Bitcoin continues to consolidate close to the $90k mark as world monetary markets stay beneath stress. Geopolitical tensions within the Center East, rising uncertainty round fiat foreign money stability in rising markets, and macro volatility have as soon as once more pushed BTC into the highlight.

Bitcoin Worth Evaluation: The Every day Chart

On the each day timeframe, BTC has damaged out of its descending channel however is going through resistance close to the $95k zone. The rally from the $80k low has been sharp, nevertheless it now seems to be cooling down after hitting the important thing resistance degree at $95k. The worth is but to reclaim the 100-day and 200-day shifting averages, that are sitting simply close to the $99k and $106k ranges, respectively.

The construction is now making an attempt a shift from bearish to impartial. If BTC can maintain above the $90k psychological degree, there may be potential for the next low to kind, opening the door for continuation towards $95k and probably the essential $100k zone. However failure to carry the $90k zone might ship the worth again into the prior downtrend channel.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, BTC is consolidating in a rising wedge sample, with native help round $90k and fast resistance close to $95k. The construction reveals indicators of weakening bullish momentum, as RSI continues to float decrease regardless of the worth holding above key help.

A breakdown under $90k might speed up the correction towards the decrease boundary of the sample at $88k. Alternatively, a breakout above $95k might spark a brand new wave and result in a bullish breakout from the falling wedge, which often ends in aggressive rallies. Till then, BTC seems to be buying and selling inside a tightening vary.

On-Chain Evaluation

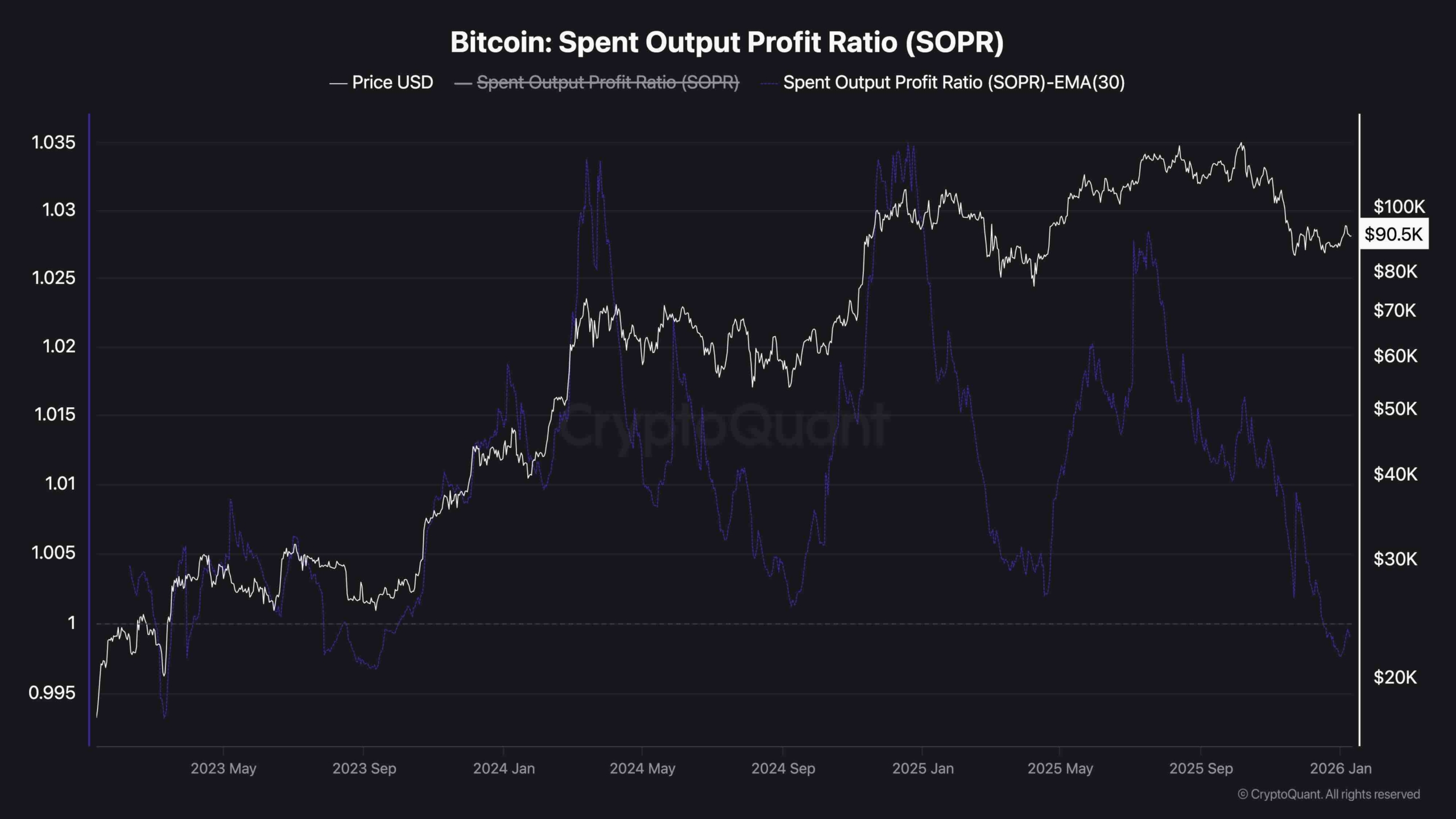

The 30-day EMA of the SOPR (Spent Output Revenue Ratio) has been hovering just under the 1.0 mark. This implies that a big portion of spent cash are realizing losses, or in different phrases, many short-term holders are exiting with out revenue. Traditionally, when SOPR drops under 1 and flattens, it typically indicators the ultimate part of a correction, or potential accumulation by stronger palms.

The SOPR development nonetheless reveals some draw back stress, however the value itself is displaying relative power. If BTC can maintain above $90k whereas SOPR resets, it might set the stage for a more healthy rally pushed by a extra stable base.

The put up Bitcoin Worth Evaluation: Is This The Most Possible Situation for BTC Subsequent Week? appeared first on CryptoPotato.