The January US CPI print is approaching at a delicate second for markets, and crypto whales are already positioning. Inflation is predicted to remain regular, broadly according to November’s cooling knowledge. However nonetheless excessive sufficient to maintain early-2026 rate-cut hopes muted. November’s softer CPI didn’t shift Federal Reserve expectations, leaving liquidity situations tight.

On this backdrop, whale conduct issues greater than value alone. When rate-cut optimism is low, giant holders are likely to act selectively quite than chase threat. Forward of the CPI launch, on-chain knowledge exhibits a transparent break up between three tokens. Crypto whales are accumulating two whereas decreasing publicity to the third one after a current rally.

Maple Finance (SYRUP)

Among the many tokens whales are positioning round forward of the CPI print, Maple Finance (SYRUP) stands out as a DeFi-focused guess quite than a macro one.

Sponsored

Sponsored

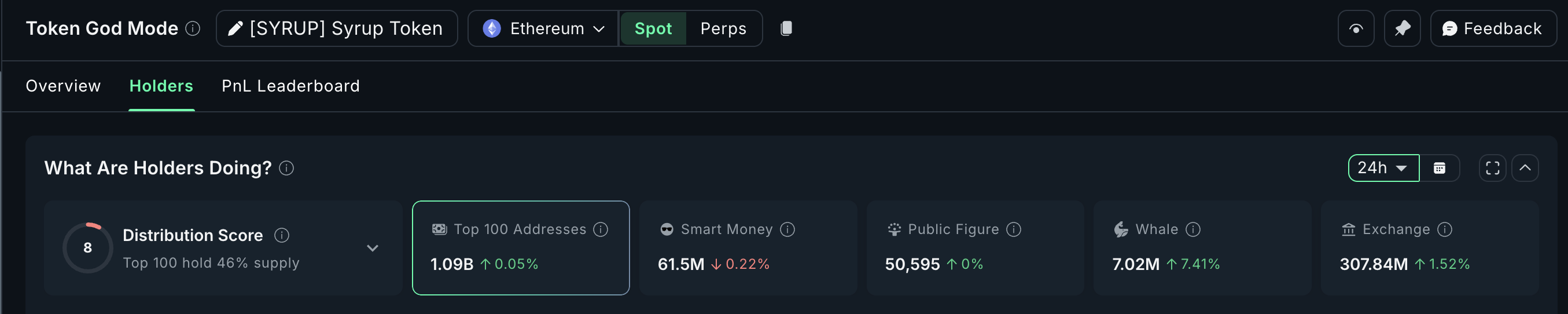

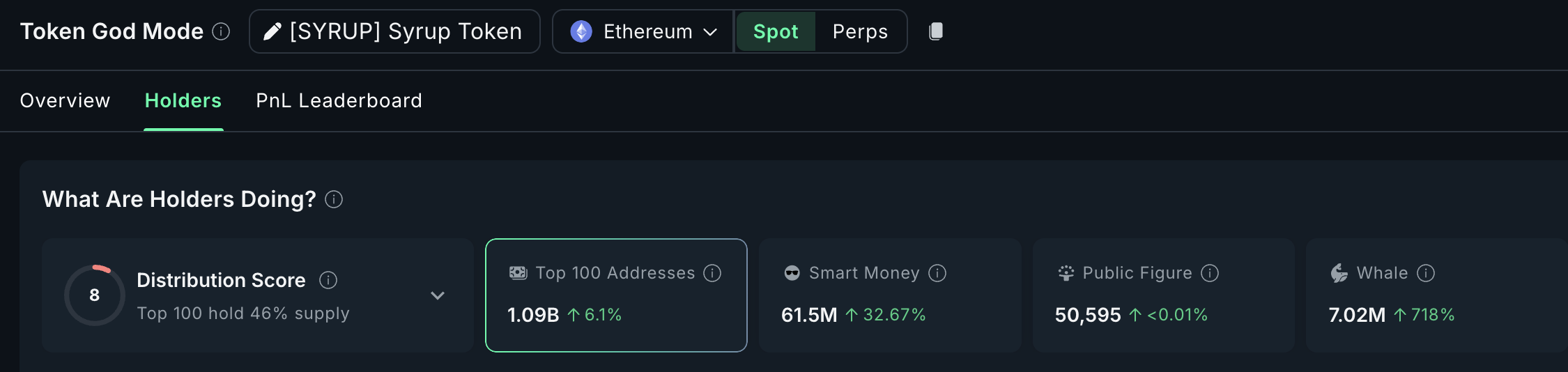

Over the previous 24 hours, Maple Finance whale wallets elevated their holdings by 7.41%. That equals about 480,000 SYRUP added, value roughly $0.19 million on the present value.

By itself, the one-day addition seems to be modest. However context issues.

On a 30-day foundation, Maple Finance whale balances are up over 718%, exhibiting regular and chronic accumulation quite than reactionary shopping for.

Worth motion helps this conduct.

SYRUP is up almost 40% over the previous 30 days (highlights continued conviction shopping for from whales), climbing from round $0.23 to $0.40 since early December. This transfer has been structurally supported by pattern alerts on the chart.

An EMA, or exponential shifting common, provides extra weight to current costs and helps outline pattern course. On SYRUP’s every day chart, the 20-day EMA has crossed above the 50-day and 100-day EMAs, a sequence that usually alerts strengthening upside momentum. The worth is now buying and selling above all main EMAs, protecting the pattern firmly bullish. Plus, the 20-day EMA is closing in on the 200-day EMA, one other bullish crossover within the making.

Sponsored

Sponsored

The following problem sits at $0.40, which has acted as a powerful resistance and rejected value on January 12. A clear every day shut above this stage, roughly a 3.8% transfer, would open the trail towards $0.46, adopted by a possible extension to $0.50 if momentum holds.

Draw back threat stays managed however clear. Shedding $0.36 can be the primary warning signal. A deeper transfer beneath $0.34 would push the worth again underneath key EMAs, weakening the bullish construction and exposing a pullback towards $0.30.

Chainlink (LINK)

Chainlink is seeing quiet whale positioning forward of the US CPI print, suggesting selective accumulation quite than broad risk-on conduct.

Over the previous 24 hours, crypto whale wallets elevated their LINK holdings from 503.12 million to 503.51 million, including roughly 390,000 LINK or $6.6 million in contemporary shopping for. This issues as a result of early-2026 rate-cut expectations stay low, which normally limits aggressive positioning. As an alternative, crypto whales look like leaning towards infrastructure names tied to the real-world asset narrative, a theme that stayed robust via 2025 and continues into 2026.

Sponsored

Sponsored

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

The LINK value construction helps that positioning. Chainlink is forming a double backside on the 12-hour chart, a W-shaped base that usually alerts vendor exhaustion.

Worth has stabilized after the second low and is now grinding larger. For momentum to construct, LINK should first clear $13.50, adopted by the extra necessary $14.90 stage, which has capped upside repeatedly. A clear 12-hour break above $14.90 would open the trail towards $15.50 and $17.01, with larger resistance ranges close to $19.56 coming into view if follow-through holds.

Threat stays outlined. A drop beneath $12.90 weakens the restoration, whereas a lack of $11.70 would invalidate the double-bottom construction fully.

Polygon Ecosystem Token (POL)

Polygon ecosystem token (POL) has seen a pointy shift in whale conduct simply forward of the US CPI print. Whereas POL stays up round 20% on the week, the token has slipped almost 4% over the previous 24 hours.

Sponsored

Sponsored

Throughout this pullback, giant crypto whales holding between 10 million and 100 million POL have began decreasing publicity after rising holdings between January 10 and January 12. Over the previous day, this cohort lower holdings from 585.39 million POL to 582.37 million POL, a discount of about 3.02 million tokens.

The timing is notable, as this promoting follows a powerful multi-day rally.

The POL value construction helps clarify the warning. POL surged sharply from early January lows, forming a steep pole, adopted by a good consolidation that resembles a bullish flag.

Nonetheless, the pullback from the highs has been aggressive quite than managed. On the identical time, On-Steadiness Quantity (OBV), which tracks whether or not quantity confirms value course, has rolled over and is now sitting close to its rising pattern line. This alerts that purchasing strain is weakening whilst the worth makes an attempt to carry its vary. A trendline breakdown may weaken the construction additional.

If POL loses $0.14 after which $0.13, the flag construction dangers invalidation, opening draw back towards $0.11 and probably $0.09. A bullish continuation solely regains credibility above $0.16, supported by enhancing quantity.

For now, whale promoting suggests the current transfer within the Polygon ecosystem token seems to be extra cyclical than conviction-driven, particularly forward of a serious macro occasion like CPI.