- Bitcoin and Ethereum funds noticed heavy outflows final week.

- XRP and Solana merchandise attracted notable inflows regardless of the broader pullback.

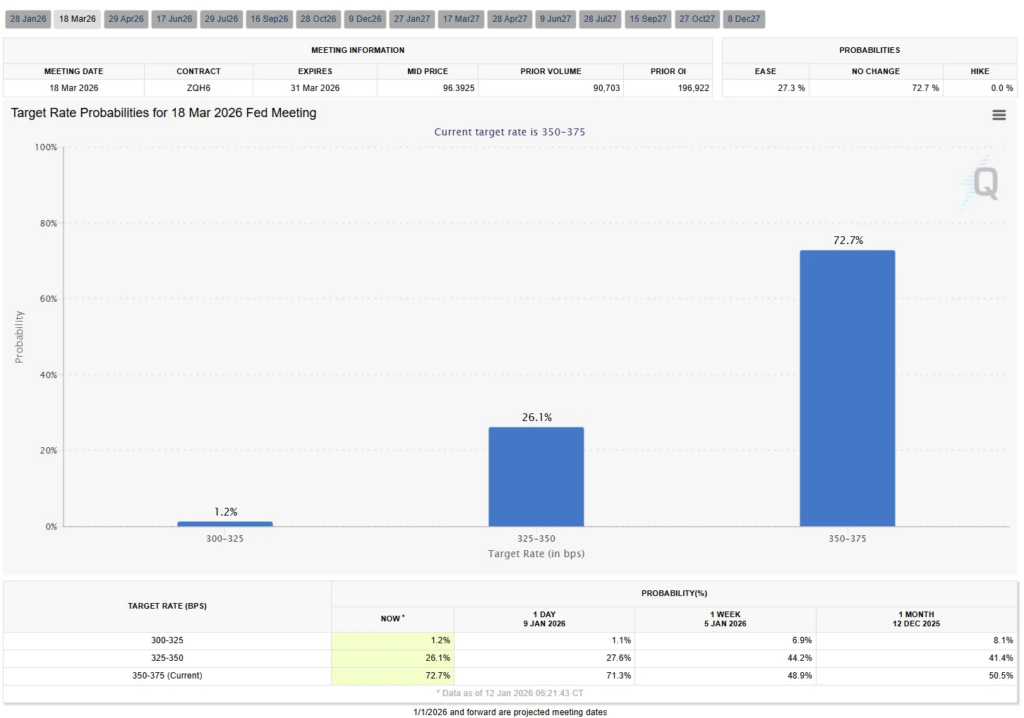

- Waning expectations of a March Fed charge minimize weighed on total sentiment.

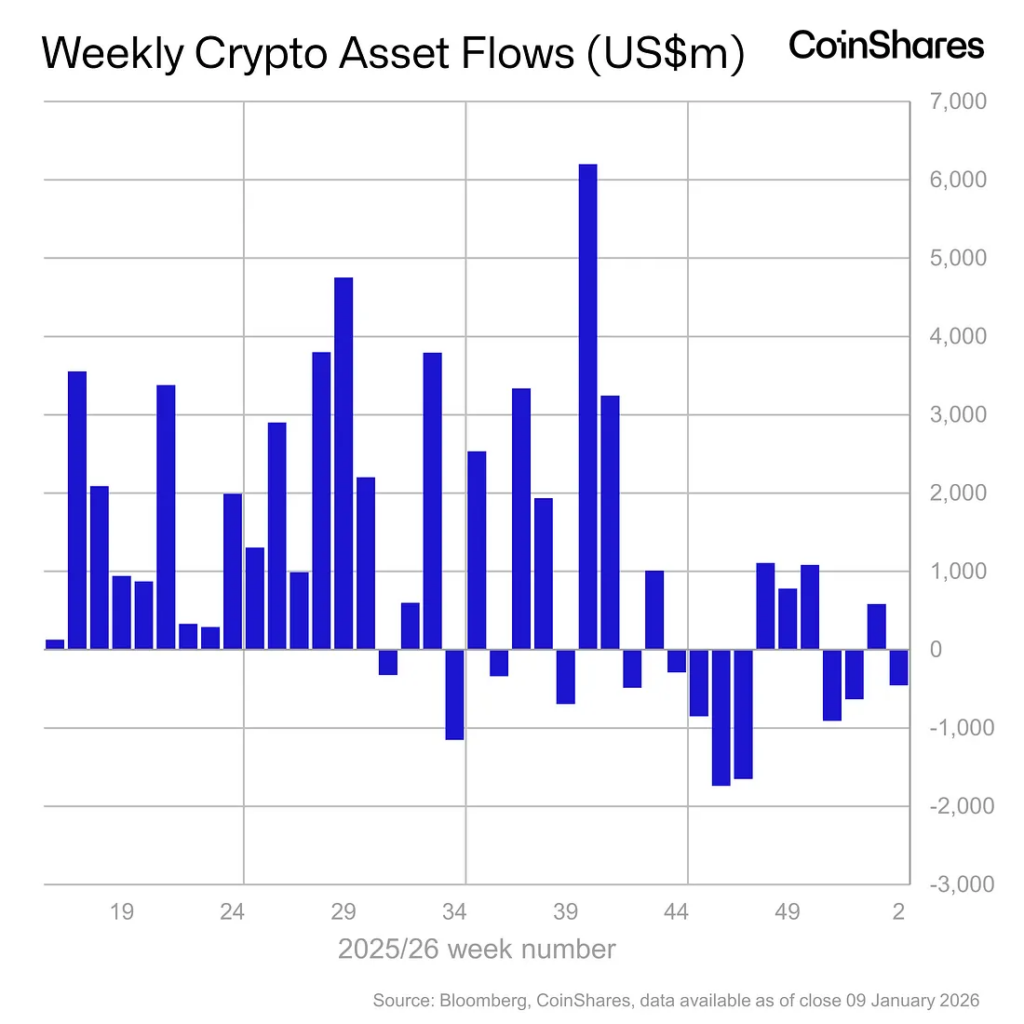

Final week’s fund flows drew a pointy line by way of crypto markets. Whereas exchange-traded crypto merchandise broadly noticed outflows, capital quietly rotated into a number of particular names. Based on the most recent CoinShares information, funds tied to XRP and Solana posted stable inflows whilst Bitcoin and Ethereum led a wave of redemptions. That divergence says extra about sentiment than the headline numbers alone.

Bitcoin and Ethereum Take the Hit

Bitcoin merchandise recorded roughly $405 million in outflows for the week, with Ethereum shut behind at $116 million. Collectively, they erased a big portion of the $1.5 billion that flowed into crypto funds earlier within the 12 months. The pullback wasn’t chaotic, however it was decisive, notably amongst U.S.-based traders who accounted for the majority of the promoting strain.

The place the Cash Truly Went

Whereas majors have been seeing crimson, XRP-linked funds attracted about $46 million in inflows, and Solana merchandise pulled in roughly $33 million. Sui and Chainlink additionally managed to shut the week in optimistic territory, albeit with smaller allocations. This wasn’t a broad altcoin rush. It was focused, suggesting traders are selecting narratives relatively than chasing the complete market.

Geography and Suppliers Inform a Story

On the supplier aspect, Grayscale and Constancy noticed a lot of the weekly redemptions, whereas iShares and ProFunds managed to usher in contemporary capital. Regionally, U.S. funds skilled the biggest outflows, whereas Germany, Canada, and Switzerland recorded internet inflows. That cut up highlights how sentiment isn’t shifting in lockstep globally, even when macro pressures are shared.

The Fed Shadow Nonetheless Looms

CoinShares analysts pointed to shifting expectations round U.S. financial coverage as a key driver. Current macro information has dampened hopes for a March charge minimize, with markets now pricing solely a 27% chance. As these odds pale, threat urge for food softened, pushing some traders to scale back publicity whereas others rotated into property they see as higher positioned.

Conclusion

This wasn’t a easy risk-off week. It was a reshuffling. Bitcoin and Ethereum took the brunt of outflows, however capital didn’t go away crypto fully. It moved selectively. XRP and Solana benefiting in that setting suggests traders are nonetheless engaged, simply way more discriminating than they have been a number of weeks in the past.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.