Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value has surged 2% within the final 24 hours to commerce at $2.15, as U.S. spot XRP exchange-traded funds (ETFs) recorded their first web outflow day since launch, with round $40.8 million exiting the merchandise.

This ended a multi-week streak of uninterrupted inflows that started in mid-November 2025, based on information from SoSoValue. Regardless of the pullback, cumulative web inflows for XRP ETFs stay sturdy at about $1.2 billion, and complete belongings below administration are nonetheless above $1.5 billion, making them a number of the best-performing crypto ETPs in the marketplace.

The outflow day got here alongside heavy promoting throughout main crypto-linked ETFs. Farside Traders reported that spot Bitcoin ETFs noticed $486 million in web outflows, their largest day by day drawdown since November, whereas spot Ether ETFs recorded $98 million in outflows.

Spot XRP ETFs noticed the first-ever web outflows of $41 million on Wednesday.

This successfully ended their 36day no-outflow streak, throughout which the funds collected a complete influx of $1.25 billion.

“Nevertheless, the size is modest, lower than 3% of cumulative inflows since launch… pic.twitter.com/XiJBQRViy0

— Danny Kunwoong Park (@ParkKunwoong) January 8, 2026

This marked a shift from the sturdy inflows seen firstly of the 12 months. Bitcoin ETFs had beforehand attracted $471 million on Friday and $697 million on Monday earlier than reversing with $243 million in outflows on Tuesday and the bigger Wednesday decline. Ether ETFs adopted the same sample, with inflows earlier within the week earlier than turning unfavorable.

XRP ETF Momentum Slows After Weeks of Sturdy Inflows

Smaller crypto ETFs confirmed extra resilience. Spot Solana ETFs continued to submit regular, modest inflows, whereas Chainlink ETFs moved to flat flows after a number of days of small beneficial properties. Dogecoin ETFs recorded no web motion on Tuesday and Wednesday after beginning the 12 months with inflows of $2.3 million and $1.6 million.

The XRP ETF outflow follows weeks of sturdy demand. By late December, XRP ETFs had logged 29 consecutive influx days, at the same time as different crypto ETFs skilled year-end outflows. Analysts beforehand attributed XRP’s reputation to its lengthy market historical past, sturdy investor familiarity, and up to date efficiency.

XRP entered 2026 as one of many best-performing main cryptocurrencies, supported by ETF inflows, bullish sentiment, and declining alternate balances. Nevertheless, market analysts warning that sturdy ETF demand doesn’t assure continued value beneficial properties. The primary outflow day could sign a shift towards extra balanced and normalized flows.

XRP Worth Holds Above Key Help After Bullish Breakout

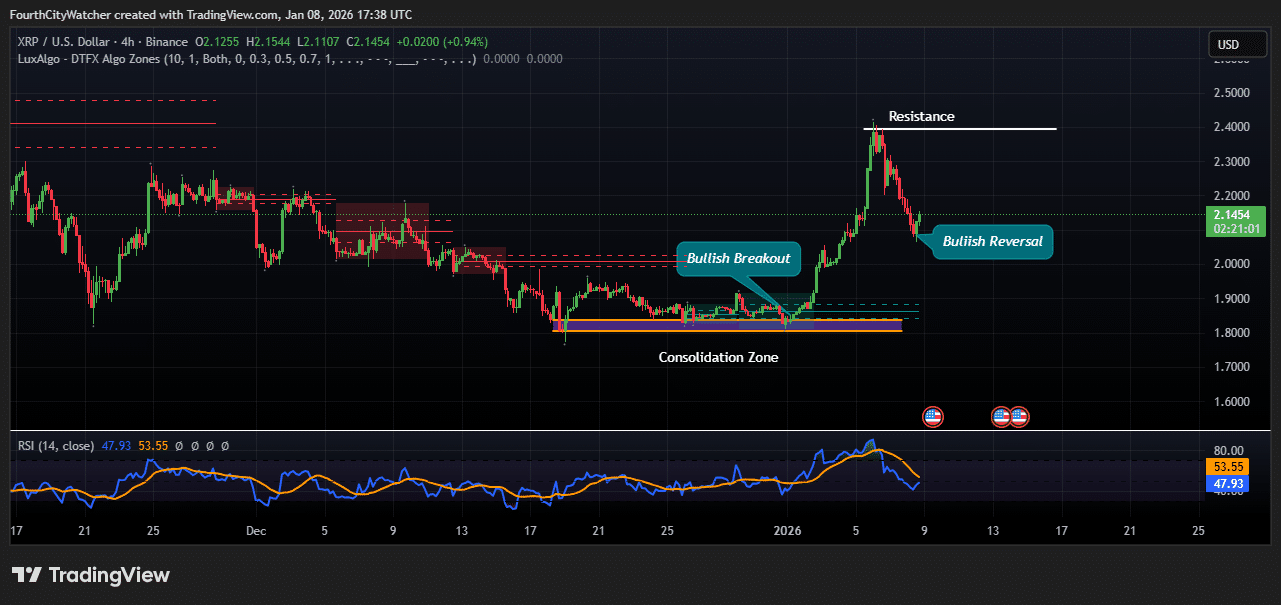

The XRP/USD 4-hour chart exhibits a transparent transfer from sideways buying and selling right into a short-term bullish pattern. For a number of weeks, XRP was caught in a consolidation zone between $1.80 and $1.95. Throughout this time, promoting stress slowly weakened, and consumers began to realize management.

The breakout occurred when XRP pushed above this vary, resulting in a powerful rally towards the $2.40–$2.45 resistance space. This degree acted as a serious promoting zone, inflicting a pullback. Nevertheless, as an alternative of falling again into the outdated vary, the value discovered help round $2.05–$2.10, forming a bullish reversal sample.

The Relative Energy Index (RSI) additionally helps this view. After reaching overbought ranges in the course of the rally, the RSI has cooled to round 47–53. That is wholesome as a result of it reduces the danger of a pointy drop and leaves room for an additional transfer greater. The RSI is just not in a bearish zone, which suggests momentum remains to be impartial to barely bullish.

Proper now, crucial help degree is $2.00–$2.05. So long as XRP stays above this space, the bullish construction stays intact. If the value strikes above $2.30, it may push again towards the $2.45–$2.50 resistance zone. A robust break above that degree would enhance the possibilities of additional upside.

On the draw back, a fall beneath $1.95 would weaken the bullish outlook and recommend that XRP could return to sideways buying and selling.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection