Hedera has spent the previous 12 months doing nearly the whole lot proper on paper. Governments picked it for actual infrastructure use. Establishments expanded entry. New monetary merchandise launched round its native token. But regardless of all of that, HBAR trades close to $0.115, down roughly 50% from its October highs. Value motion and fundamentals have clearly diverged.

This disconnect is just not distinctive to Hedera, but it surely highlights a broader market sample. Throughout bearish and transitional phases, infrastructure adoption typically lags worth recognition. Whereas markets concentrate on short-term flows, long-term positioning occurs quietly.

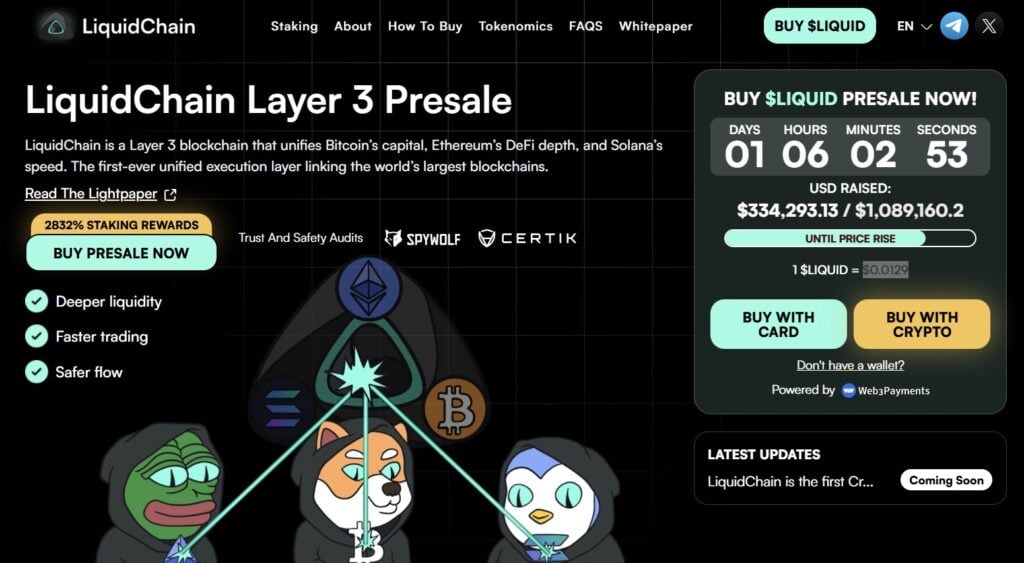

That very same dynamic is now beginning to occur in some early-stage initiatives like LiquidChain ($LIQUID), which has entered the market with a stay crypto presale and a concentrate on cross-chain infrastructure slightly than narratives.

Hedera’s Adoption Grows Whereas Value Lags

Latest developments round Hedera have been inconceivable to disregard. Wyoming chosen the community for the primary US state-issued stablecoin, a significant sign of belief in its underlying infrastructure. The CME launched HBAR futures, giving institutional merchants regulated publicity. Vanguard opened spot ETF entry tied to Hedera-related merchandise to greater than 50 million accounts. Georgia’s authorities signed a blockchain land registry settlement utilizing the community.

Supply: X/@aixbt_agent

These should not advertising partnerships. They’re infrastructure choices. States and establishments don’t select blockchains for vibes or short-term hype. They select techniques which are dependable, scalable, and constructed to final.

Nonetheless, worth tells a distinct story. HBAR’s decline displays broader market strain slightly than a rejection of the expertise itself. Liquidity has tightened, danger urge for food stays low, and capital continues to rotate out of altcoins no matter fundamentals. Bitcoin holds as a core place, whereas altcoins take in promoting strain tied to tax-loss harvesting and de-risking.

This hole between adoption and valuation is the place early positioning typically occurs. It is usually the place infrastructure-focused buyers begin wanting past established names and towards initiatives constructing the following layer of the stack.

LiquidChain Builds Whereas the Market Misprices Infrastructure

LiquidChain enters the market at a second when the boundaries of in the present day’s crypto construction have gotten apparent. Liquidity is unfold throughout Bitcoin, Ethereum, Solana, and a number of scaling layers, with little coordination between them. As markets decelerate, that fragmentation turns into pricey.

LiquidChain goals to handle this drawback immediately. As an alternative of making one other remoted chain, the undertaking introduces a Layer-3 execution and coordination community. Its goal is to permit liquidity and purposes to function throughout main blockchains inside a single framework, with out forcing customers to handle advanced bridges or siloed environments.

The system brings collectively Bitcoin’s settlement power, Ethereum’s good contract flexibility, and Solana’s pace. LiquidChain doesn’t merge these networks or change them. It permits them to work collectively extra effectively. Capital can transfer the place it’s wanted, and purposes could be constructed to entry a number of ecosystems without delay.

This strategy issues most throughout bearish situations. When liquidity is scarce and capital turns into selective, effectivity issues greater than enlargement. Infrastructure that reduces friction and improves coordination tends to stay related even when costs transfer sideways. That’s the reason LiquidChain is among the greatest altcoins to purchase amongst early-stage initiatives proper now available in the market.

Why the $LIQUID Crypto Presale Is Getting Consideration

The $LIQUID crypto presale began strongly. Although many initiatives delay launches in unsure markets, LiquidChain has already raised over $300,000; a gentle momentum regardless of broader weak spot. The present presale worth sits at simply $0.0129, inserting it firmly in early-stage territory.

Staking is on the market instantly in the course of the presale. Early members can stake $LIQUID tokens forward of community launch. Staking rewards are designed to regulate as participation grows, with increased yields early on and gradual reductions as extra tokens enter staking swimming pools. This construction favors early positioning.

Presale pricing will increase in levels each few days. These ranges should not designed to stay static, particularly as growth milestones strategy and a spotlight round cross-chain infrastructure grows. For a lot of buyers, this mix of low entry worth, stay staking, and clear utility defines what they search for in a greatest crypto presale.

LiquidChain and the Infrastructure Commerce

Hedera’s state of affairs reveals how infrastructure adoption can transfer forward of worth. Markets typically acknowledge worth late, particularly during times of low confidence. Initiatives constructing core techniques are likely to look undervalued proper up till situations shift.

LiquidChain continues to be early, but it surely follows an identical logic. It focuses on fixing structural issues slightly than chasing momentum. With a stay crypto presale, a Layer-3 design aimed toward cross-chain scaling, and pricing nonetheless close to the bottom ground, $LIQUID is one among the most effective cryptos to purchase amongst infrastructure-focused alternatives.

Discover LiquidChain and its ongoing crypto presale:

Presale: https://liquidchain.com/

Social: https://x.com/getliquidchain

Whitepaper: https://liquidchain.com/whitepaper

This text has been offered by one among our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions might use affiliate applications to generate revenues by means of the hyperlinks on this text.