With a 28% rally over the previous 4 days, Dogecoin (DOGE/USDT) is again at a well-known resolution level on larger timeframes, with three analysts leaning towards “pullback-then-continue” moderately than a easy fade, as long as a key Fibonacci reclaim holds.

Throughout the 4H, weekly, and month-to-month charts shared by Matt Hughes (@matthughes13), Byzantine Common (@ByzGeneral), and Cantonese Cat (@cantonmeow), the market is framed as robust however now confronting close by resistance after a pointy transfer.

Is Dogecoin’s Rally A Useless Cat Bounce?

Matt Hughes’ core inform is the weekly 0.382 retracement at 0.13847, which his chart highlights because the pivot degree bulls wanted to regain. He put it plainly: “DOGE regaining the .382 fib at .13847 is bullish for continuation larger. It was just some days in the past when some individuals have been bearish at this main assist zone that I identified within the submit beneath” He anchored that learn to the prior demand space he’d flagged final week: “Threat/reward within the .11-.12 zone for DOGE is unbelievable right here.”

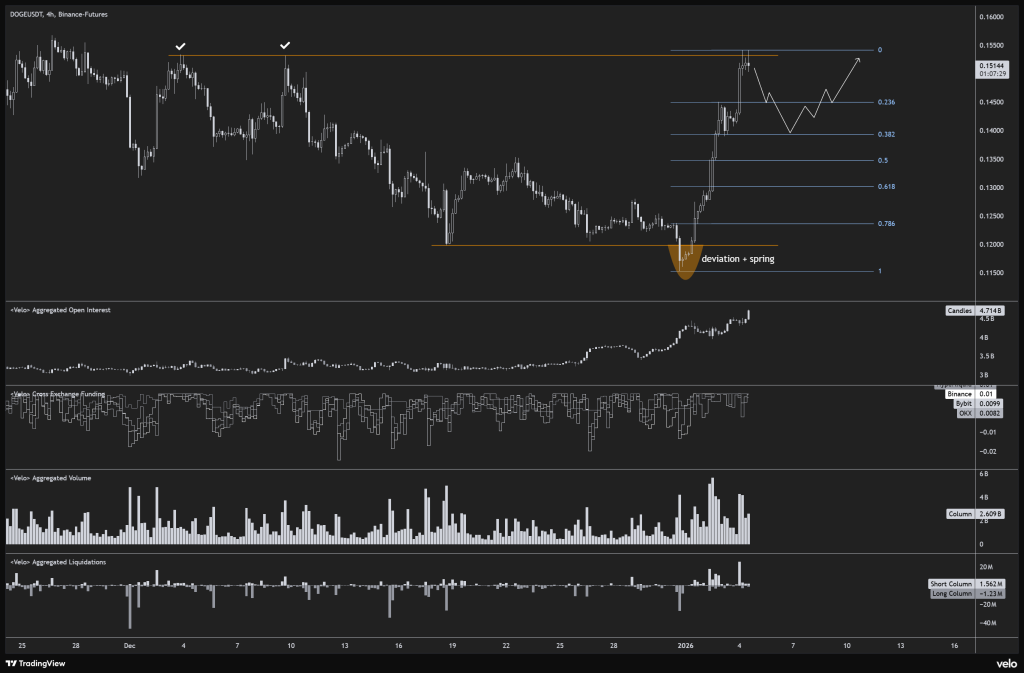

The newest, lower-timeframe view (DOGEUSDT 4H, Binance futures) reveals why “useless cat bounce” discuss is tempting: worth ripped larger, tagged the prior vary highs, after which backed off, precisely the form of sequence that may both flip right into a clear retest or an abrupt rollover.

Associated Studying

Byzantine Common’s take matches that posture. He expects a reset to the $0.14 area, earlier than the rally resumes: “DOGE made a reasonably unbelievable transfer. After taking out the vary highs I feel a little bit pullback is sensible, but it surely nonetheless seems to be very robust general.”

On the identical 4H format, the transfer is accompanied by rising derivatives positioning, Velo’s aggregated open curiosity is proven pushing as much as 4.714B, whereas cross-exchange funding reads constructive (Binance 0.01, Bybit 0.0099, OKX 0.0082), in step with a market leaning lengthy however not clearly depicted as euphoric in these panels.

Cantonese Cat’s framing is extra tactical: the rally can nonetheless “work,” however provided that it respects the construction and reacts cleanly at resistance. He wrote: “DOGE perhaps hitting resistance right here quickly Let’s see the way it reacts there To date it’s simply been a brutal retrace to 0.382, which nonetheless makes this a sound deal with for the large 4-year cup and deal with formation.”

Associated Studying

After worth met that space, he adopted up: “Actually proper on the cash with resistance. Now what? We’ve received an entire month forward of us. Let’s see how DOGE does it from right here on out.”

On the 4-hour chart by Hughes, the roadmap is express: the 0.382 degree sits at 0.13847, with the subsequent marked retracements above at 0.19070 (0.5) and 0.26261 (0.618).

The month-to-month view reinforces that the present zone is a decent band between 0.11778 (0.382) and 0.15428 (0.5), with 0.20210 (0.618) above, helpful reference factors for the place continuation would wish to show itself, step-by-step, moderately than in a single candle.

That leaves the “useless cat bounce” query principally conditional. If DOGE can maintain weekly acceptance above 0.13847 and reclaim the close by month-to-month 0.15428 space (the identical neighborhood because the prior vary highs on the 4H), the analysts’ shared bias reads as consolidation-before-extension.

If worth loses 0.13847 once more, the setup begins to look extra like a failed reclaim, with the decrease marked helps on the charts at 0.11778 and 0.09320 coming again into focus.

At press time, DOGE traded at $0.14944.

Featured picture created with DALL.E, chart from TradingView.com