The US federal debt handed $38 trillion on January 3, 2026, in response to Treasury monitoring. That new milestone was reached as some within the cryptocurrency neighborhood noticed Genesis Day, the anniversary of Bitcoin’s first block. Experiences notice the timing drew consideration as a result of it highlighted contrasts between public borrowing and Bitcoin’s fastened provide.

Debt Hits New Excessive

In line with Treasury figures, the gross federal debt climbed previous $38 trillion on January 3. The rise has been sharp over the past two years, shifting from about $34 trillion in early 2024 to roughly $36 trillion by late 2024, after which at $38.5 trillion in late 2025.

Analysts have calculated that the debt has been rising by roughly $6 billion per day not too long ago, a tempo that pushes curiosity prices larger and narrows choices for future budgets. A few of the enhance comes from persevering with funds shortfalls the place spending outstrips income.

On 3 January 2009, the Bitcoin community launched with the mining of its first block, often known as the Genesis Block.

Embedded in that block was a headline from @TheTimes newspaper:

“Chancellor on brink of second bailout for banks.”

The message completely anchors Bitcoin’s origin… pic.twitter.com/hGozJOYd3I

— Bitcoin Coverage UK (@bitcoinpolicyuk) January 3, 2026

Drivers Behind The Surge

In line with market protection, a number of elements are behind the soar: sustained annual deficits, rising curiosity funds on current debt, and huge spending payments enacted in latest classes of Congress.

Debt held by the general public and quantities owed to federal belief funds collectively make up the headline determine. Economists warn that because the debt grows relative to the scale of the economic system, extra taxpayer {dollars} can be wanted simply to service curiosity funds, which may crowd out different priorities.

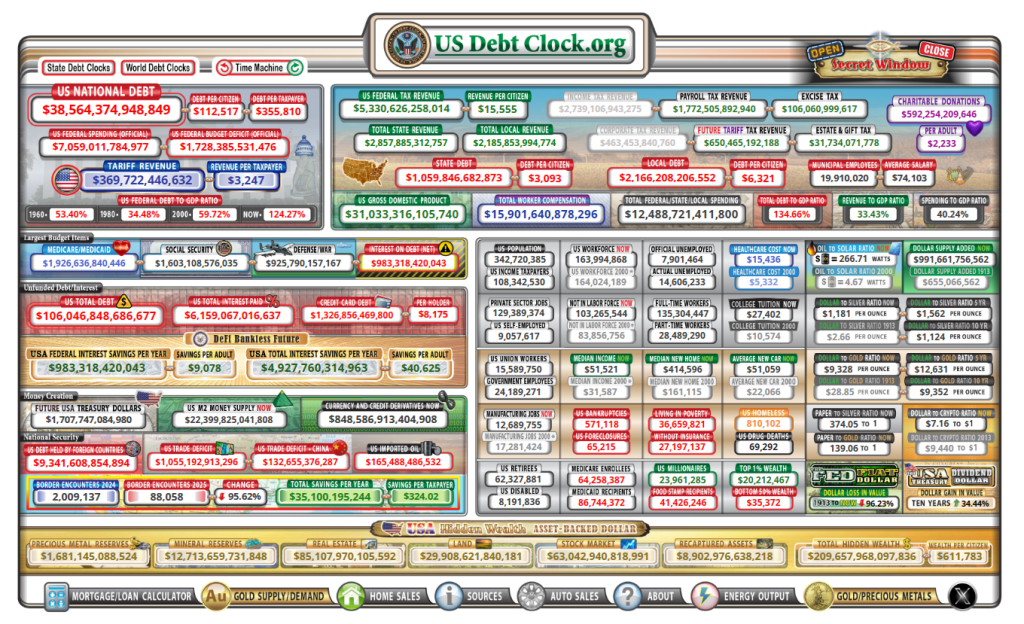

A dashboard displaying the US authorities debt, now over $38 trillion and climbing. Supply: US Debt Clock

Bitcoin Group Responds

On January 3, many Bitcoin supporters marked Genesis Day, a date they view as symbolic of economic change when Bitcoin’s first block was mined in 2009. Some customers posted concerning the distinction between a nationwide debt that retains climbing and Bitcoin’s capped provide of 21 million cash.

Others used the anniversary to raise broader questions on fiscal guidelines and cash provide. The reactions had been blended; some view it as a warning, others noticed it as a second for commemoration.

Buyers and commentators have weighed the implications. A portion of the market treats scarce property like Bitcoin and gold as hedges towards what they view because the dangers of heavy borrowing.

On the similar time, mainstream economists warning that working giant and chronic deficits can increase borrowing prices and sluggish development over the long term. Treasury officers monitor money wants intently and typically change borrowing schedules to cowl gaps between receipts and outlays.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.