- Memecoin market cap rebounded sharply in early January as capital rotated again into risk-on belongings

- Solana-based memecoins led the restoration, signaling renewed speculative urge for food

- Giant-cap memecoins confirmed conviction-backed features, whereas smaller tokens noticed increased volatility

After weeks of drifting sideways, memecoins are beginning to get up once more. Capital is slowly however clearly rotating again in, and the shift has been constructing over the previous month. It hasn’t been loud or sudden, however the change in momentum is getting more durable to disregard.

By mid-December, the sector appeared drained. Complete market cap slid from above $42 billion to only over $36 billion, bleeding steadily as danger urge for food cooled. Then early January flipped the script. Capital rushed again, pushing memecoin market cap from round $38 billion to a peak close to $48 billion, earlier than settling nearer to $44.69 billion. Not good, however a significant rebound.

Quantity tells the identical story. Buying and selling exercise jumped roughly 17.4% to $4.75 billion, confirming that this wasn’t only a skinny bounce. Merchants confirmed up, they usually stayed.

Solana Memecoins Lead the Threat-On Shift

One element stands out on this rebound. A lot of the early momentum got here from Solana-based memecoins, which regularly act as a proxy for broader danger urge for food. When capital is prepared to rotate into high-beta belongings on Solana, it normally says one thing about sentiment.

That rotation has been helped by a supportive macro backdrop. Bitcoin holding above $90,000 has given merchants confidence to maneuver additional out on the chance curve. Collectively, these situations are lifting confidence throughout crypto markets, with memecoins behaving much less like remoted hype and extra like early risk-on indicators.

Massive Memecoins Transfer First, and With Conviction

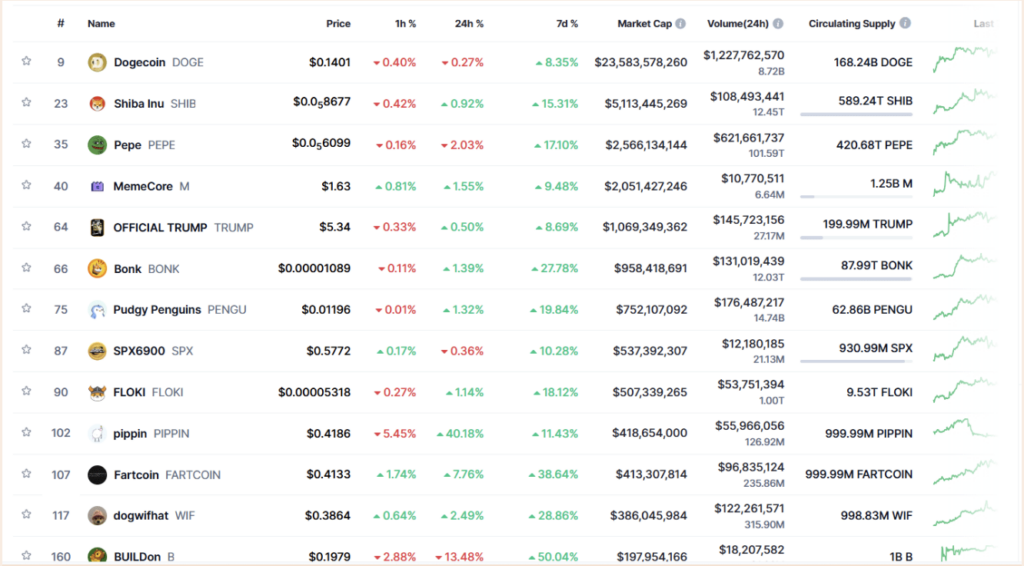

Knowledge from CoinMarketCap exhibits that features have been led by the biggest memecoins, which tends to matter. Bonk has been out in entrance, leaping almost 28% over the previous seven days whereas posting about $131 million in every day quantity. That pairing, value and quantity, factors to conviction quite than a low-liquidity pump.

Shiba Inu adopted with a 15.3% acquire over the identical interval. With a market cap north of $5 billion, SHIB’s transfer carried extra weight than most. Capital rotated in steadily, suggesting accumulation quite than fast-money hypothesis.

Pepe additionally joined the social gathering, climbing about 17.1% and backed by a hefty $621 million in every day quantity. That stage of exercise alerts actual dealer engagement, not simply passive value drift.

Smaller Tokens Chase Momentum, With Extra Volatility

As normally occurs, momentum spilled into smaller names too. Dogwifhat surged almost 29%, Fartcoin ripped increased by near 39%, and Pudgy Penguins added slightly below 20%. These strikes have been fueled by the identical broader rebound, helped alongside by Solana’s low charges and quick execution.

Retail participation has clearly picked up after a tough 2025. Publish-holiday optimism, tax-related positioning, social media hype, and simpler on-chain entry are all feeding into the renewed curiosity. That mentioned, smaller market caps include sharper swings. Volatility cuts each methods.

In easy phrases, the distinction is exhibiting. High memecoins are displaying power backed by quantity and capital rotation. Mid-tier and smaller tokens, in the meantime, are seeing quicker, extra fragile strikes pushed by momentum chasing. The sector is heating up once more, however not all rallies are constructed the identical.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.