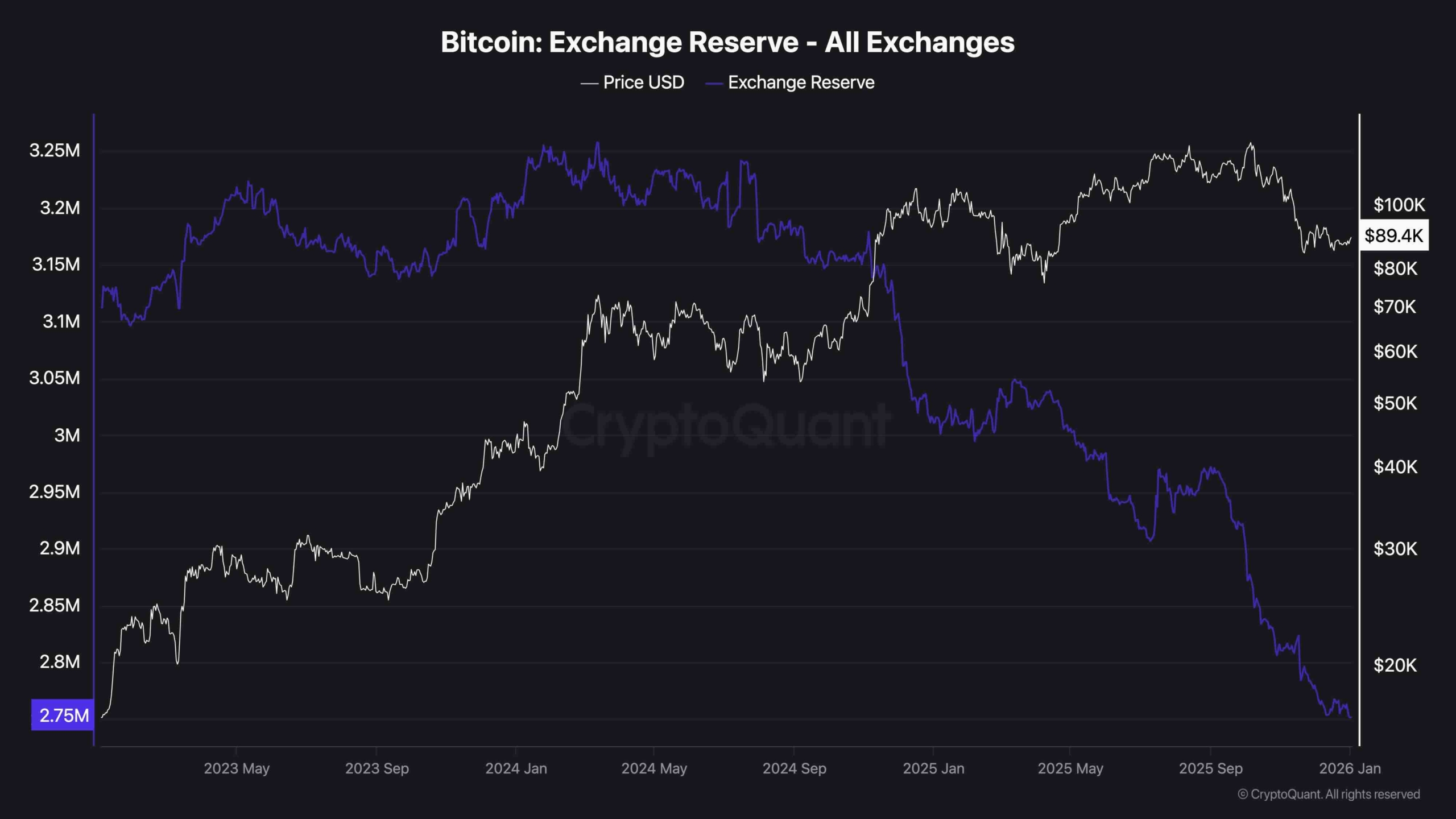

The BTC change reserve metric continues to drop sharply, hitting 2.75M BTC, a big multi-year low. This development displays ongoing accumulation and diminished promote strain on centralized exchanges.

Whereas the worth motion has remained stagnant, this underlying metric helps the long-term bullish thesis. Nonetheless, the disconnect between low reserves and weak value motion highlights the broader uncertainty and hesitation amongst market contributors heading into the primary quarter of 2026. Subsequently, extra sideways and even corrections may be required earlier than the market can start rallying once more.

The submit Bitcoin Worth Evaluation: BTC Targets $90K Once more – Breakout Incoming or One other Rejection? appeared first on CryptoPotato.