- The SEC authorised Bitwise’s Chainlink ETF, marking LINK’s first U.S. ETF launch.

- LINK has rebounded lately however stays nicely beneath its all-time excessive.

- ETF entry improves long-term demand potential, even when short-term worth motion stays muted.

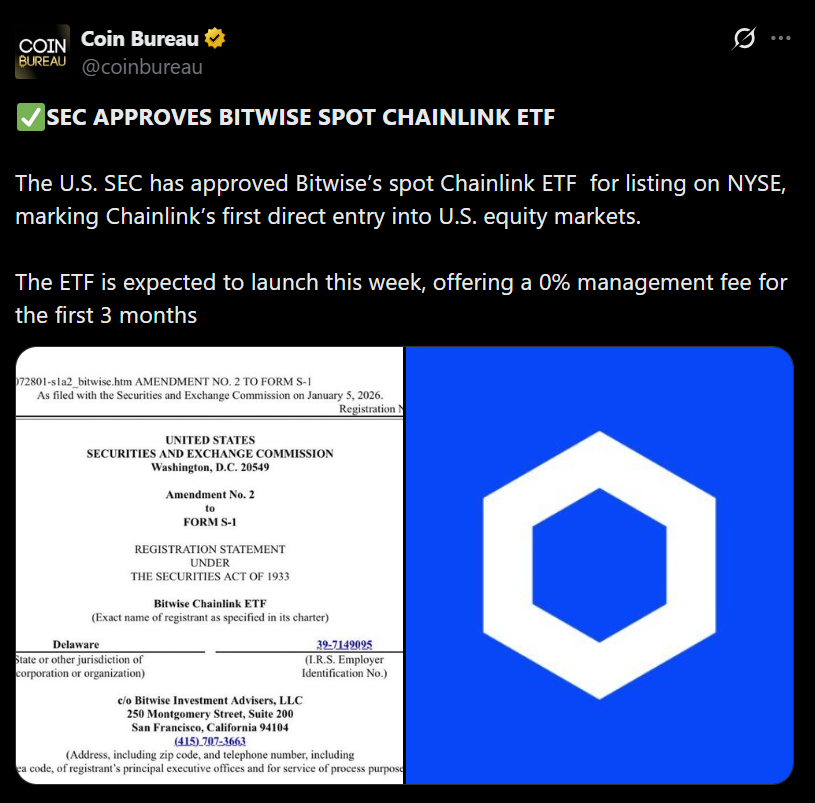

The SEC has formally authorised Bitwise’s Chainlink ETF, marking a significant milestone for the asset and its first direct entry into U.S. fairness markets. The ETF is ready to launch on the New York Inventory Alternate, with stories suggesting buying and selling may start as early as this week. Bitwise can also be waiving administration charges for the primary three months, a transfer designed to draw early institutional curiosity. For LINK, this isn’t simply one other product launch — it’s a structural shift in accessibility.

LINK Is Rebounding, Even If the Greater Image Nonetheless Wants Work

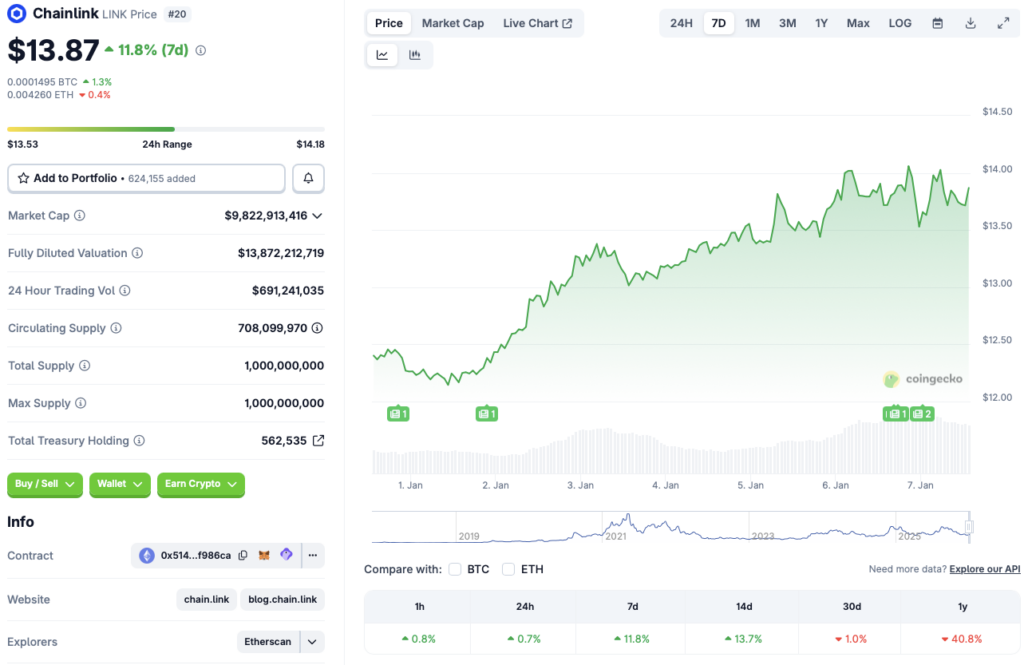

Chainlink’s worth has quietly began to stabilize. CoinGecko information reveals LINK is up 0.7% during the last 24 hours, almost 12% on the week, and near 14% over the previous 14 days. These beneficial properties come after a protracted drawdown, with LINK nonetheless down about 41% since January 2026 and barely purple on the month-to-month chart. That context issues. ETF approvals don’t often spark instantaneous parabolic strikes, however they typically enhance the bottom that future rallies are constructed on.

Why the ETF Issues Extra Than the First Week of Buying and selling

ETFs have been a defining power in the course of the 2025 market cycle, serving to push Bitcoin and Ethereum to new highs as capital flowed in via regulated channels. Whereas Bitcoin was the one asset to hit recent all-time highs instantly after its ETF debut, Ethereum, Solana, and XRP all noticed delayed reactions. That sample suggests persistence issues. For Chainlink, the ETF opens the door to long-only capital that beforehand couldn’t contact LINK instantly, which tends to reshape demand over time relatively than in a single day.

Can LINK Realistically Push Towards $50?

LINK’s all-time excessive close to $52.70 stays a distant reference, with the token nonetheless greater than 70% beneath that peak. Reclaiming these ranges will seemingly require extra than simply an ETF launch. Broader market situations, macro stability, and renewed threat urge for food all play a job. That stated, the ETF approval removes a significant barrier and offers LINK one thing it’s by no means had earlier than — direct publicity to U.S. institutional flows. If sentiment improves and capital rotates again into infrastructure property, LINK’s upside ceiling turns into simpler to think about, even when the trail there isn’t fast.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.