- Ethereum is approaching a possible breakout as value tightens close to the highest of a descending wedge

- Community exercise is rising sharply, with new handle creation leaping over 100% in current weeks

- Mid-term holders could present short-term assist, however might add promoting stress as ETH rises

Ethereum is slowly, nearly stubbornly, urgent increased, now buying and selling close to the higher fringe of a descending wedge that’s been forming for weeks. It’s not a dramatic surge, extra of a affected person grind, however value is getting uncomfortably near a breakout zone. Merchants are watching carefully, as a result of strikes like this have a tendency to resolve a method or one other, and often with drive.

A lot of the current momentum is being linked to the Fusaka improve, which went reside on December 3. The improve focuses on enhancing scalability and reducing Layer 2 prices, a difficulty Ethereum has wrestled with for a very long time. With market members already positioning for 2026, these adjustments are touchdown at a second when confidence is slowly rebuilding, not exploding, however stabilizing.

Community Exercise Picks Up as New Customers Arrive

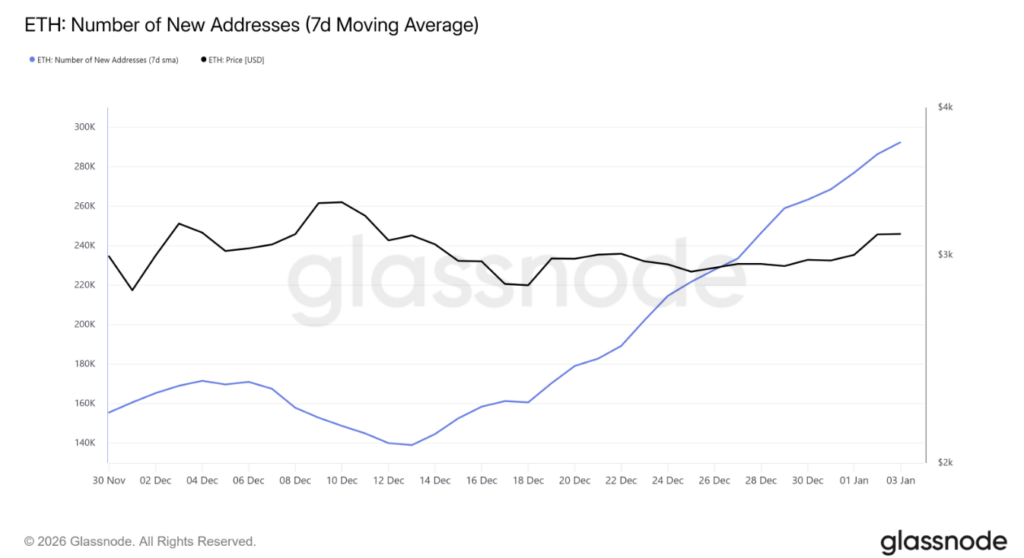

On-chain information reveals Ethereum’s community exercise has picked up sharply over the previous three weeks. New handle creation, wallets interacting with ETH for the primary time, has jumped by roughly 110% in that interval. That’s not a small bump, it’s a noticeable acceleration.

Ethereum is now including near 292,000 new addresses per day. A few of that’s doubtless seasonal, vacation buying and selling, year-end positioning, the same old stuff. However optimism across the Fusaka improve additionally seems to be pulling customers again into the ecosystem. Not each new pockets turns into a long-term holder, after all, however progress at this tempo usually feeds into increased transaction demand over time.

Mid-Time period Holders Add a Layer of Help, and Danger

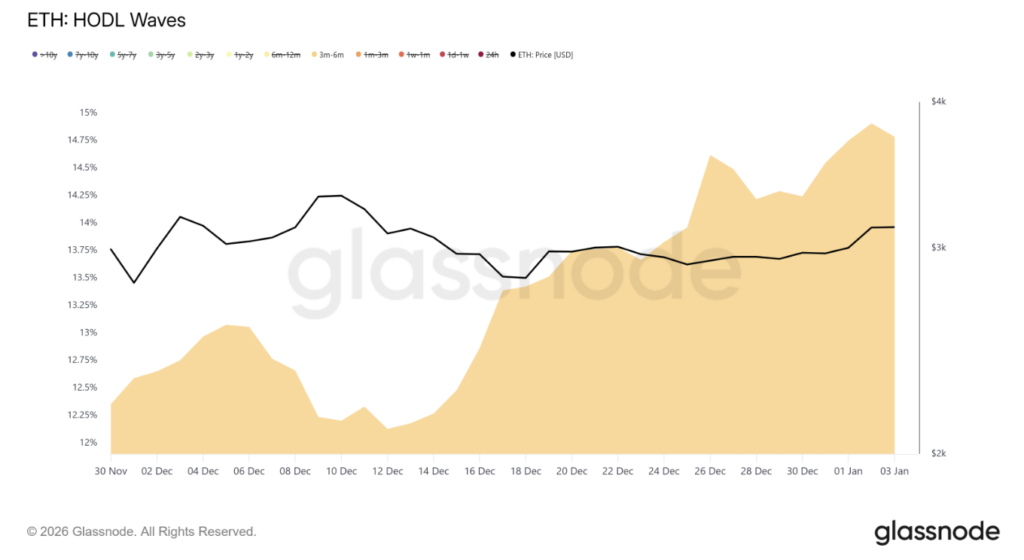

Zooming out, Ethereum’s HODL Waves reveal an fascinating dynamic. Wallets holding ETH for 3 to 6 months have grown noticeably, that means a big chunk of provide entered the market between July and October 2025. Early July patrons are sitting on beneficial properties, whereas those that entered later stay underwater.

This creates a sort of compelled persistence. Many holders aren’t desirous to promote at a loss, which reduces near-term promote stress and may also help assist value throughout pullbacks. That’s the great half. The flip facet is that as ETH climbs again towards break-even ranges for these holders, promoting stress might reappear. Any sustained upside will doubtless want contemporary demand to soak up that potential distribution.

Worth Motion Tightens Close to a Breakout Zone

From a technical standpoint, Ethereum stays locked inside a descending wedge that started forming in early November. ETH is at present buying and selling round $3,141, inserting it proper close to the construction’s higher boundary. When value compresses like this, it usually units the stage for a directional transfer, although the path isn’t assured.

Primarily based on the wedge projection, a full breakout might theoretically goal the $4,061 space, implying roughly 29.5% upside. That’s a stretch and not using a surge in shopping for stress. A extra reasonable near-term state of affairs would see ETH escape and push above $3,287, opening the door towards $3,447 if momentum builds.

Draw back Nonetheless Lurks If the Setup Fails

None of this comes with out threat. If macro situations worsen or patrons hesitate, a rejection at resistance might ship Ethereum again beneath the $3,000 mark. In that case, a retest of assist close to $2,902 turns into doubtless, and the bullish setup would lose credibility.

For now, Ethereum sits in a fragile steadiness. Adoption is rising, upgrades are in place, and value is urgent increased, however affirmation remains to be lacking. The following transfer, whichever approach it goes, is prone to outline sentiment nicely into early 2026.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.