- SEC Chairman Paul Atkins’ remarks have reignited confidence in XRP’s regulatory outlook.

- Help for clearer SEC–CFTC jurisdiction indicators a transfer away from enforcement-first coverage.

- Legislative momentum might unlock institutional entry and finish years of authorized uncertainty.

Crypto markets are buzzing once more after latest remarks from SEC Chairman Paul Atkins reignited confidence round XRP’s regulatory future. After years of lawsuits, uncertainty, and what many traders noticed as enforcement-first policymaking, Atkins’ feedback about congressional motion landed in another way. For a rising variety of market watchers, the message was clear: regulatory readability for XRP could lastly be inside attain, and from a coverage standpoint, the lengthy combat may very well be nearing its finish.

What Paul Atkins Really Stated

Atkins didn’t point out XRP straight, however his phrases carried weight. In a public publish, he stated this week may very well be a turning level for crypto as Congress strikes to modernize monetary markets for the twenty first century. He additionally said he’s totally supportive of Congress clarifying how regulatory authority needs to be cut up between the SEC and the CFTC. That alone marks a noticeable shift away from years of ambiguity and towards legislation-led oversight, which the trade has been asking for.

Why Some Analysts Say XRP Is “Achieved”

Crypto analyst JackTheRippler was fast to label XRP a finished deal after Atkins’ remarks. His reasoning rests on the concept that regulators and lawmakers now seem aligned on ending extended authorized grey areas. When senior officers publicly encourage clearer laws, markets are likely to assume follow-through is coming. That expectation alone can transfer sentiment quick, particularly for an asset like XRP that has spent years caught in regulatory limbo.

The Jurisdictional Shift That Adjustments the Equation

On the middle of this renewed optimism is the proposed Digital Asset Market Readability Act. The laws goals to obviously outline classes of digital belongings and assign oversight between businesses, straight addressing the confusion that has surrounded XRP because the SEC lawsuit started in 2020. If handed, it might exchange courtroom battles with rule-based readability and create a repeatable framework for future crypto regulation, not only for XRP.

What This Means for XRP’s Authorized and Market Outlook

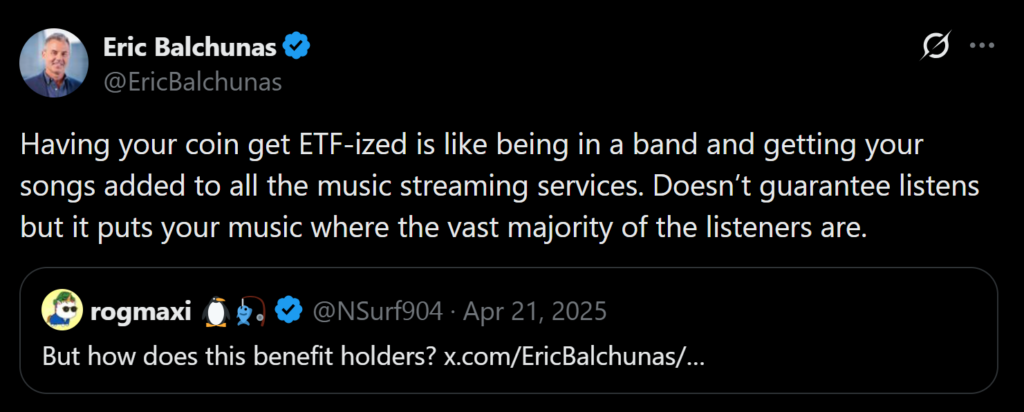

Bloomberg Intelligence ETF analyst Eric Balchunas has beforehand in contrast regulatory approval to getting music added to main streaming platforms. It doesn’t assure success, however it places the asset the place establishments can lastly entry it. For XRP, that issues. Clear authorized standing is a prerequisite for merchandise like spot ETFs, and Atkins’ assist for legislative motion has meaningfully improved these odds. In consequence, many traders are already repositioning, betting that entry and legitimacy come subsequent.

Why Timing Issues Now

Atkins has argued {that a} sturdy regulatory framework is important if the US needs to compete with Europe and Asia on digital asset innovation. His feedback arrived alongside the Senate Banking Committee releasing a large draft crypto market construction proposal, suggesting each lawmakers and regulators are transferring in sync. The tone has shifted from adversarial to collaborative, and that alone is a serious change.

For XRP holders who endured years of uncertainty, the sign feels completely different this time. The regulatory dialog seems to be transferring out of courtrooms and into laws. Whether or not costs react instantly continues to be an open query, however from a coverage perspective, many imagine the course is now set. For XRP, that could be what folks imply once they say it’s a finished deal.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.