- Cost rely explosion

- XRP pushes by

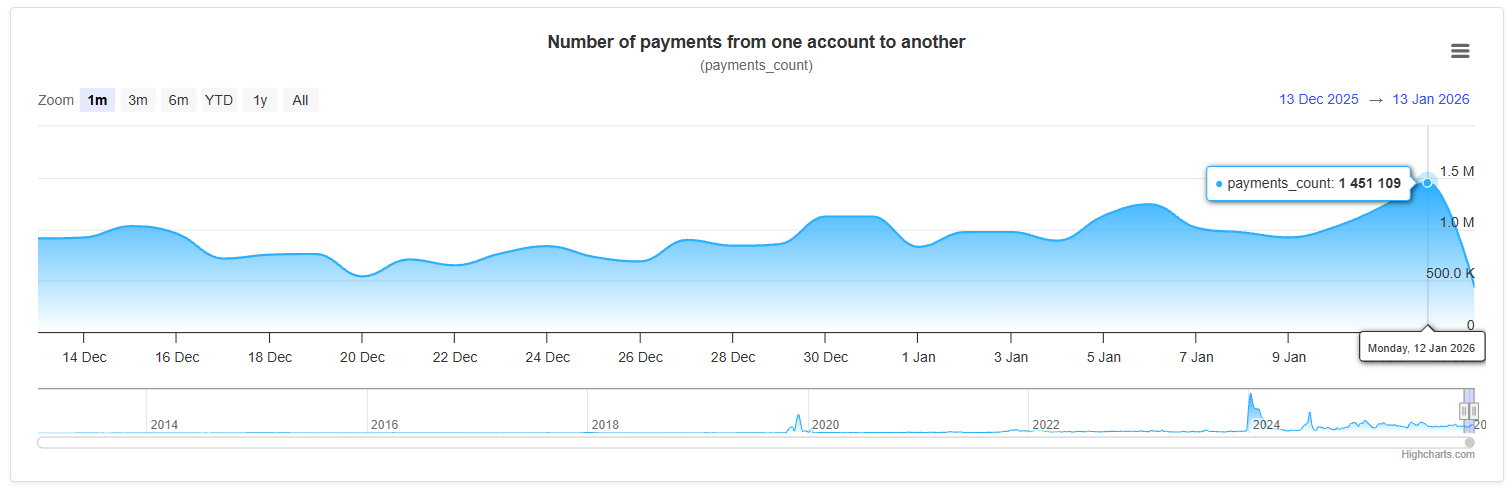

There’s extra happening with XRP than simply value noise for the time being. The XRP Ledger’s on-chain exercise not too long ago recorded its highest fee rely in about 180 days, with each day transactions reaching about 1.45 million. That could be a structural indication that utilization is resuming after a protracted cooling-off interval, not an opportunity spike. XRPs on-chain metrics have a historical past of cyclical motion.

Cost rely explosion

Weekends and holidays trigger exercise to drastically decelerate, however as soon as common settlement flows resume, it picks again up rapidly. What counts on this case is that the rebound exceeded current native highs fairly than merely returning to baseline. This suggests that involvement is rising fairly than being a one-time outburst from a single actor.

Take a look at the value chart subsequent to that now. Sitting beneath the 200 EMA and having issue regaining increased transferring averages, XRP remains to be buying and selling beneath important long-term resistance zones. This isn’t but a confirmed bull pattern from a technical standpoint. After rising from a protracted downtrend channel, the asset not too long ago recovered from native lows and is presently consolidating round short-term EMAs.

XRP pushes by

That is typical reset conduct: the market determines whether or not there may be adequate demand to push increased volatility contracts and momentum indicators stabilize. Divergence is essential. Whereas the value remains to be comparatively low, on-chain exercise is growing. This sometimes signifies one in all two issues: both the value finally must rise to maintain up with the rise in utilization or the community exercise fades as soon as extra and the value goes down.

Sustained development within the variety of funds tends to precede fairly than observe directional strikes, as XRP has repeatedly demonstrated. Buyers shouldn’t anticipate a breakout straight away. Reclaiming the 50 and 100 EMAs can be a strong first sign, however the chart nonetheless wants affirmation.

Nonetheless, the present association prioritizes endurance over concern. In distinction to purely speculative pumps rising, transaction counts present that XRP is getting used actively fairly than simply traded, which lowers draw back threat.

To place it succinctly, XRP seems to be early fairly than late. Longer-term alternatives sometimes come up when on-chain information is main and value is lagging.