- Ripple secured each EMI and cryptoasset registration approval from the UK’s FCA

- The licenses enable Ripple Funds to scale throughout the UK inside a regulated framework

- XRP’s position as a settlement asset strengthens as entry to institutional fee flows expands

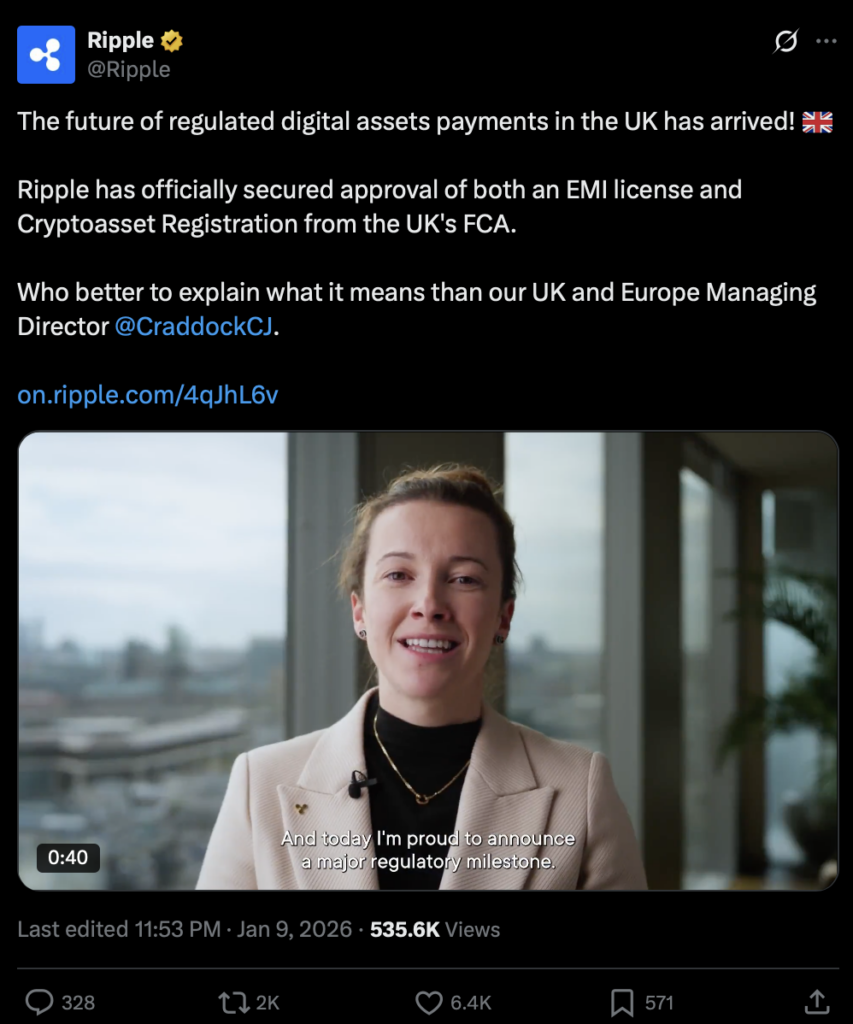

Ripple simply crossed an necessary regulatory line within the UK, and it didn’t do it with a lot noise. On January 9, 2026, the corporate confirmed it had obtained approval for each an Digital Cash Establishment license and cryptoasset registration from the UK’s Monetary Conduct Authority. It’s the sort of replace that doesn’t transfer markets in a single day, but it surely adjustments how the enterprise operates in one of many world’s greatest monetary facilities.

The approval expands Ripple’s regulated footprint and opens the door for deeper integration with UK-based banks and fee corporations. Cassie Craddock, Ripple’s Managing Director for the UK and Europe, described it as a significant step ahead for regulated digital asset adoption within the area. For Ripple, it’s additionally a payoff for years spent constructing relationships and infrastructure in London.

FCA Approval Unlocks Ripple Funds within the UK

With each licenses in hand, Ripple can now scale Ripple Funds throughout the UK beneath a transparent regulatory framework. UK establishments are ready to make use of digital property for cross-border funds whereas staying inside licensed channels, which removes a significant barrier that’s existed for years.

Ripple Funds works as an end-to-end system. Ripple manages the blockchain layer and operational complexity, whereas prospects plug into a world community of payout companions. That setup permits companies to launch digital fee companies with out constructing all the things in-house. The emphasis stays on pace, transparency, and reliability, issues conventional programs nonetheless battle with.

In Ripple’s official announcement, President Monica Lengthy famous that finance is shifting past pilot packages. In her phrases, blockchain and digital property have gotten core infrastructure for world worth switch. Increasing Ripple’s licensing footprint, she added, helps on the spot settlement at scale, not simply in principle however in stay markets.

What This Means for XRP’s Position

The FCA approval doesn’t simply profit Ripple as an organization, it immediately strengthens XRP’s place contained in the funds stack. Ripple builds its merchandise on the XRP Ledger, the place XRP acts because the native settlement asset. As Ripple Funds expands within the UK, the necessity for environment friendly liquidity turns into greater than a speaking level.

XRP is designed for quick, low-cost cross-border settlement, which inserts neatly with the wants of regulated fee suppliers. It capabilities as a bridge asset, serving to transfer worth between currencies with out friction. Having access to licensed UK establishments will increase the possibilities of real-world utilization, not simply theoretical demand.

Over time, utility tends to draw participation. As XRP helps precise fee flows, liquidity can deepen naturally, pushed by settlement exercise moderately than short-term hypothesis. This approval locations XRP nearer to institutional fee rails in a significant monetary hub, which can show extra necessary than any single worth response within the close to time period.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.