The cryptocurrency market is getting into a well-recognized however usually misunderstood section. Value volatility has cooled, momentum seems muted, and lots of retail traders are questioning whether or not the chance has already handed.

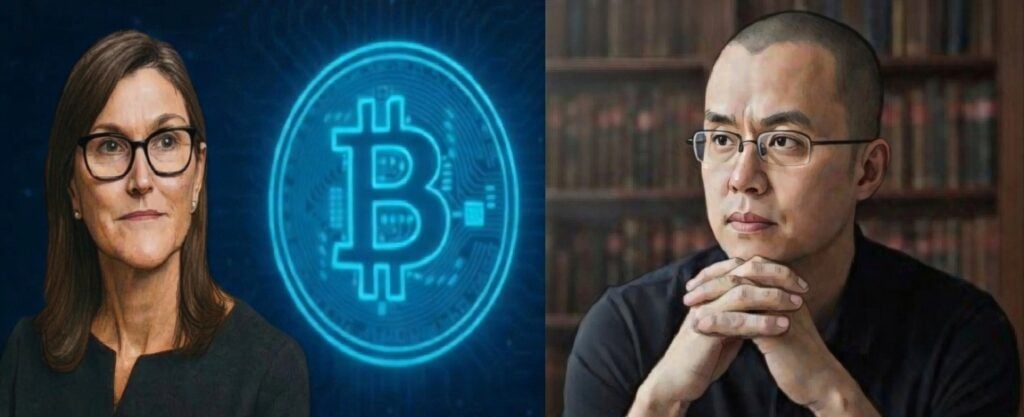

On the similar time, on-chain information and market conduct recommend a special story is unfolding beneath the floor. Latest commentary from Changpeng Zhao and long-standing institutional voices akin to Cathie Wooden factors to a recurring sample.

Whereas retail participation tends to say no during times of uncertainty or consolidation, institutional gamers usually view these circumstances as accumulation zones relatively than warning indicators.

This divergence in conduct isn’t new, however its implications in 2026 could also be extra important than in earlier cycles.

Retail Emotion vs Institutional Technique

Retail traders have traditionally struggled with market timing. Capital usually flows into crypto throughout sharp rallies, pushed by worry of lacking out, and exits throughout quieter or corrective phases when confidence weakens. Establishments, in contrast, are inclined to function on longer time horizons.

On-chain information helps this pattern, as famous by Merlijn The Dealer. Pockets exercise from massive holders has picked up during times when Bitcoin’s worth strikes sideways.

These accumulation patterns recommend that establishments are positioning themselves forward of upcoming modifications in liquidity, laws, and wider adoption.

Somewhat than reacting to short-term worth actions, massive gamers seem centered on structural developments that might form the following section of the market.

Why Traders See These Tokens because the Greatest Crypto to Purchase Now

Bitcoin continues to anchor the crypto ecosystem, more and more acknowledged by establishments and governments as a strategic asset. Its safety and decentralization stay unmatched, nevertheless it was not constructed for high-speed execution, complicated purposes, or scalable DeFi.

Consequently, a lot of its liquidity stays idle. This hole between institutional adoption and practical constraints has created demand for complementary infrastructure.

Layer 2 networks, like Bitcoin Hyper, intention to increase Bitcoin’s capabilities, preserving safety whereas unlocking new use circumstances and effectivity.

On the similar time, tasks like Maxi Doge show that speculative alternatives nonetheless play a job within the ecosystem, providing traders a special kind of engagement alongside infrastructure-focused belongings.

Bitcoin Hyper (HYPER)

Bitcoin Hyper just lately raised over $30 million in its presale, making it the fastest-growing presale at the moment regardless of fearful market circumstances. The presale is launching later this 12 months, giving early members an opportunity to safe tokens forward of broader market exercise.

Crypto knowledgeable Austin Hilton, on his YouTube channel, highlighted Bitcoin Hyper as a possible subsequent massive layer 2 challenge this 12 months.

As a layer 2 resolution for Bitcoin, it addresses Bitcoin’s sluggish transaction occasions, which presently common 54 minutes, enabling near-instant transactions whereas sustaining the safety of the primary blockchain.

Customers can bridge Bitcoin to Bitcoin Hyper, transact effectively, and withdraw tokens again to their Bitcoin wallets.

With rising neighborhood engagement and institutional curiosity, Bitcoin Hyper emphasizes utility and scalability, positioning itself as a robust candidate for enhancing Bitcoin’s usability in real-world purposes.

Go to Bitcoin Hyper

Maxi Doge (MAXI)

Maxi Doge has emerged as a standout meme coin amid cautious investor sentiment. In contrast to fleeting meme launches, it leverages robust timing, a compelling narrative, and vibrant neighborhood engagement, getting into the market early to permit members to get in earlier than wider publicity.

Its enchantment comes from a particular id, a transparent purpose to develop past a single-cycle meme, and early proof of a thriving neighborhood. The presale has already raised over $4 million, with tokens priced at simply $0.0002775, making it some of the reasonably priced alternatives available in the market at the moment.

This low entry level, mixed with its progress potential, positions Maxi Doge as a prime contender for traders on the lookout for the very best crypto to purchase now.

Whereas it stays a extremely risky asset, Maxi Doge offers a means for traders to seize speculative progress whereas complementing extra conservative allocations in infrastructure-focused tasks.

Go to Maxi Doge

Two Paths to Seize Crypto Potential

Bitcoin Hyper and Maxi Doge are linked not by class, however by their function in several phases of the market cycle.

Bitcoin Hyper serves because the infrastructure layer, enabling establishments to deploy capital effectively throughout the Bitcoin ecosystem. Maxi Doge represents the speculative edge that good points momentum as confidence available in the market returns.

This demonstrates how capital diversifies as accumulation phases mature: infrastructure helps long-term positioning, whereas selective hypothesis captures momentum throughout broader participation.

Participation within the Maxi Doge and Bitcoin Hyper presales is finest managed by the Greatest Pockets, a safe and dependable platform for crypto investments.

Accessing presales by this pockets ensures early entry into tasks earlier than they surge available in the market, offering a strategic benefit in capturing potential progress.

This text has been offered by one in every of our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues by the hyperlinks on this text.