Briefly

- Former New York Metropolis Mayor Eric Adams launched the NYC token, claiming it will fund charitable causes.

- The token surged to a virtually $600 million market cap earlier than crashing to over $1oo million.

- A pockets linked to the token deployer eliminated $2.43 million in USDC liquidity, added again $1.5 million, leaving $932,000 unaccounted for.

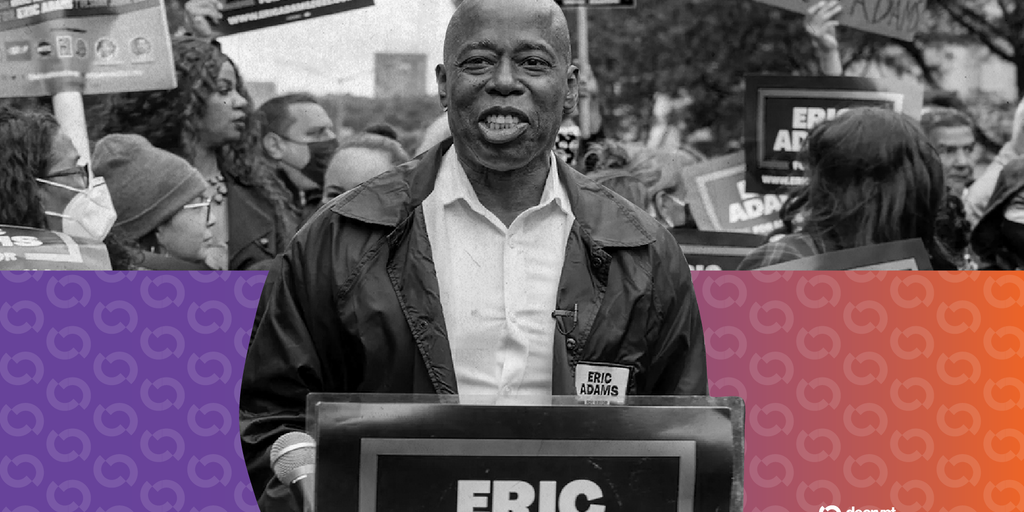

A pockets linked to former New York Metropolis Mayor Eric Adams’ newly launched crypto token allegedly pocketed practically $1 million by way of suspicious manipulation of a liquidity pool on Monday.

The creator of the NYC token despatched 80 million cash to an account that added the tokens as liquidity on a decentralized change.

That account then eliminated $2.43 million in USDC earlier than including again $1.5 million, leaving roughly $932,000 in unaccounted-for USDC liquidity, on-chain analytics platform Bubblemaps confirmed to Decrypt on Monday.

The episode comes amid rising scrutiny of politician-backed cryptocurrencies, together with meme cash, following final yr’s collapse of the LIBRA token promoted by Argentine President Javier Milei, which led to fraud and racketeering class-action lawsuits.

Bubblemaps additionally recognized the suspicious exercise, reporting that pockets 9Ty4M, related to the NYC token deployer, created one-sided liquidity swimming pools on Meteora.

“This pockets then: eliminated ~$2.5M USDC on the peak, added again ~$1.5M USDC after a -60% drop,” Bubblemaps reported.

“There was no clarification for these liquidity strikes,” Bubblemaps tweeted. “That is sadly harking back to the $LIBRA launch, the place liquidity was additionally closely manipulated.”

The previous mayor introduced the token at a Instances Sq. press convention on Monday, saying the venture would tackle “antisemitism and anti-Americanism” utilizing income generated by the token, whereas additionally instructing youngsters “the best way to embrace the blockchain expertise.”

The NYC token has a most provide of 1 billion tokens, with it representing “the spirit of New York Metropolis—innovation, variety, and the drive to succeed,” in line with the token’s official web site.

NYC surged to a $600 million market cap earlier than crashing to round $110 million, in line with Solscan information. The token’s value has fallen by greater than 81% from a peak of round $0.58 to only $0.11, information exhibits.

Decrypt has reached out to Eric Adams for remark.

Political disasters

President Milei’s LIBRA token scandal led to frozen belongings, investigations into fraud, and class-action lawsuits.

Solely 14% of LIBRA traders turned a revenue, whereas 86% of those that invested within the token misplaced a mixed $251 million, in line with a report by Nansen.

Court docket filings in a U.S. class motion lawsuit later named Meteora co-founder Benjamin Chow because the mastermind behind a minimum of 15 token launches following an “similar blueprint,” together with the high-profile MELANIA and LIBRA tokens.

The lawsuit alleges that First Woman Melania Trump and President Milei have been used as “props to legitimize” what prosecutors describe as coordinated liquidity traps.

The MELANIA token, promoted by the First Woman simply two days after President Trump’s personal meme coin debut in January, surged to a near-$7 billion market cap earlier than collapsing by 99% to $80 million over the next months.

In November, an Argentine decide froze belongings referring to the LIBRAsc andal after investigators found potential “oblique funds to public officers” by Kelsier Ventures CEO Hayden Davis.

Bubblemaps linked wallets used to launch MELANIA and LIBRA, revealing a sample of coordinated manipulation.

Day by day Debrief Publication

Begin on daily basis with the highest information tales proper now, plus authentic options, a podcast, movies and extra.