Ethereum-based liquid staking resolution Lido has seen its Complete Worth Locked (TVL) climb by 25% within the final 30 days. Consequently, the Lido TVL is on the verge of reaching its all-time excessive of $40 billion, which it reached in March.

Regardless of the rise on this metric, Lido DAO Token (LDO), the native cryptocurrency of the Decentralized Finance (DeFi) mission, may discover it arduous to proceed appreciating. Right here is why.

Confidence in Staking on Lido Circles Again Towards March Peaks

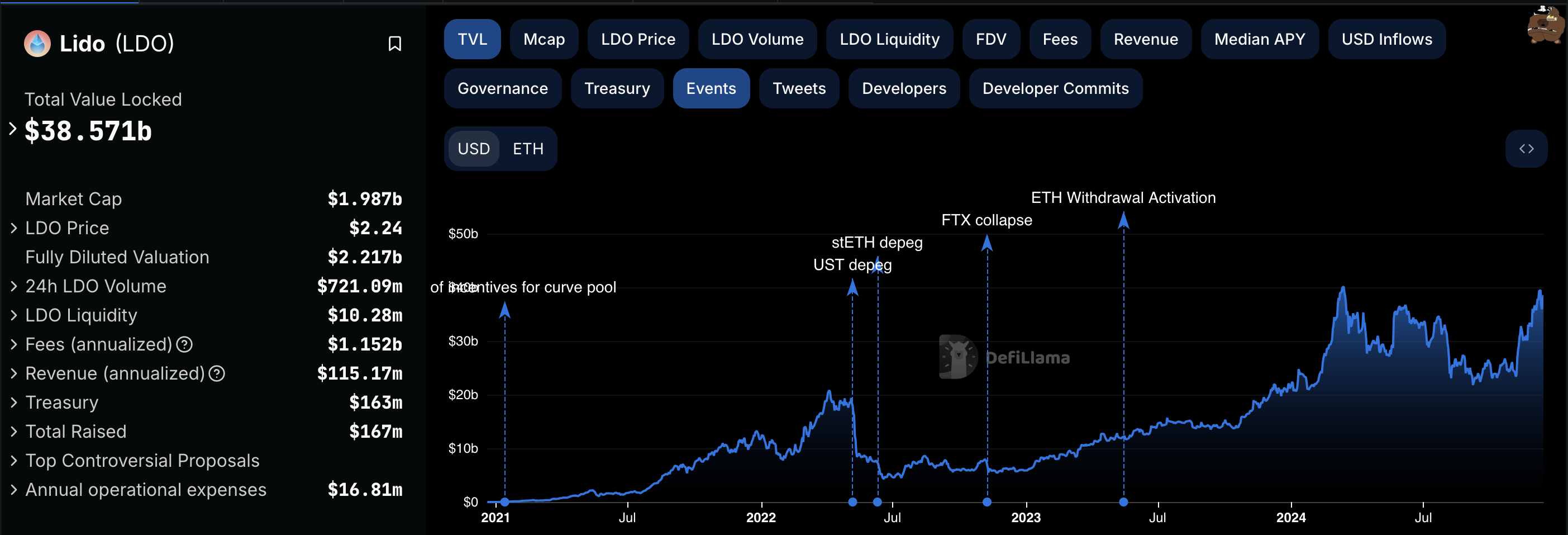

In November, Lido’s TLV was $24.60 billion. The TVL measures the worth of the full property locked or staked on a blockchain. As TVL rises, an inflow of property is being locked right into a platform.

This development usually enhances liquidity, fosters larger consumer confidence, and might result in elevated demand for the platform’s native token. However, a lower in TVL suggests a surge in asset withdrawals, indicating much less investor confidence.

In line with DeFiLlama, the protocol’s Complete Worth Locked (TVL) presently stands at $38.57 billion, inserting it lower than $2 billion shy of its all-time excessive. This development suggests renewed confidence in Lido’s capability to supply aggressive yields.

This surge aligns with a ten% enhance in LDO’s worth over the previous 24 hours. The rally is likely to be attributed to the Grayscale Lido DAO Belief, which signifies that institutional buyers can now acquire publicity to the cryptocurrency.

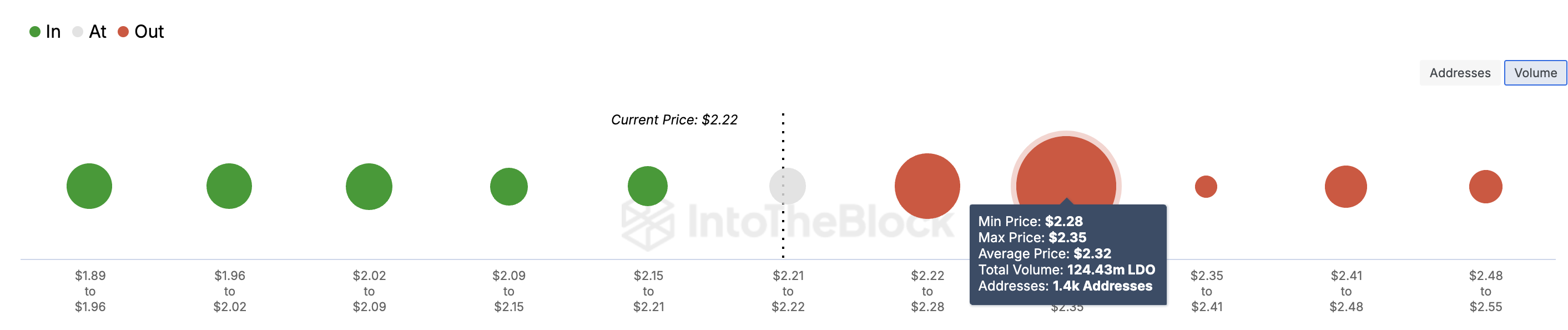

Nonetheless, the In/Out of Cash Round Worth (IOMAP) revealed that it could possibly be difficult for the altcoin’s worth to rise towards the $3 mark. That is due to the numerous resistance round $2.32.

For context, the IOMAP classifies addresses based mostly on these within the cash, out of the cash, and addresses on the breakeven level. When there’s a bigger quantity of tokens within the cash, it signifies resistance, whereas a big cluster out of the cash signifies resistance.

As seen above, about 1,400 addresses maintain 124.43 million and collected at a median worth of $2.32. This quantity is greater than these bought between $1.89 and $2.22, indicating robust resistance across the present worth. Given this case, LDO may expertise a notable pullback.

LDO Worth Prediction: Altcoin Eyes Decrease Ranges

From a technical perspective, the Superior Oscillator (AO) on the each day chart is constructive. Nonetheless, the AO, which measures momentum, has flashed pink histogram bars. The pink bars on the AO point out that momentum round LDO is waning.

Just like the AO, the Transferring Common Convergence Divergence (MACD) additionally helps a bearish outlook. Sometimes, when the MACD is constructive, it signifies that the momentum is bullish

Nonetheless, on this case, the detrimental studying means that LDO’s worth might drop to $1.65. This worth is the place the 61.8% Fibonacci retracement indicator is.

If shopping for stress will increase, this may not be the case, LDO might climb to $2.38. Ought to that intensify and the Lido TVL all-time excessive involves cross, the altcoin might surpass $3 within the quick time period.

The put up LDO Worth Faces Crucial Second Whereas Lido TVL Nears $40 Billion All-Time Excessive appeared first on BeInCrypto.