The market is exhibiting indicators of fatigue as Bitcoin worth hovers slightly below $90,000, with construction softening whereas sentiment stays defensive somewhat than panicked.

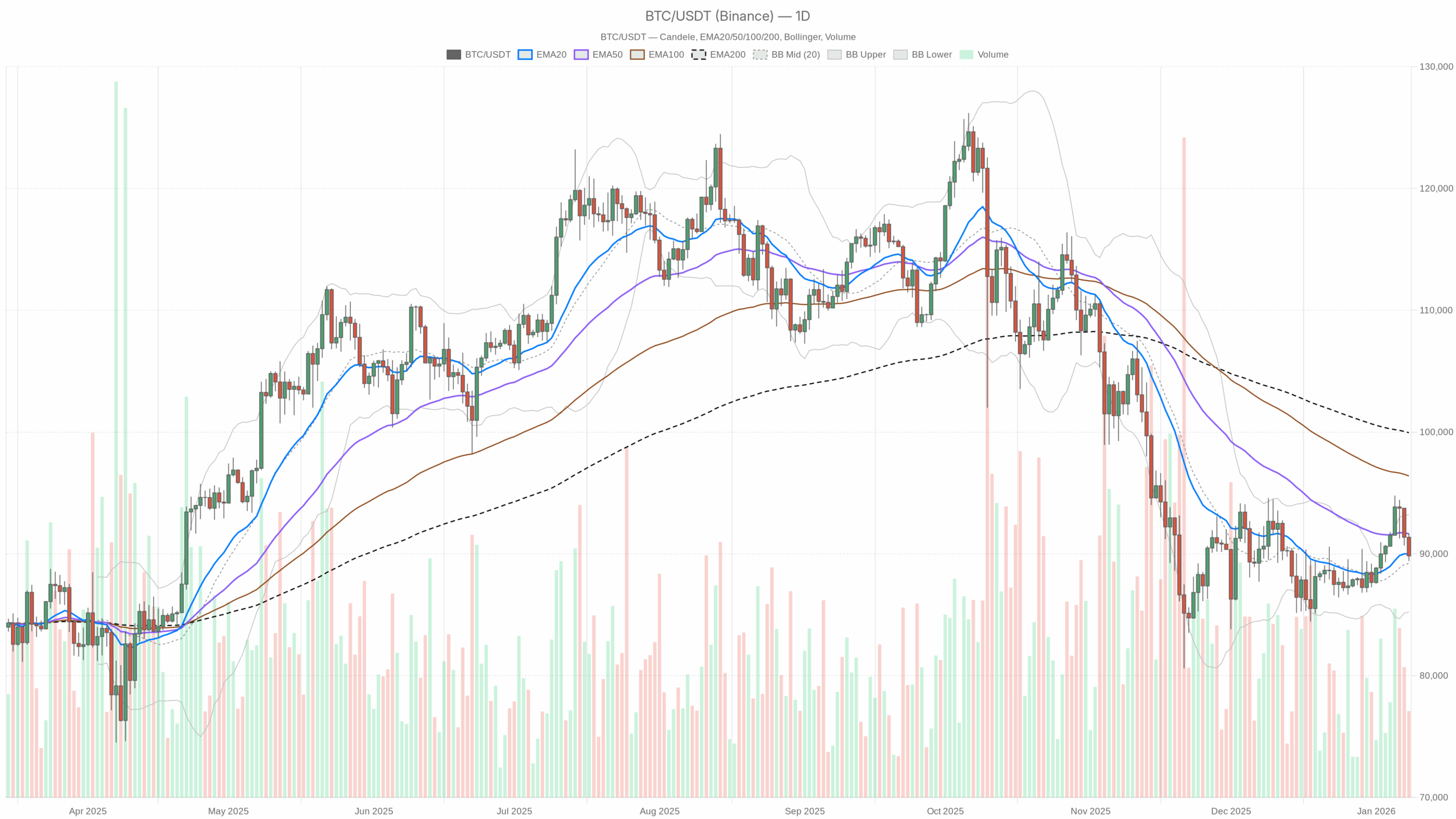

Primary Situation from the Day by day Chart (D1): Softly Bearish Bias

On the each day timeframe, the principle state of affairs is bearish, however not in a crash sense – extra in a managed, corrective sense.

- Worth vs EMAs (pattern/construction)

D1 shut: $89,830.75

EMA 20: $89,988.22

EMA 50: $91,649.28

EMA 200: $99,951.29

Bitcoin worth on the each day chart is marginally beneath the 20-day EMA and effectively beneath the 50- and 200-day EMAs. In follow, that may be a market that has misplaced upside momentum and is buying and selling on the improper facet of medium- and long-term pattern strains. It’s a down-sloping or flattening regime the place rallies usually tend to be offered into till value can reclaim no less than the 20- and 50-day EMAs with conviction. - RSI 14 (momentum)

D1 RSI 14: 49.45

RSI is sitting nearly precisely on the midpoint. Which means each day momentum is now not overbought and never but oversold. The prior sturdy impulsive leg has cooled and now the market is in a wait-and-see zone. Bulls have misplaced the higher hand, however bears haven’t taken full management both. This matches a consolidation or early-distribution part somewhat than a blow-off prime or panic low. - MACD (cycle / momentum follow-through)

D1 MACD line: 508.88

D1 Sign: 18.23

D1 Histogram: +490.66

The MACD nonetheless prints a strongly constructive unfold, echoing the highly effective upside part that introduced Bitcoin worth again above $90k. Nonetheless, the regime flag being bearish suggests that is seemingly a lagging snapshot of previous power somewhat than contemporary gasoline. In different phrases, the market had sturdy upside power, however value is now slipping below the quick EMA. That may be a traditional setup the place pattern indicators look good on paper whereas precise value motion is beginning to roll over. - Bollinger Bands (volatility & positioning)

Mid band: $89,219.29

Higher band: $93,210.30

Decrease band: $85,228.29

Worth is hovering simply above the mid band, barely beneath the 20-day EMA. That’s the center of the vary, not a stretch to both excessive. There’s room for value to float towards the decrease band close to $85k if sellers keep in management, however the market shouldn’t be at a volatility climax. This can be a regular pullback inside a broader high-value space somewhat than a band-ripping pattern day. - ATR 14 (each day volatility)

D1 ATR 14: $2,197.75

Day by day ranges round $2.2k at this degree are elevated however not excessive for BTC above $80k. That means directional trades want some respiration room, as a result of tight stops will get picked off simply. Volatility is excessive sufficient to harm late chasers in both course however not on the form of excessive that often marks a serious prime or backside. - Day by day Pivots (near-term ranges)

Pivot (PP): $90,309.27

Resistance 1 (R1): $91,209.47

Assist 1 (S1): $88,930.54

Worth is parked slightly below the each day pivot, successfully trapped between PP and S1. Buying and selling below the pivot on a bearish-regime day suggests intraday rallies towards $90.3–91.2k are extra liable to promoting stress till bulls can shut above these ranges persistently. On the draw back, the primary line within the sand is the $88.9k space. Dropping that with momentum opens the trail towards the mid–low $80ks.

Placing the each day image collectively, the major bias is bearish. BTC is beneath key shifting averages, drifting below the pivot, and sentiment is in Concern. Nonetheless, momentum shouldn’t be outright damaged. It’s extra like a drained uptrend slowly giving approach to imply reversion.

Hourly Context (H1): Defensive, However Not a Collapse

The 1-hour chart refines this view. Quick-term motion is weak, however not in full panic mode.

- Worth vs EMAs (short-term construction)

H1 shut: $89,778

EMA 20: $90,622.38

EMA 50: $91,405.52

EMA 200: $90,940.85

Worth is beneath all three hourly EMAs, and the 20/50 EMAs are above the 200. That often displays a market that had been in an intraday uptrend however is now present process a pullback deep sufficient to interrupt beneath the longer intraday pattern line. That is corrective-to-bearish intraday construction, matching the each day tender bearish bias. - RSI 14

H1 RSI 14: 33.99

Hourly momentum is approaching oversold territory however has not hit true exhaustion but. That is the place markets typically see bounces inside a broader downmove. Quick-term sellers are energetic, but when they push a lot additional with out a pause, the prospect of a squeeze increased into the EMAs grows. - MACD

H1 MACD line: -525.16

H1 Sign: -496.11

H1 Histogram: -29.05

MACD is detrimental with a modest detrimental histogram, signaling energetic draw back momentum however no capitulation. Bears management the tape intraday, but the transfer is measured, not a waterfall. That aligns effectively with the each day view: a managed grind decrease somewhat than a vertical flush. - Bollinger Bands

Mid band: $90,668.14

Higher band: $91,758.76

Decrease band: $89,577.53

Present value is hugging the decrease band area round $89.6–89.8k. That always marks the sting of a short-term impulse. Both the market will get a small bounce again towards the mid band, or a correct pattern leg develops the place value rides the band decrease. With RSI close to 34, the risk-reward for contemporary shorts right here is much less engaging except bears can pressure a sustained band stroll. - ATR 14

H1 ATR 14: $573.68

Intraday swings of roughly $500–600 per hour are vital however not irregular at these ranges. It is sufficient to punish overleveraged positions, particularly these buying and selling aggressively round tight intraday ranges. - Hourly Pivots

Pivot (PP): $89,716.40

Resistance 1 (R1): $90,023.74

Assist 1 (S1): $89,470.66

Worth is hovering basically on the hourly pivot, barely above S1 and beneath R1. This can be a short-term resolution zone. Lose $89.5k with momentum and intraday bears preserve urgent. Reclaim and maintain above $90k, and the market is more likely to see a restoration towards the hourly EMAs.

The system tags H1 as impartial, which matches this image. Quick-term stress is down, however the market is near ranges the place brief sellers turn into much less comfy including.

15-Minute Execution View (M15): Micro Downtrend Inside a Vary

The 15-minute chart is for timing, not for the large thesis, but it surely helps describe execution threat proper now.

- Worth vs EMAs

M15 shut: $89,795.01

EMA 20: $90,032.79

EMA 50: $90,367.51

EMA 200: $91,536.57

Worth is below all short-term EMAs, with the 20 and 50 effectively beneath the 200. That may be a clear micro downtrend inside a bigger, range-like atmosphere. In sensible phrases, rallies intraday into the 20/50 EMA bands close to $90–90.4k are possible promote zones except the market can reclaim them decisively. - RSI 14

M15 RSI 14: 39.89

Quick-term momentum is weak however not washed out. There’s nonetheless room for one more small leg down or sideways grind with out triggering traditional oversold readings. That’s in step with brief sellers patiently leaning on rallies somewhat than chasing value decrease in any respect prices. - MACD

M15 MACD line: -165.10

M15 Sign: -155.84

M15 Histogram: -9.26

The MACD is detrimental with a small detrimental histogram on 15m, mirroring a gradual intraday downtrend. There isn’t a signal of a pointy bullish reversal but, however the histograms are comparatively shallow, so momentum is grinding, not accelerating. - Bollinger Bands

Mid band: $90,034.14

Higher band: $90,385.03

Decrease band: $89,683.25

Worth is sitting between the decrease band and the mid band. Current candles seemingly tagged or flirted with the decrease band, that means the market is stretched short-term however not at an excessive. Once more, this favors a sell-the-bounce mindset intraday somewhat than chasing breakdowns from right here. - ATR 14

M15 ATR 14: $253.24

Typical 15-minute swings of round $250 imply volatility is massive relative to small timeframes. Any tight scalping strategy has to account for frequent $200–300 swings contained in the noise. - 15m Pivots

Pivot (PP): $89,695.44

Resistance 1 (R1): $89,970.00

Assist 1 (S1): $89,520.46

Worth is simply above the 15m pivot and beneath R1. For execution, that may be a mid-range spot, neither apparent help nor resistance. Micro bulls need to defend the $89.5–89.7k space. Bears will seemingly lean on something nearer to $90k–90.2k.

The system calls the 15m regime bearish, which is seen within the construction. Quick-term charts agree with the each day bias, even when the hourly is nearer to impartial.

Market Context: Concern, Liquidity, and Dominance

Past the BTCUSDT chart, the broader crypto market is including an vital layer.

- BTC dominance ~56.8%: Bitcoin nonetheless clearly leads the market. In phases the place BTC dominance is that this excessive, the market tends to commerce Bitcoin first, alts second. That helps the concept that Bitcoin worth is the first threat barometer.

- Whole market cap: ~$3.15T, down ~2.8% in 24h: Your entire complicated is in a risk-off day, not simply BTC. This can be a synchronized pullback.

- 24h quantity down ~15.9%: Declining quantity on a down day factors extra to disengagement than outright panic. It’s extra consumers standing apart than compelled promoting.

- Concern & Greed Index at 28 (Concern): Sentiment is cautious, however not capitulative. Traditionally, when Concern coincides with solely a reasonable technical pullback, the following main transfer typically is determined by whether or not macro flows, akin to ETFs and institutional demand, re-engage on the purchase facet or not.

DeFi charge information exhibits combined traits throughout DEXs, with some platforms sharply down in each day charges and others spiking. That speaks to rotation and selective exercise somewhat than broad on-chain exuberance. In different phrases, leverage pockets nonetheless exist, however the common participant shouldn’t be chasing at any value.

Bullish Situation for Bitcoin Worth

For a constructive path ahead, bulls have to show that it is a pullback into a brand new worth space somewhat than the beginning of a bigger unwind. At this stage, the main focus is on whether or not the present consolidation can type a help base.

What the bullish path seems like:

- On the 15m and 1h, BTC begins holding above the native pivots and S1 ranges, with a number of closes above $90,000–90,300. That might flip the present resistance band into help.

- Hourly RSI pushes again above 45–50, signaling that the most recent intraday down-leg has run its course and consumers are regaining short-term management.

- Worth reclaims the H1 20/50 EMAs ($90.6k–91.4k) and doesn’t instantly reject. That’s the place merchants would see whether or not this was merely a shakeout.

- On the each day, BTC closes again above the 20-day EMA (~$90k) and ideally challenges the 50-day EMA (~$91.6k). That might flip the tender bearish regime again towards impartial.

- Concern & Greed drifting from the excessive 20s again towards impartial with out a sharp collapse in value would affirm a climb the wall of fear atmosphere, with reluctant however persistent dip shopping for.

Key bullish invalidation:

The bullish state of affairs is in bother if BTC loses and closes beneath the D1 S1 space round $88,900 with follow-through promoting and can’t reclaim $89k–90k shortly. A decisive break and acceptance below $88.9k, particularly if hourly RSI doesn’t get oversold however grinds decrease, would point out that the market shouldn’t be treating this as a horny worth zone.

Bearish Situation for Bitcoin Worth

The bears are already aligned with the present regime: value below key EMAs, hourly momentum weak, and Concern again within the driver’s seat. To this point, rallies are struggling to change this bias.

What the bearish path seems like:

- BTC fails repeatedly to reclaim the $90k–90.5k band, which incorporates the each day pivot and H1 mid-BB/EMAs. Every bounce into this area will get offered.

- H1 RSI will get brief, shallow bounces that stall round 45 earlier than rolling again down, a traditional signature of a managed downtrend.

- Worth breaks beneath $88,900 (D1 S1) and begins buying and selling nearer to the center of the each day Bollinger Band vary, opening the best way towards the decrease band close to $85,200.

- On the each day, BTC continues to respect the underside of the 20- and 50-day EMAs, confirming them as dynamic resistance. Any rallies into $91–92k get rejected shortly.

- Broader crypto cap retains bleeding whereas quantity stays solely reasonable, indicating a sluggish drift decrease somewhat than a spike backside.

Key bearish invalidation:

The bearish case weakens materially if BTC can shut a full day again above the 20-day EMA (~$90k) and maintain above it, after which comply with by means of towards or above the 50-day EMA (~$91.6k). A sustained reclaim of the $90–92k area, with hourly EMAs turning up and RSI stabilizing mid-range or increased, would sign that sellers have misplaced management of the short-term tape.

Assume About Positioning, Danger, and Uncertainty

Proper now, Bitcoin worth is caught between a drained uptrend and a not-yet-confirmed downtrend. Day by day bias is bearish in construction, hourly is impartial with draw back stress, and 15-minute charts lean bearish however non-parabolic. That multi-timeframe combine often rewards persistence and punishes emotional trades.

For directional merchants, the secret’s acknowledging that the market is in a transition zone.

- Chasing contemporary shorts sub-$90k is late from a tactical perspective except the thesis is a breakdown by means of $88.9k towards the low $80ks.

- Shopping for aggressively right here is successfully a name that $88–90k is the brand new truthful worth zone in an ongoing bull construction, which isn’t but confirmed by each day EMAs.

Volatility (ATR) on all timeframes is excessive sufficient that place sizing and cease placement matter greater than common. Market-wide Concern exhibits sentiment is already defensive, which might both cushion additional draw back, as sturdy arms take up provide, or imply there may be much less marginal demand till decrease costs.

In this type of atmosphere, a extra disciplined strategy is to let the market declare a course. Merchants could watch for a transparent reclaim above $90–92k for a renewed bullish construction, or for a clear break and acceptance beneath $88.9k to respect the bearish regime. Till then, Bitcoin worth is successfully chopping round an vital pivot zone the place noise is excessive and conviction is low.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee at no further value to you.

Disclaimer: This evaluation is for informational and academic functions solely and isn’t funding, buying and selling, or monetary recommendation. Markets are unstable and unpredictable; at all times do your individual analysis and take into account your threat tolerance earlier than making any buying and selling selections.