The Senate Banking Committee has pulled the scheduled Thursday markup of its crypto asset market construction invoice after a late-stage flare-up with Coinbase, freezing what had seemed like a tightening path towards motion. The pause lands at a delicate second for Washington’s crypto negotiations: trade heavyweights are publicly splitting over the Senate draft at the same time as lawmakers insist bipartisan talks are nonetheless alive.

Senate Banking Committee Chairman Tim Scott (R-S.C.) stated Wednesday the committee will postpone the markup “as bipartisan negotiations proceed,” framing the delay as tactical somewhat than terminal. “I’ve spoken with leaders throughout the crypto trade, the monetary sector, and my Democratic and Republican colleagues, and everybody stays on the desk working in good religion,” Scott wrote on X. “As we take a quick pause earlier than shifting to a markup, this market construction invoice displays months of great bipartisan negotiations and actual enter from innovators, traders, and legislation enforcement.”

Scott positioned the invoice as a foundational framework somewhat than a slim trade carveout. “The aim is to ship clear guidelines of the highway that defend shoppers, strengthen our nationwide safety, and guarantee the way forward for finance is in-built the USA,” he added.

Coinbase Breaks Ranks Late

The quick catalyst was Coinbase CEO Brian Armstrong, who stated the trade “can’t help the invoice as written” after reviewing “the Senate Banking draft textual content over the past 48hrs.”

Armstrong argued the draft accommodates a number of provisions he says could be “materially worse than the present establishment,” contending that it quantities to “a defacto ban on tokenized equities,” consists of “DeFi prohibitions” that broaden authorities entry to monetary information and erode privateness, and would “stifl[e] innovation” by weakening the CFTC relative to the SEC.

He additionally pointed to “draft amendments” he stated “would kill rewards on stablecoins,” warning the adjustments might enable banks to “ban their competitors.” Armstrong’s backside line was blunt: “We’d somewhat haven’t any invoice than a foul invoice.” Nonetheless, he struck a conciliatory be aware about course of and odds of a compromise, including he was “fairly optimistic” that continued work might produce “the proper end result.”

After reviewing the Senate Banking draft textual content over the past 48hrs, Coinbase sadly can’t help the invoice as written.

There are too many points, together with:

– A defacto ban on tokenized equities

– DeFi prohibitions, giving the federal government limitless entry to your monetary…— Brian Armstrong (@brian_armstrong) January 14, 2026

That posture break up the distinction between onerous opposition to the textual content and help for continued negotiations,an necessary distinction because the markup course of is often the place senators provide and vote amendments.

Crypto Business Break up

Coinbase’s stance rapidly triggered a counter-response from different main crypto companies and advocacy teams backing the Senate Banking GOP’s push. Assist was voiced by a16z, Circle, Kraken, The Digital Chamber, Ripple, and Coin Middle, coalescing right into a public entrance geared toward preserving momentum intact regardless of the delay.

Ripple CEO Brad Garlinghouse forged the invoice as overdue however directionally constructive. “Whereas long-overdue, this transfer by @SenatorTimScott and @BankingGOP on market construction is an enormous step ahead in offering workable frameworks for crypto, whereas persevering with to guard shoppers,” he wrote. He stated Ripple would stay engaged, including: “We’re on the desk and can proceed to maneuver ahead with truthful debate. I stay optimistic that points could be resolved by the mark-up course of.”

In the meantime, Tim Draper stated Armstrong’s opposition is justified, arguing the Senate compromise “is worse than no invoice in any respect” and suggesting that “the banks have been meddling.”

Ryan Rasmussen, Head of Analysis at Bitwise Asset Administration , referred to as the present CLARITY Act draft broadly dangerous, itemizing tokenization, stablecoins, DeFi, privateness, builders, customers, traders, and innovation, and concluded that the trade would “somewhat haven’t any invoice than a foul invoice.”

White Home Crypto Czar David Sacks urged the trade to deal with the delay as a slim window to align somewhat than a gap to splinter. “Passage of market construction laws stays as shut because it’s ever been,” Sacks wrote. “The crypto trade ought to use this pause to resolve any remaining variations. Now’s the time to set the foundations of the highway and safe the way forward for this trade.”

Galaxy Digitall’s CEO Mike Novogratz struck a extra optimistic tone, saying: “Whereas the crypto invoice is perhaps delayed to maintain engaged on it, I’m very assured {that a} invoice will get achieved quickly. I’ve spoken to over 10 senators on each side of the aisle prior to now 24 hrs and I imagine all of them are working in good religion to get one thing achieved. At all times will get tense on the finish.”

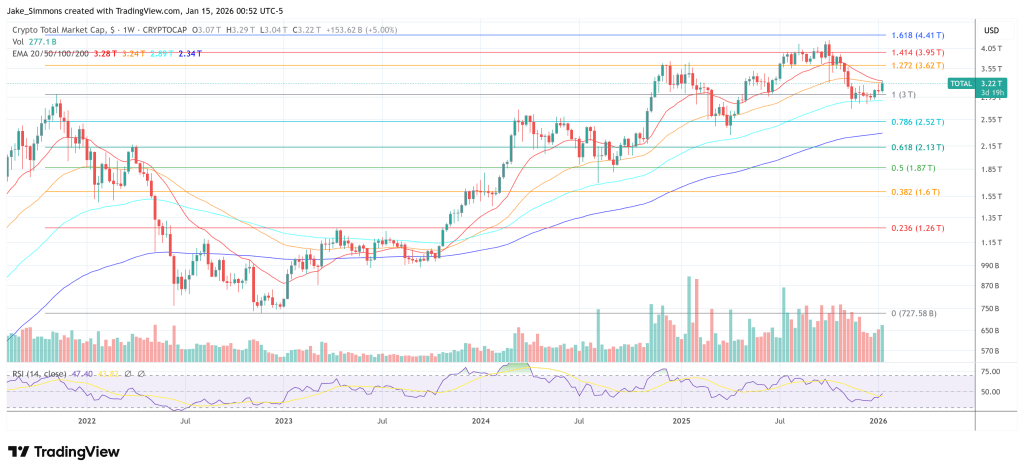

At press time, the full crypto market cap stood at $3.22 trillion.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.