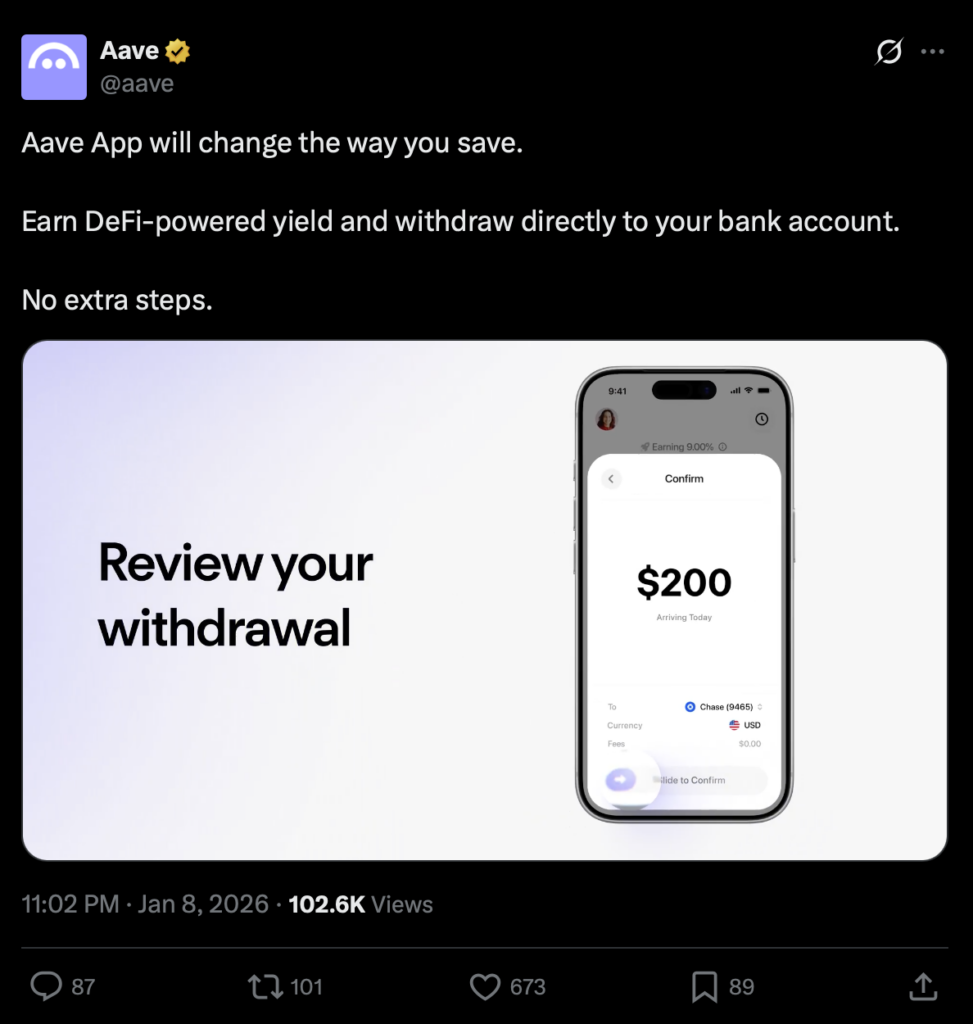

- Aave now permits customers to earn DeFi yield and withdraw funds on to a checking account

- The replace removes a lot of the technical friction that has stored DeFi out of attain for on a regular basis customers

- Aave’s rising market share highlights rising demand for easy, regulated-friendly DeFi entry

Aave has quietly rolled out a characteristic that adjustments how individuals work together with decentralized finance. The Aave App now lets customers earn DeFi-powered curiosity and withdraw funds straight into a conventional checking account. No additional hops, no sophisticated off-ramps.

It’s a small replace on paper, however a significant one. By linking blockchain-based yield immediately with acquainted banking rails, Aave is reducing the barrier for each newcomers and skilled customers who need simplicity with out giving up returns.

DeFi Financial savings, With out the Headache

DeFi has grown quick over the previous couple of years, providing alternate options to financial savings accounts, loans, and even advanced funding methods. The issue has at all times been friction. Wallets, tokens, fuel charges, sensible contracts, it provides up shortly, particularly for freshmen.

The Aave App smooths a lot of that out. Customers can deposit fiat or crypto, earn yield routinely, and transfer a reimbursement to their checking account when wanted. There’s no requirement to manually swap tokens or route funds by third-party exchanges, which regularly feels just like the riskiest step within the course of anyway.

Take a easy instance. A small enterprise proprietor with $5,000 sitting idle may deposit these funds by the Aave App and begin incomes yield generated by DeFi lending markets. If money is required later, the funds will be despatched again to a checking account inside days. It begins to really feel much less like an experiment, and extra like a contemporary financial savings software.

How the Yield Is Truly Generated

Behind the scenes, the mechanics are nonetheless pure DeFi. Deposits circulation into liquidity swimming pools the place debtors take out loans and pay curiosity. That curiosity is then shared throughout everybody who provided liquidity, making a passive revenue stream tied to actual utilization, not simply hypothesis.

What’s modified is the interface. The app handles the blockchain complexity, so customers don’t should handle non-public keys or monitor sensible contract exercise. For many individuals, that’s the distinction between being inquisitive about DeFi and truly utilizing it.

Aave’s Rising Footprint in DeFi

Aave’s rise hasn’t been delicate. In simply two years, it’s expanded its share of the DeFi market from roughly 8 % to about 28 % right this moment. That development displays greater than hype. It reveals regular adoption of its lending and borrowing protocols throughout retail and institutional customers.

By combining clear sensible contracts, aggressive rates of interest, and more and more user-friendly instruments, Aave has positioned itself as one of many few DeFi platforms that feels prepared for scale. Its development additionally mirrors a broader development throughout the house, the place platforms that prioritize accessibility and safety are capturing a bigger slice of the $100 billion-plus DeFi market.

This newest replace suits that sample. DeFi doesn’t must really feel sophisticated to be highly effective, and Aave appears intent on proving that, one characteristic at a time.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.