It’s Wednesday, Jan. 14, and the crypto markets are reacting to a few main occasions: a Shiba Inu billionaire simply flooded Robinhood with 145 billion tokens, a dealer who is legendary for nuking 255 BTC in December has switched again to brief mode after betting $30 million on XRP and Bitcoin’s breakout to $96,000 led to a 10-to-1 liquidation imbalance, inflicting brief sellers to lose lots.

TL;DR

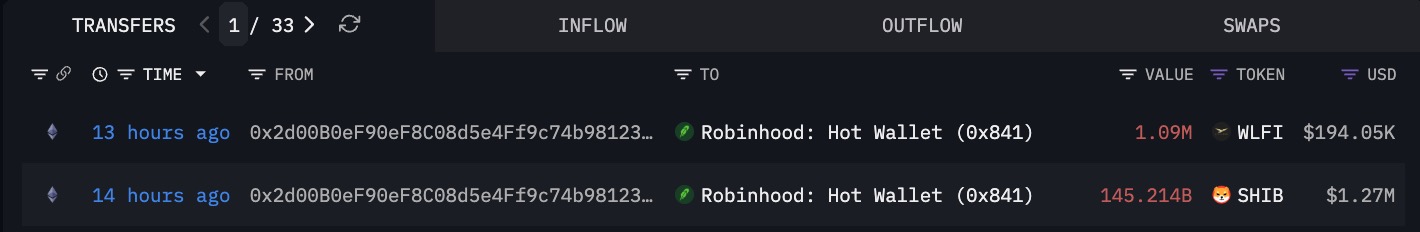

- 145.2 billion SHIB value $1.27 million despatched to Robinhood, hinting at retail ramp or stealth exit.

- XRP whale closes $413 million longs, flips brief on BTC, ETH, SOL — however XRP left untouched.

- Bitcoin hits $96,000, triggers $291.8 million liquidations with 942% short-side imbalance.

Robinhood sees 145,214,184,927 Shiba Inu (SHIB) tsunami

One of many largest crypto retail platforms simply received hit with a SHIB flood. In line with Arkham, pockets “f7bB” unloaded 145.2 billion SHIB — value over $1.27 million — into Robinhood’s scorching pockets lower than 14 hours in the past. Then, a second transaction of 1.09 million WLFI value about $194,000 went to the identical place, which means that it was an organized sale and never only a random determination.

The pockets’s different holdings nonetheless have 11.85 billion SHIB equal to $104,000, which exhibits the complete place may have been lots greater. It’s fascinating that the SHIB worth barely moved after the switch, which makes us suppose two issues: both somebody’s holding these tokens for a sale later, or they’re on the point of do some sort of inside staking program or OTC onboarding for a market maker.

Within the meantime, the Shiba Inu coin is at the moment stabilizing beneath the $0.000009 ceiling. If the meme coin breaks above that degree, be prepared for a fast transfer to $0.00001102. But when the Robinhood inflow finally ends up hitting the open market — both by way of consumer gross sales or inside hedging — a fakeout rejection may drag SHIB again to $0.0000076.

If the switch was really retail offloading, it might be the beginning of a meme rotation cycle with Robinhood in cost. But when it was an institutional one, Shiba Inu may face promoting stress disguised as influx quantity.

$30 million XRP dealer betting on crash

The “255 BTC” whale is again, and he is able to rumble, based on Lookonchain. After making over $413 million in lengthy trades on BTC, ETH, SOL and XRP, the well-known Hyperliquid whale has gone brief once more, taking a contemporary $35 million place. This comes simply weeks after going all-in on XRP with $30 million and 20x leverage.

The most recent transfer appears to substantiate that the December-to-January lengthy marketing campaign was a deliberate entice: draw within the crowd, make a revenue, then return and promote all the things. It’s fascinating that the brand new brief positions exclude XRP, which suggests certainly one of two issues: both the whale is anticipating a shock catalyst for XRP that would enhance the worth, or they’ve misplaced religion in XRP’s capability to create volatility.

Additionally it is value mentioning that his earlier XRP entry at $2.1027 is simply barely above the present worth, which makes the small acquire appear to be a stopout fairly than a clear revenue exit. Both manner, the whale’s buying and selling sample now seems to be extra like a hedge fund scalper than a directional bull or bear. His actions recommend that he’s extra keen on making a fast revenue than in long-term technique.

Look ahead to any sudden influx into Hyperliquid’s perpetuals round XRP. If this dealer reengages there, it may sign front-running of insider catalyst knowledge or pre-positioning forward of ETF motion, Readability Act revisions or Fed liquidity shifts.

Bitcoin prints 1,000% liquidation imbalance as BTC worth rockets

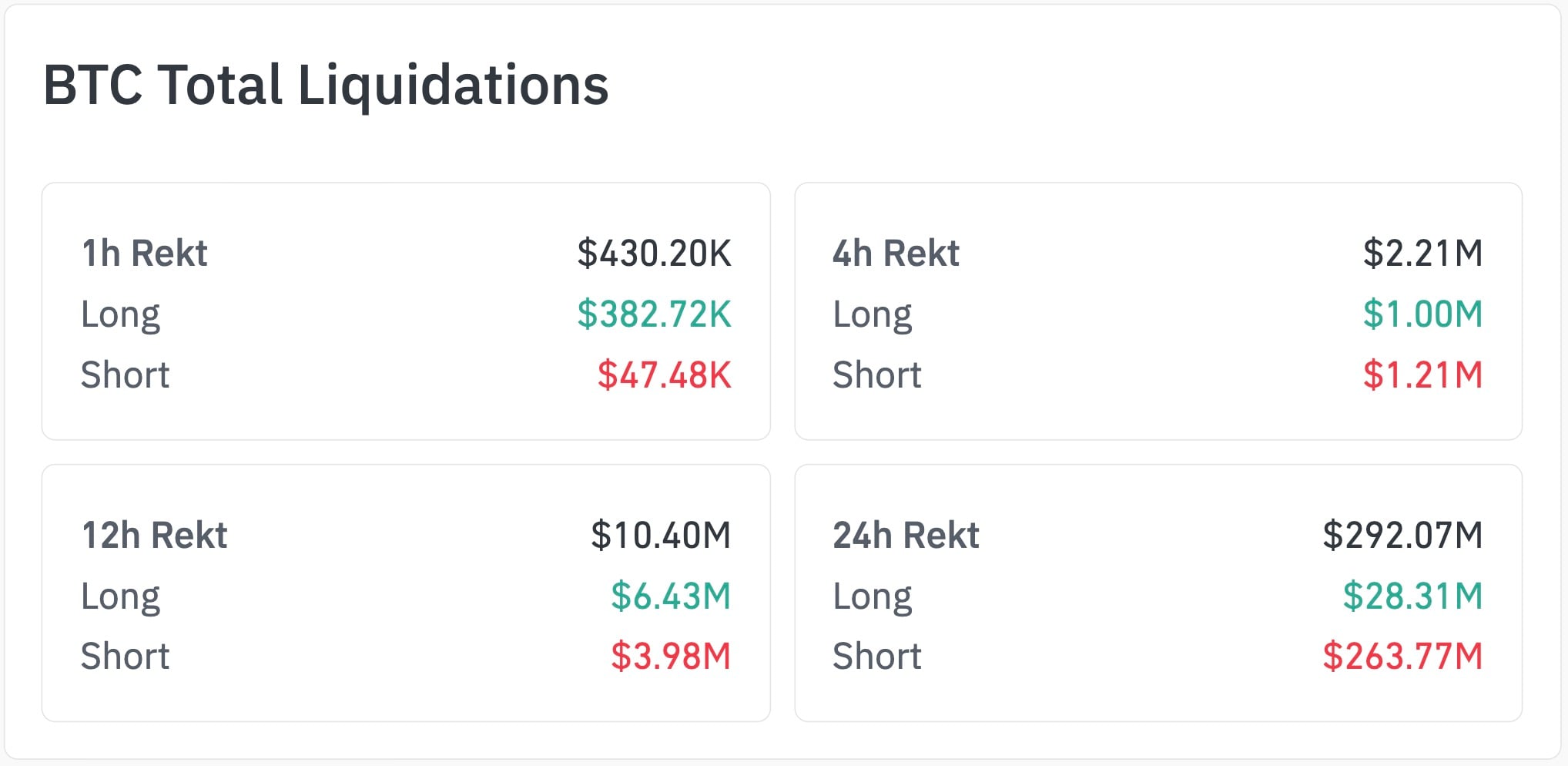

Bitcoin’s worth taking pictures up previous $96,000 may need seemed clean on the floor, however behind the scenes, it was a complete catastrophe — for brief sellers. In line with CoinGlass, $291.86 million in futures have been liquidated inside 24 hours — $263.85 million of that in brief positions alone. Longs took a small $28 million hit, making a 942% liquidation imbalance that means a violent brief squeeze, as an alternative of a pure grind-up.

This liquidation storm hit its peak between 2:00 and three:00 a.m. UTC, proper across the time BTC crossed the $95,000 degree. The most important single commerce was over $9 million. The rekt ratio is now at 3.09x the seven-day common, so this occasion is within the “excessive” class.

Proper now, BTC is up 10% this yr, and it’s testing some psychological ranges. The $100,000 goal is again on observe, however the actual quantity to control is $107,154, which is the excessive level from October 2025. If shorts reenter and get squeezed once more, we may see a slingshot situation, the place BTC bursts by six figures in a single session.

Controversially, this transfer would possibly even result in some ETF rebalancing dangers. If spot BTC ETFs begin getting numerous inflows once more in the midst of the month, we’d see a March-style overextension adopted by a pullback. The present danger isn’t just concerning the verticality; it’s that open curiosity is maxed out and whales are taking part in ping-pong with retail stops.

If the $92,000 breaks, anticipate a cascading liquidation again to $87,500. However so long as shorts are crowded, ache will get increased.

Crypto market snapshot

Whales are shifting their cash round tremendous rapidly, dumping billions of tokens, flipping their bias midweek and making markets reactive. It seemed like a SHIB influx, nevertheless it is likely to be Robinhood on the point of shock meme coin holders. What appeared like an XRP moonshot simply turned out to be a brief setup.

And Bitcoin? It’s not like climbing anymore however extra like searching stops.

Key ranges to look at:

-

Shiba Inu (SHIB): Urgent $0.000009 with breakout opening room to $0.00001102, however dipping under $0.000008 invitations $0.0000071 retest.

-

XRP: Flat at $2.13 as $2 marks the pivot — lose it, and $1.86 follows quick.

-

Bitcoin (BTC): One other squeeze gasoline builds towards $107,000, however be careful $92,000 if issues break down.

January comes as an actual chess match between the large gamers, market makers and information algorithms. Be prepared for extra wild market swings round key financial dates.