Michael Saylor’s Technique, the Tysons Nook, Virginia-based agency previously generally known as MicroStrategy, kicked off the brand new 12 months with one other giant Bitcoin acquisition, shopping for 1,286 BTC for roughly $116 million, in keeping with a Monday submitting with the U.S. Securities and Change Fee (SEC).

The acquisition, made between December 29, 2025, and January 4, 2026, boosts the corporate’s Bitcoin holdings to 673,783 BTC, valued at round $62.7 billion at present costs.

The most recent purchase was funded completely by way of the proceeds of MSTR Class A inventory gross sales below the corporate’s at-the-market (ATM) program. The corporate offered practically 2 million shares, producing $312.2 million in internet proceeds.

The acquisition additionally coincides with the agency growing its U.S. greenback reserve to $2.25 billion, up from $1.44 billion in December, supposed to help dividend funds on most well-liked shares and curiosity obligations on excellent debt.

The typical value for the current buy was $90,391 per Bitcoin, with a small portion — 3 BTC — acquired within the closing days of 2025 at $88,210 every.

Total, Technique’s Bitcoin portfolio was accrued at a mean price foundation of $75,026 per coin, reflecting complete expenditures of $50.55 billion.

Regardless of the good points in 2026, the corporate reported a $17.44 billion unrealized loss on its digital property within the fourth quarter of 2025, largely attributable to Bitcoin sliding from its October excessive of $126,000.

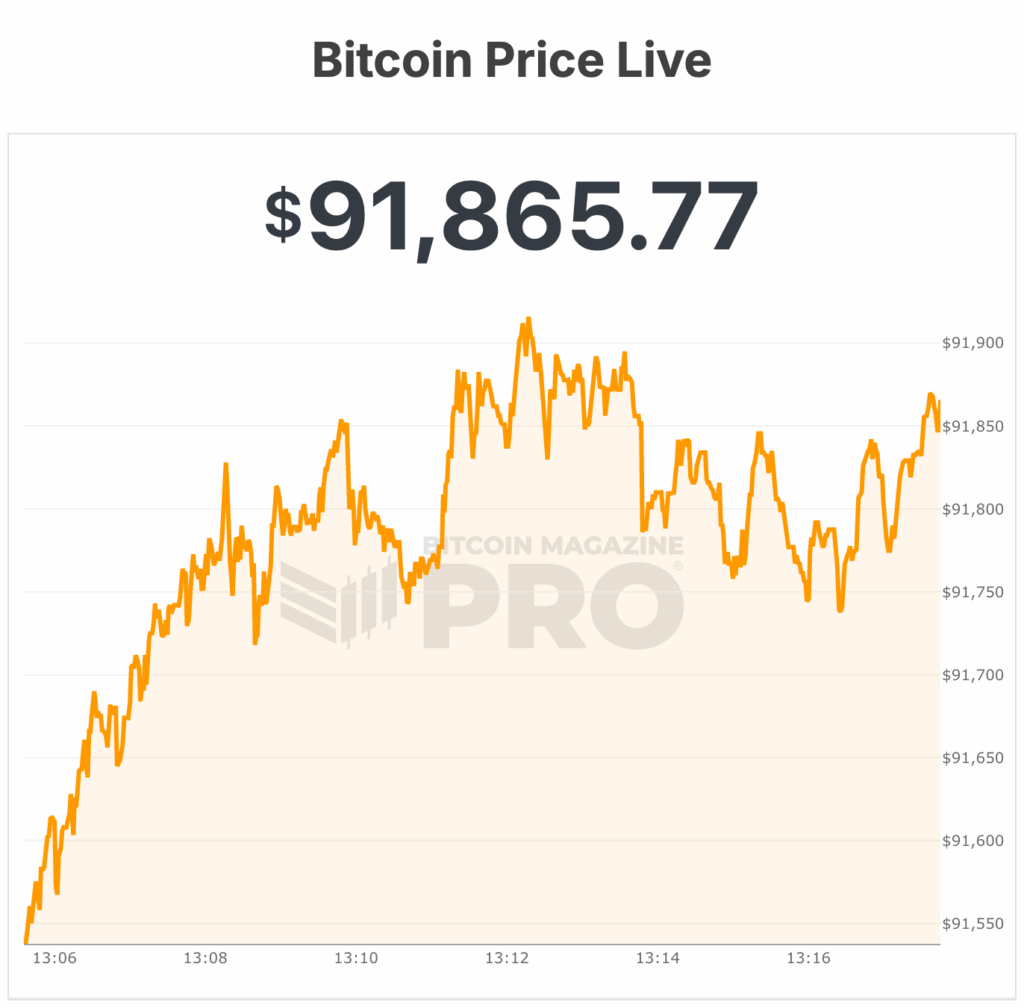

Bitcoin’s value surpassed $90,000 at the beginning of the 12 months, partly buoyed by geopolitical tensions within the U.S.-Venezuela hall and ongoing market optimism. As of Monday, BTC traded close to $93,000, representing a roughly 6% achieve year-to-date.

The transfer underscores the corporate’s continued dedication to its Bitcoin-first treasury mannequin. Michael Saylor, co-founder and govt chairman, signaled the acquisition on Sunday through X posting the agency’s Bitcoin portfolio with the caption, “Orange or Inexperienced?”

This weekly acquisition sample has change into a trademark of Technique’s strategy to constructing its bitcoin holdings over time.

Technique’s MSCI delisting chance

Nevertheless, the agency faces ongoing challenges past market volatility. Technique may quickly be faraway from the Morgan Stanley Capital Worldwide (MSCI) international indices, which proposed final October that corporations with 50% or extra of property in digital currencies resemble funding funds and could also be excluded.

A possible MSCI delisting may set off $2.8 billion in inventory outflows, in keeping with executives, with additional impacts attainable throughout different indexes, together with the Nasdaq 100 and Russell benchmarks. Analysts from JPMorgan and TD Cowen estimate that exclusion from these indices may threaten billions in extra market worth.

In December, Technique submitted a proper response to MSCI’s session. The corporate referred to as the brink “misguided” and warned it may have “profoundly dangerous penalties” for buyers and the broader digital asset business.

Earlier in November, Saylor pushed again on media studies warning that Technique may face billions in passive outflows if MSCI did comply with by way of with its determination.

In an announcement on X, Saylor stated that the corporate is “not a fund, not a belief, and never a holding firm.” He described the agency as a publicly traded working firm with a $500 million software program enterprise and a singular treasury technique that makes use of Bitcoin as productive capital.

Regardless of these pressures, Technique’s aggressive accumulation of Bitcoin has influenced different publicly traded corporations.

Tokyo-listed Metaplanet, as an example, has now change into the fourth-largest company holder of Bitcoin, with 35,102 cash valued at roughly $3.27 billion.

Technique’s USD reserve and inventory sale-driven purchases illustrate a fastidiously managed, albeit high-risk, technique of sustaining liquidity whereas increasing its digital asset holdings. The corporate has used the reserve to bolster its monetary footing amid market swings, aiming to make sure operational continuity and investor confidence.

On the time of writing, bitcoin is dropping to beneath $92,000.