Software program engineer and AI founder Vincent Van Code (@vincent_vancode) is arguing that institutional boundaries to holding and utilizing XRP have largely shifted from “market construction” to “plumbing,” claiming Ripple has spent 2025–2026 assembling an institutional stack for custody, treasury, and prime brokerage that makes large-scale participation operationally viable.

In a publish on X on Wednesday, the engineer framed self-custody as a non-starter for conventional allocators managing retirement swimming pools, pensions, and financial institution steadiness sheets.

Ripple Assembles The XRP ‘Wall Avenue Equipment’

“Establishments juggling billions in 401(okay)s, pensions, hedge funds, banks & governments? Self-custody was all the time insane—audit hell, compliance nightmares, danger officers saying ‘no approach,’” he wrote. “That modified in 2025–2026. Ripple constructed the full-stack bridge: regulated, scalable, bank-trusted infrastructure so large cash can lastly maintain & use XRP + RLUSD with out the chaos.”

Associated Studying

Van Code’s core competition is that the crypto-native custody debate misses the institutional actuality: danger committees, auditors, and compliance features require regulated custody, reporting, and controls that may plug into current workflows. He argues Ripple’s latest buildout quantities to a “Wall Avenue equipment” that addresses these constraints end-to-end, spanning funds rails, company treasury tooling, prime brokerage companies, and bank-grade custody.

Whereas the publish is advocacy relatively than a proper Ripple announcement, it displays a view more and more frequent amongst XRP supporters: that productized rails and controlled wrappers matter as a lot as market narratives when giant allocators take into account including publicity or utility.

Van Code pointed to Ripple Funds because the transaction layer, describing it as “ISO 20022-compliant, real-time cross-border rails on XRPL—already shifting billions for international banks.” He then tied institutional adoption to what he portrayed as adjoining infrastructure designed to make XRP and Ripple’s RLUSD workable inside company and financial-institution operations.

Associated Studying

Among the many items he highlighted was GTreasury, which Ripple acquired for $1 billion, characterizing it as an enterprise treasury administration platform enabling companies to handle “fiat + digital liquidity in real-time.” He additionally cited Ripple Prime, described as being “powered by Hidden Street acquisition for $1.25B”, as a first-rate brokerage stack providing “clearing, financing & OTC buying and selling—together with XRP & RLUSD—with seamless XRPL settlement for quicker, cheaper post-trade ops.”

For custody, he argued Ripple has converged on a bank-facing providing by way of a collection of offers and integrations. “Ripple Custody (bolstered by Palisade acquisition + prior Customary Custody/Metaco) → Financial institution-grade, regulated storage with MPC safety, multi-chain help & zero-trust structure,” he wrote, including that it’s “auditable, insured, scalable for billions.” Van Code additionally claimed “RLUSD reserves [are] custodied by BNY Mellon for final belief.”

The publish’s conclusion was blunt about anticipated influence. “Backside line: Excuses erased. Compliance baked in. Custody danger? Solved,” Van Code wrote. “Establishments aren’t simply watching—they’re quietly stacking & constructing on XRPL. 2026 is the yr XRP shifts from ‘spec play’ to core monetary infrastructure. Billions incoming.”

If that thesis holds, the subsequent sign for markets is not going to be rhetoric however observable integration: whether or not these parts translate into sustained institutional flows, deeper liquidity venues, and manufacturing use of XRP and RLUSD, finally displaying up in worth discovery.

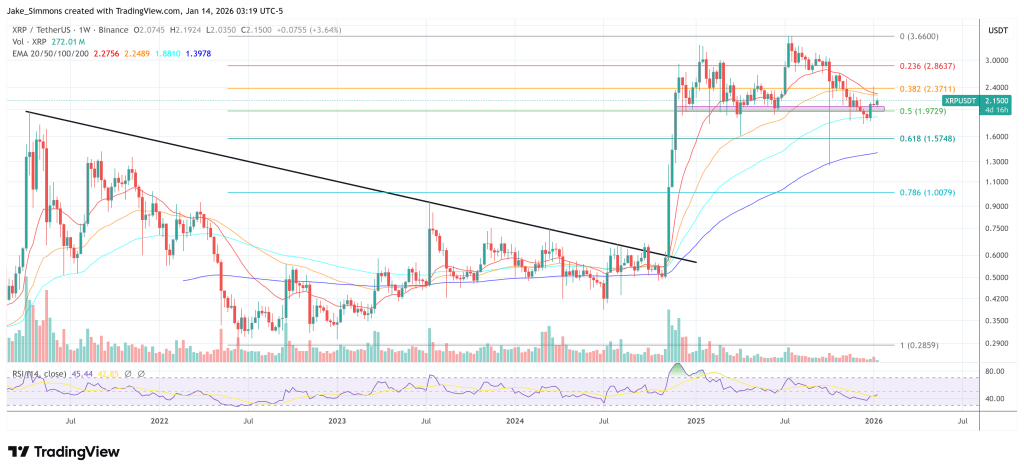

At press time, XRP traded at $2.15.

Featured picture created with DALL.E, chart from TradingView.com