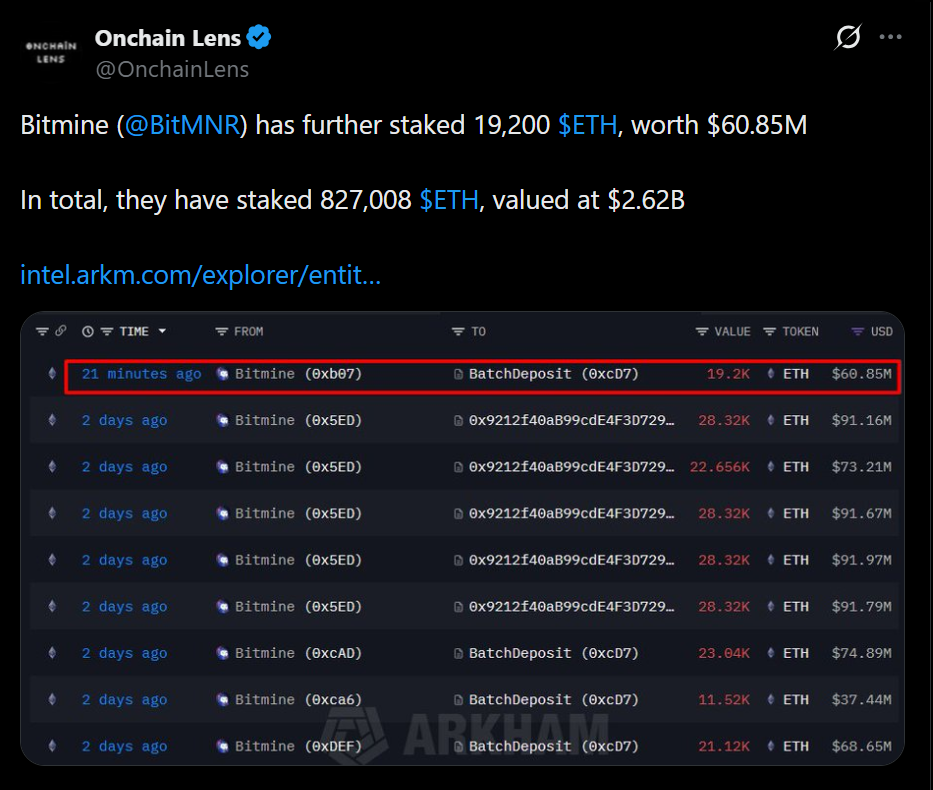

- Bitmine staked a further 19,200 ETH, bringing whole staked holdings above 827,000 ETH.

- The agency is launching its personal U.S.-based validator community to internalize staking operations.

- Ethereum is being positioned as long-term, yield-generating infrastructure on the steadiness sheet.

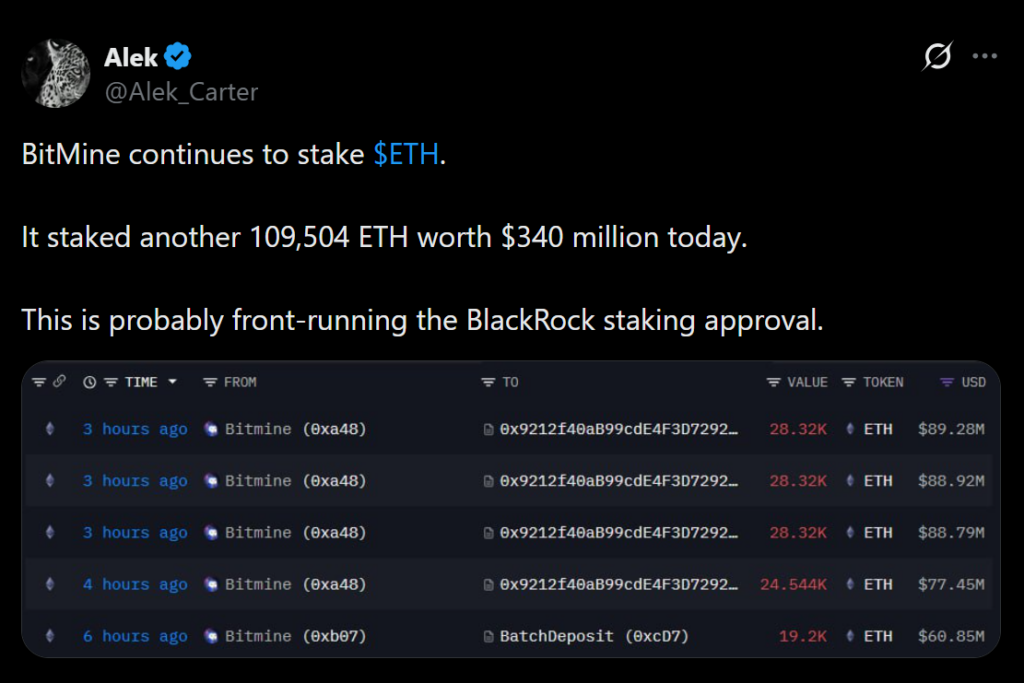

Bitmine is quietly turning Ethereum right into a balance-sheet technique, not a commerce. The Nasdaq-listed agency staked a further 19,200 ETH price greater than $60 million, pushing its whole staked holdings previous 827,000 ETH, now valued at over $2.5 billion. The tempo issues. In simply 4 days, Bitmine seems to have moved roughly 167,800 ETH into staking, signaling urgency, not experimentation.

Ethereum Is Being Handled Like Infrastructure

This isn’t passive holding. Bitmine is actively making ready to launch its personal Made-in-America Validator Community, referred to as MAVAN, designed to internalize staking operations slightly than outsource them indefinitely. Pilot packages with institutional suppliers are already underway, suggesting that is about management, reliability, and scale. Staking ETH instantly turns Ethereum from a risky asset into productive infrastructure on the steadiness sheet.

The Steadiness Sheet Tells the Actual Story

As of January 4, Bitmine held greater than 4 million ETH alongside smaller Bitcoin positions and roughly $915 million in money, all wrapped inside a $14.2 billion steadiness sheet centered on long-term crypto accumulation. That composition isn’t unintentional. It displays a conviction that Ethereum’s function as settlement and yield-bearing infrastructure justifies deep, affected person publicity slightly than tactical positioning.

Why This Issues for Ethereum

Massive-scale staking like this removes liquid provide whereas reinforcing community safety. When establishments select to lock capital as a substitute of maintaining it liquid, they’re signaling consolation with value, protocol, and coverage threat. That mixture is uncommon. Bitmine isn’t chasing short-term upside. It’s embedding Ethereum into its core monetary structure, yield and all.

What This Indicators Going Ahead

This transfer suits a broader sample. Ethereum is more and more being handled much less like a speculative token and extra like programmable monetary infrastructure. Corporations prepared to stake lots of of hundreds of ETH aren’t ready for hype cycles. They’re positioning for sturdiness. And that type of positioning tends to matter lengthy after the headlines fade.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.