- XRP has fallen practically 15% since January 6, however long-term holders are accumulating on the quickest tempo since September

- The 20-day EMA and dense on-chain provide clusters close to $2.00 are appearing as key protection zones

- Focused dip shopping for is supporting value, at the same time as momentum stays weak and bigger whales keep cautious

XRP has been sliding exhausting since its January 6 peak, and the transfer hasn’t been refined. In lower than per week, value is down shut to fifteen%, with a number of assist ranges already breaking alongside the way in which. Momentum appears to be like weak, sentiment feels heavy, and the chart hasn’t provided a lot consolation to late patrons.

However underneath the floor, one thing totally different is occurring. Conviction patrons are stepping in aggressively, at a tempo XRP hasn’t seen since early September. That disconnect between falling value and rising long-term demand is making a uncommon pressure, one which often doesn’t final very lengthy.

One Pattern Line Is Quietly Deciding XRP’s Destiny

The sell-off actually picked up after XRP didn’t reclaim its 200-day EMA on the January 6 excessive. That rejection mattered. EMAs, particularly longer ones, usually act like pattern gatekeepers, and staying under them tends to maintain sellers in management.

From there, XRP misplaced the 100-day EMA, then the 50-day, one after one other. Now value is hovering close to the 20-day EMA, which has change into the ultimate short-term line holding the construction collectively. This degree usually separates a managed pullback from one thing extra painful.

There’s precedent right here. In early December, XRP misplaced the 20-day EMA on December 4 and proceeded to drop roughly 15% within the days that adopted. That reminiscence is why this degree feels heavy now. Holding it retains the construction alive, barely. Shedding it on a day by day shut probably extends the freefall.

Dip Shopping for Is Surging, however It’s Not Everybody

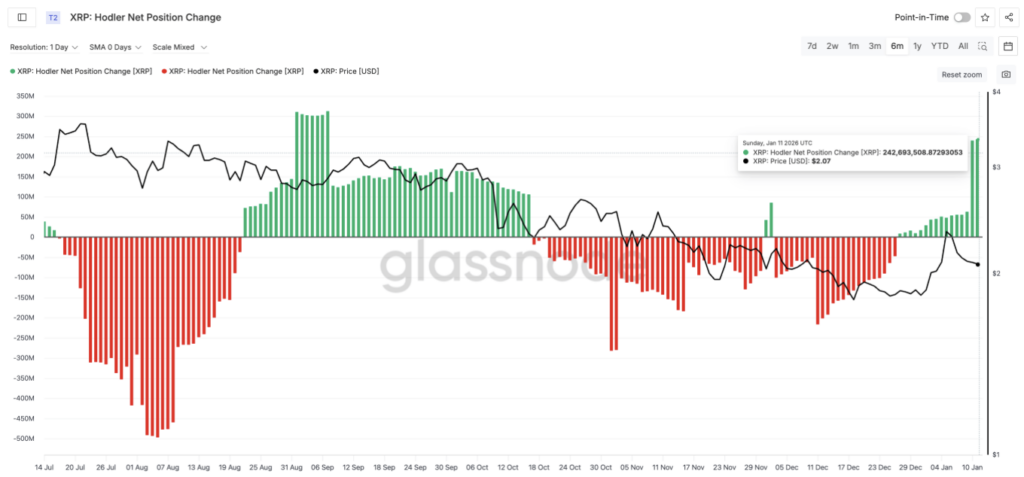

Regardless of the technical harm, long-term holders are shopping for into the weak spot, and so they’re doing it with conviction. This reveals up clearly within the HODLer web place change metric, which tracks whether or not long-term wallets are including or lowering their balances.

On January 9, these holders added round 62 million XRP. Over the subsequent two days, that quantity exploded. Roughly 239 million XRP was absorbed on January 10, adopted by one other 243 million on January 11, at the same time as value continued to fall. That makes it the strongest two-day accumulation streak since September 7.

What’s notable is who isn’t shopping for. Massive whales stay principally sidelined. Solely smaller whales, these holding between 1 million and 10 million XRP, have proven exercise. Their mixed balances elevated by about 10 million XRP, roughly $20.5 million at present costs.

This isn’t broad-based accumulation. It’s focused, defensive shopping for. Smaller gamers are stepping in close to key ranges, whereas greater cash waits for readability. That imbalance explains why XRP is holding assist however failing to bounce with power.

Provide Clusters Clarify Why Consumers Aren’t Panicking

The conviction from long-term holders traces up virtually completely with XRP’s on-chain price construction. Massive provide clusters sit slightly below the present value, appearing like stress pads relatively than entice doorways.

One main cluster sits between $2.00 and $2.01, the place roughly 1.9 billion XRP had been accrued. One other lies slightly below, between $1.96 and $1.97, with about 1.8 billion XRP purchased. Holders close to these ranges are near breakeven, which regularly encourages dip shopping for as an alternative of panic promoting.

That’s why promoting stress has slowed, at the same time as momentum stays weak. So long as these clusters maintain, XRP can print lengthy decrease wicks and try to stabilize. A reclaim of the 20-day EMA close to $2.04 could be the primary actual sign that this protection is working.

Above that, XRP must reclaim $2.21 after which $2.41, the January 6 peak. Clearing $2.41 would reopen $2.69 and flip the construction bullish once more, however that’s an extended highway.

Draw back danger hasn’t disappeared. A clear break under $2.01 exposes $1.97, then $1.77 after that. Notably, these ranges additionally line up with seen assist on the value chart, reinforcing how carefully construction and on-chain information are aligned proper now.

XRP’s present power isn’t coming from momentum or headline-driven hype. It’s coming from construction. So long as the 20-day pattern line holds and dense provide clusters sit beneath value, conviction patrons are prepared to soak up the stress, quietly, patiently, and with out a lot noise.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.