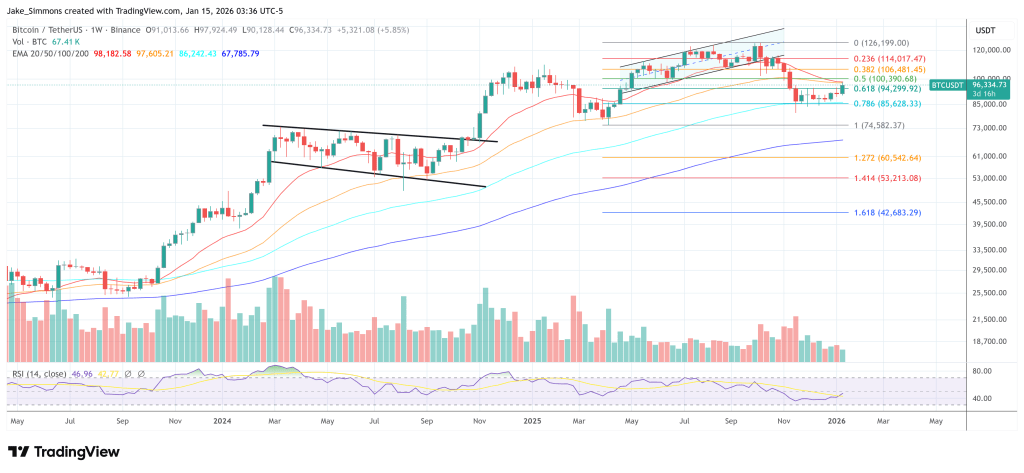

Bitcoin’s early-2026 bounce has pushed again into a well-known downside space: a dense pocket of overhead provide that Glassnode says has repeatedly capped rallies since November. In its newest Week On-chain report, the analytics agency frames the transfer above $96,000 as constructive on the floor, however nonetheless largely depending on derivatives positioning and liquidity circumstances relatively than persistent spot accumulation.

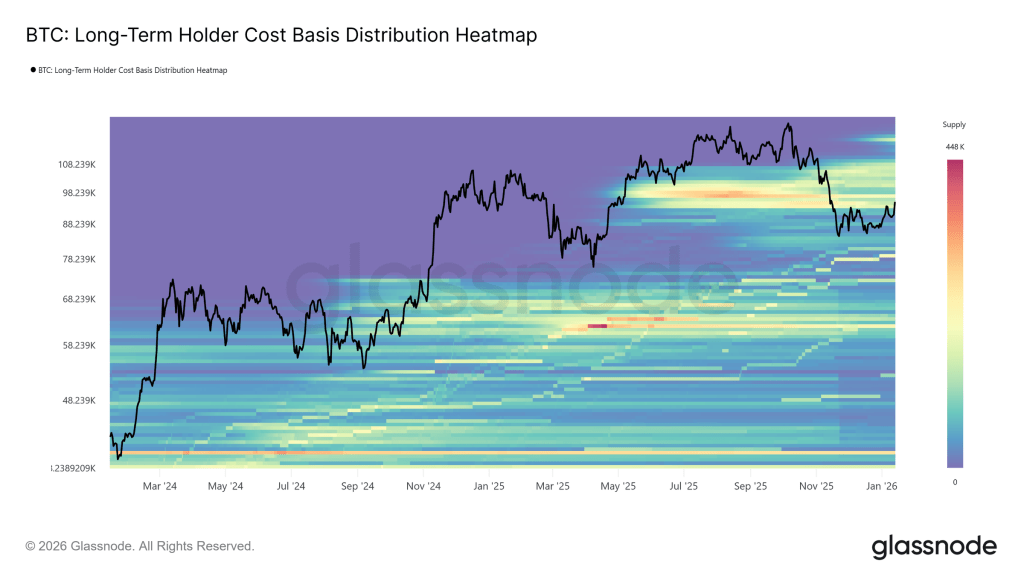

Glassnode’s central argument is that Bitcoin has rallied straight right into a traditionally vital band of long-term holder (LTH) price foundation, constructed throughout April to July 2025 and related to sustained distribution close to cycle highs. The report describes a “dense cluster” spanning roughly $93K to $110K, with rebounds since November repeatedly stalling close to the decrease boundary.

“This area has persistently acted as a transition barrier, separating corrective phases from sturdy bull regimes,” Glassnode wrote. “With worth as soon as once more urgent into this overhead provide, the market now faces a well-known check of resilience, the place absorbing long-term holder distribution stays a prerequisite for any broader development reversal.” The agency’s framing is blunt: the market is again on the identical promote ceiling, and clearing it requires actual absorption, not simply worth probing.

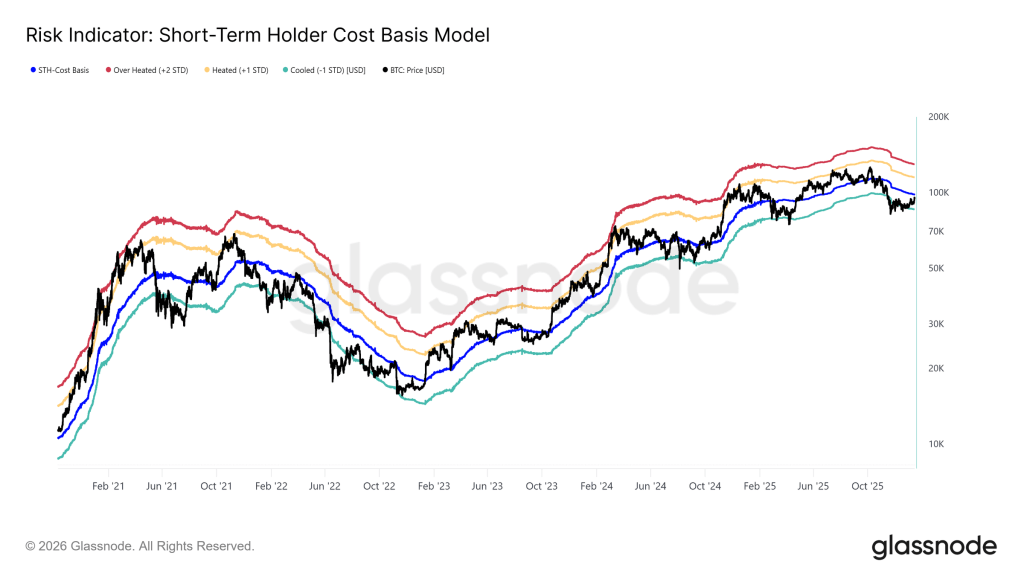

The subsequent degree the report highlights is the short-term holder (STH) price foundation at $98.3K, which it treats as a confidence gauge for newer patrons. Sustained buying and selling above it might point out that latest demand is powerful sufficient to maintain late entrants in revenue whereas absorbing overhead provide.

On-chain, Glassnode notes long-term holders stay internet sellers, with complete LTH provide nonetheless trending decrease. The important thing change is velocity. The report says the speed of decline has “slowed materially” versus the aggressive distribution seen in Q3 and This autumn 2025, suggesting profit-taking is constant however with much less depth.

Associated Studying

“What follows will rely totally on the demand aspect’s skill to soak up this provide, significantly from traders gathered over Q2 2025,” the report mentioned. “Failure to carry above the True Market Imply at ~$81k, in the long run, would considerably improve the danger of a deeper capitulation section, harking back to the April 2022 to April 2023 interval.” It is among the clearest draw back conditionals within the notice: if the market loses the long-run imply, the chance distribution shifts towards a extra extreme unwind.

A associated sign is the Internet Realized Revenue and Lack of Lengthy-Time period Holders, which Glassnode says displays a “markedly cooler distribution regime.” Lengthy-term holders are realizing roughly 12.8K BTC per week in internet revenue, a pointy slowdown from cycle peaks above 100K BTC per week. That moderation doesn’t suggest capitulation threat is gone, nevertheless it does recommend the heaviest section of profit-taking has eased.

Bitcoin Demand Stays Uneven

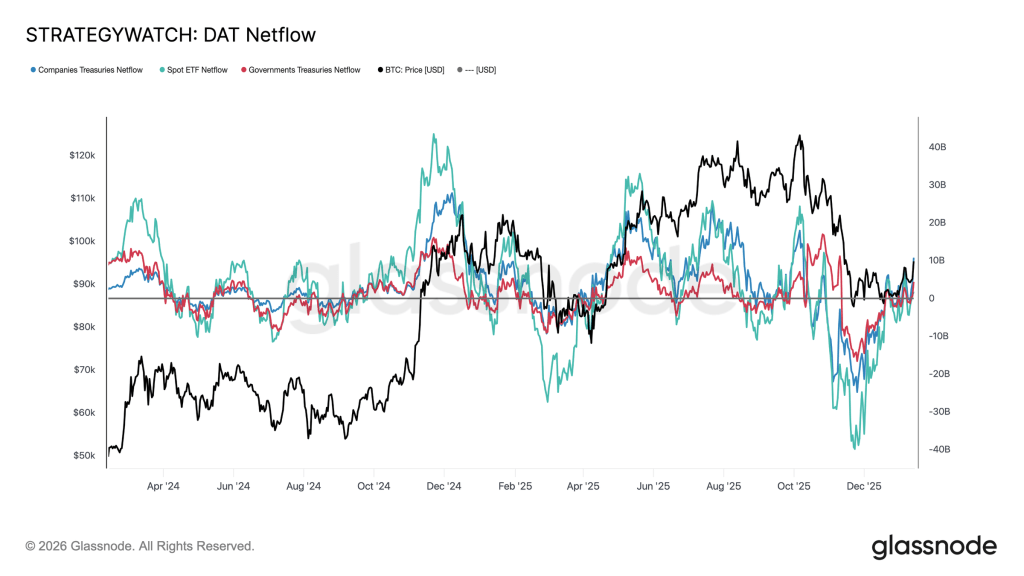

Off-chain indicators lean extra constructive. Glassnode argues institutional balance-sheet flows have “gone by way of a full reset” after months of heavy outflows throughout spot ETFs, corporates, and sovereign entities, with internet flows stabilizing as sell-side strain seems exhausted. Spot ETFs are described as the primary cohort to show optimistic once more, re-establishing themselves as the first marginal purchaser.

Company and sovereign treasury flows, against this, are portrayed as sporadic and event-driven relatively than constant. The upshot is a market the place balance-sheet demand will help stabilize worth, however could not but operate as a sustained development engine, leaving short-term path extra delicate to derivatives positioning and liquidity circumstances.

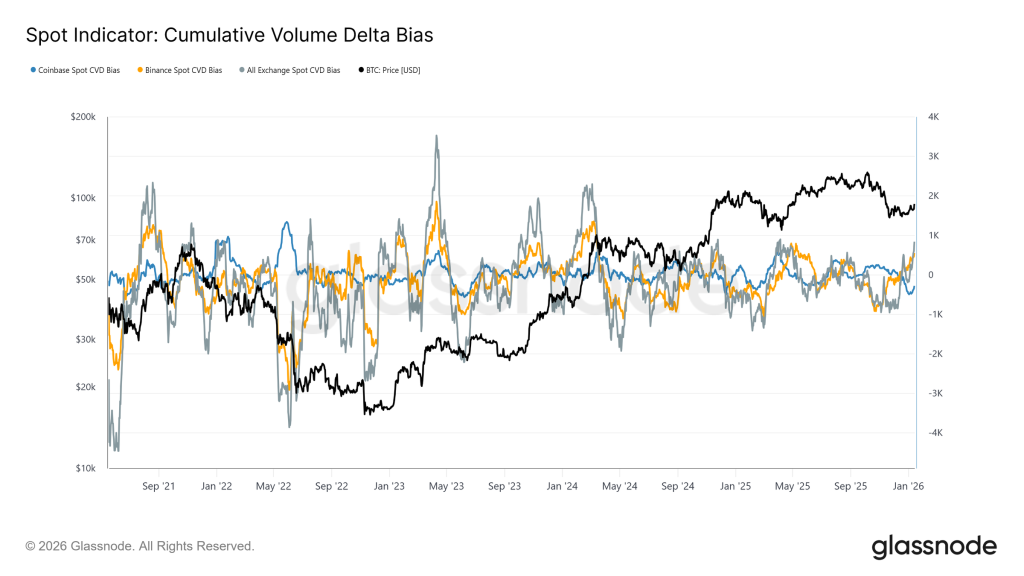

On the venue degree, Glassnode factors to bettering spot conduct. Binance and mixture change circulation measures have shifted again into buy-dominant regimes, and Coinbase, described as a constant supply of sell-side aggression throughout the consolidation, has “meaningfully slowed its promoting exercise.” The report calls this a constructive structural shift, whereas stressing it nonetheless falls in need of the persistent, aggressive accumulation usually related to full development expansions.

Associated Studying

Probably the most pointed warning within the report is that the transfer into the $96K area was “mechanically bolstered” by quick liquidations in a comparatively skinny liquidity setting. Futures turnover stays effectively beneath the elevated exercise seen throughout most of 2025, implying it took comparatively little capital to power shorts out and push worth by way of resistance.

“This means that the breakout occurred in a relatively mild liquidity setting, the place modest positioning shifts had been capable of drive disproportionately giant worth responses,” Glassnode mentioned. “In sensible phrases, it didn’t take vital new capital to power shorts out of the market and elevate worth by way of resistance.” The implication is that continuation now relies on whether or not spot demand and sustained quantity can substitute compelled overlaying as soon as the squeeze impulse fades.

Choices markets add a second layer of rigidity. Glassnode describes implied volatility as low however “deferred,” whereas skew continues to cost draw back asymmetry, with 25-delta skew biased towards places in mid and longer maturities. In brief: contributors seem snug holding publicity, however stay unwilling to take action with out insurance coverage.

Positioning additionally issues on the microstructure degree. The report flags sellers as quick gamma round spot, with a zone roughly from $94K to $104K. In that setup, hedging flows can amplify strikes relatively than dampen them, shopping for into rallies and promoting into dips, elevating the percentages of quicker journey towards high-interest strikes reminiscent of $100K if momentum takes maintain.

At press time, BTC traded at $96,334.

Featured picture created with DALL.E, chart from TradingView.com