- Zcash builders left ECC to type a brand new firm however will proceed constructing the protocol.

- The Zcash community itself stays unaffected, with no change to core performance.

- Value volatility mirrored governance uncertainty, not technical threat.

Zcash noticed a pointy bout of volatility on Thursday after the core growth staff behind the privateness coin introduced it had left to type a brand new firm. The transfer adopted a governance dispute with Bootstrap, the nonprofit group created to assist the community. On the floor, it regarded like a serious fracture. ZEC dropped as a lot as 19% on the day, interrupting what had in any other case been a standout yr, with the token up roughly 880% in 2025.

However as soon as the noise settles, the image appears far much less dramatic than the value response suggests.

The Builders Didn’t Depart Zcash

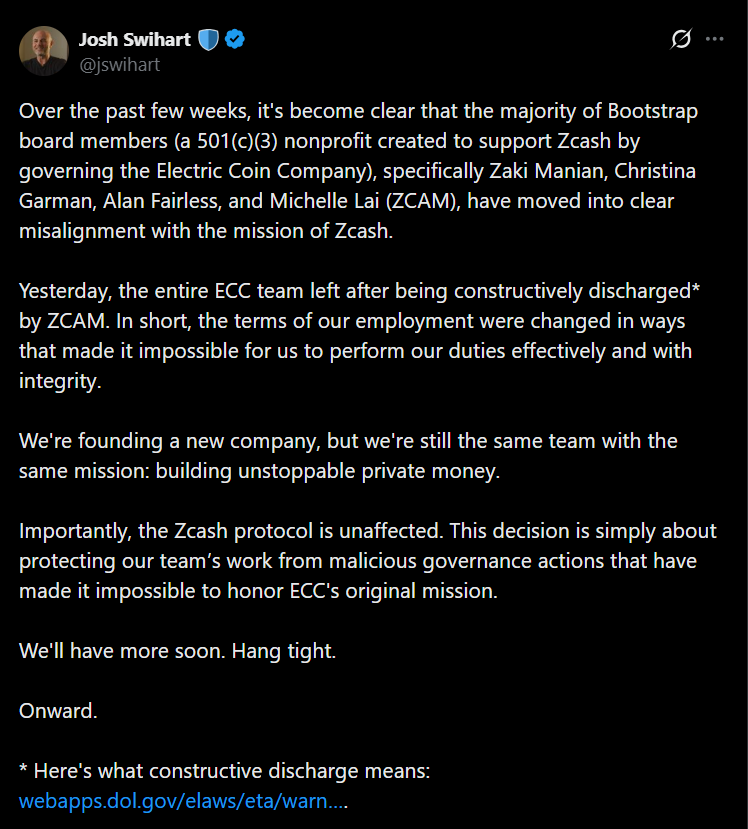

The departing staff, previously a part of Electrical Coin Firm, made it clear they’re persevering with to work on Zcash, just below a brand new company construction. In line with former ECC CEO Josh Swihart, the protocol itself stays untouched. The choice was framed as a response to governance friction, not a rejection of the community’s mission. Bootstrap will nonetheless oversee the nonprofit aspect of Zcash and will even fund the brand new growth entity by way of open grants.

Mert Mumtaz, CEO of Solana’s API platform Helius, summed it up bluntly. Zcash didn’t lose something. The identical builders, the identical codebase, and the identical roadmap stay, solely now and not using a board construction the staff felt was slowing progress.

Governance Pressure Was the Breaking Level

On the coronary heart of the dispute was governance course, notably round Zashi, a cell pockets tied to the protocol. The event staff needed flexibility to discover exterior funding and quicker iteration, whereas Bootstrap emphasised authorized warning and compliance. That mismatch ultimately turned untenable. A number of outstanding contributors described the scenario as constructive discharge, arguing that forms was interfering with Zcash’s broader aim of advancing monetary privateness.

Veteran cryptographer Sean Bowe echoed that view, suggesting the brand new construction would enable the staff to maneuver quicker and keep aligned with Zcash’s unique objective. Different builders emphasised that nobody really stop the challenge, they merely modified the wrapper round how the work will get finished.

Why the Community Is Probably Unchanged

Zcash’s core properties usually are not depending on any single firm. The protocol is open supply, permissionless, and already reside. Former ECC CEO Zooko Wilcox bolstered that time, stating that nothing concerning the community’s safety or privateness is affected by inside organizational disputes. For customers, shielded transactions nonetheless work, upgrades nonetheless ship, and day-to-day performance stays the identical.

That distinction issues. Markets typically conflate governance drama with technical threat, however the two don’t at all times overlap.

Monero Benefited From the Optics

Whereas Zcash absorbed the shock, Monero caught a bid. XMR rose as a lot as 6.5% following the announcement, widening its market cap lead over ZEC. Some market individuals framed the transfer as a distinction between governance-heavy and governance-light privateness fashions. Whether or not that narrative sticks stays to be seen, however within the brief time period, Monero benefited from the uncertainty.

What This Actually Means Going Ahead

The true threat isn’t technical failure, it’s relational friction. Strained ties between builders and governance our bodies can gradual coordination over time, even when the code retains shifting. That mentioned, Zcash has weathered inside restructuring earlier than. The builders chargeable for shielded transactions and main upgrades are nonetheless on the desk, simply working below a unique title.

For now, this appears much less like an existential disaster and extra like a messy however survivable transition.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.