- Early PEPE investor James Wynn has closed all of his lengthy positions.

- His transfer comes regardless of predicting a $69B market cap for PEPE in 2026.

- Weak market sentiment and bearish forecasts are fueling correction fears.

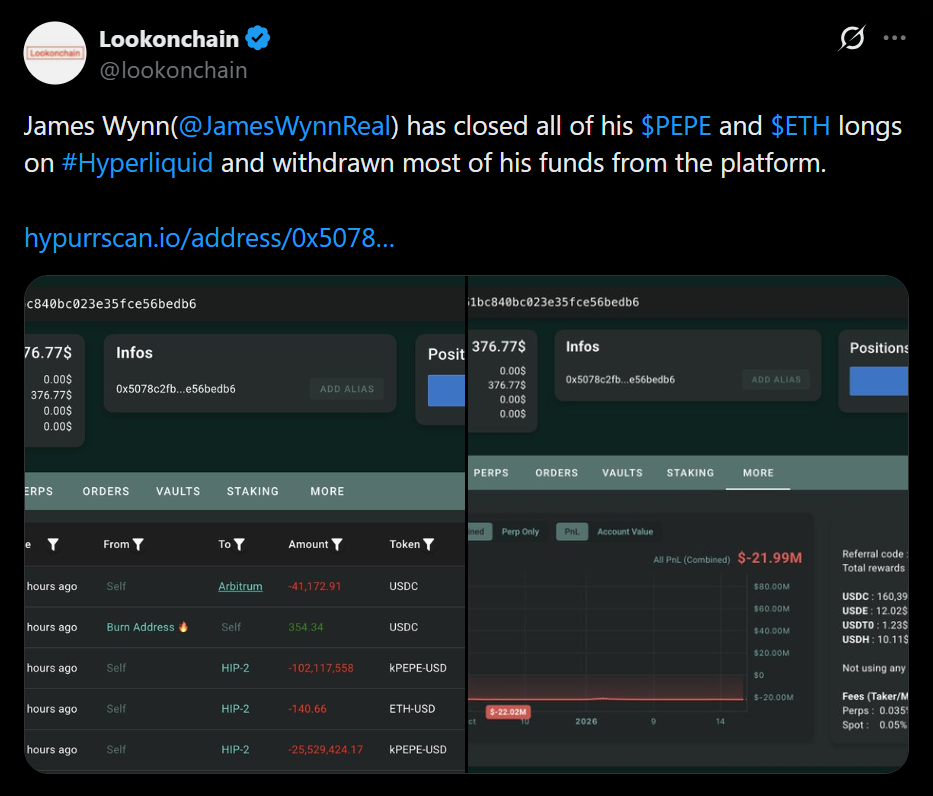

James Wynn, one among PEPE’s earliest and most vocal supporters, is again within the highlight — however this time for what he did, not what he mentioned. Wynn beforehand predicted that PEPE’s market cap might attain an attention-grabbing $69 billion in 2026, a name that helped gas consideration and inflows throughout the memecoin’s early run. Now, knowledge from LookOnChain exhibits that Wynn has closed all of his PEPE and Ethereum lengthy positions on Hyperliquid and withdrawn most of his funds from the platform. That transfer has sparked recent debate about whether or not he’s bracing for a deeper correction.

From Daring Predictions to Closed Positions

Wynn’s affect contained in the PEPE group grew quickly after his early market cap predictions proved directionally right, attracting vital speculative curiosity. His calls grew to become a part of the broader PEPE narrative, particularly after he publicly mentioned he would delete his account if the token failed to succeed in the $69 billion goal. In opposition to that backdrop, closing his lengthy positions has raised eyebrows. For a lot of merchants, it seems to be much less like routine danger administration and extra like a sign that expectations could also be shifting.

Market Situations Add Further Strain

The timing issues. Crypto markets are nonetheless stabilizing after the late-2025 downturn, and danger urge for food stays fragile. Gold and silver hitting a number of all-time highs counsel many buyers are nonetheless leaning defensive. In that surroundings, memecoins like PEPE — already among the many most risky belongings out there — are inclined to really feel strain quicker than larger-cap tokens. Wynn stepping apart throughout this section naturally feeds hypothesis that he expects turbulence forward.

Value Motion Tells a Combined Story

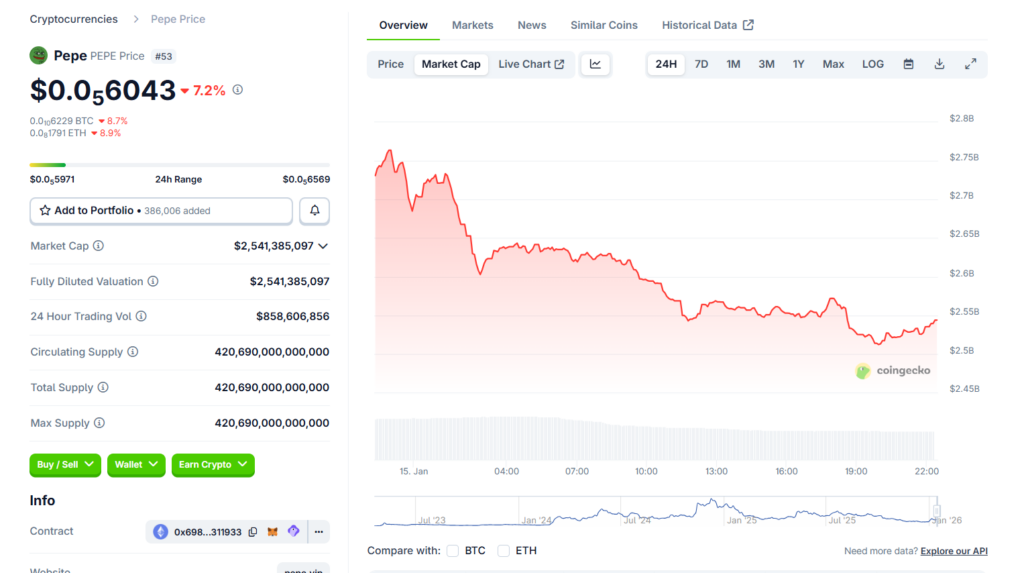

PEPE rallied sharply earlier this month, however momentum has pale. Based on CoinGecko knowledge, the token is down 8.2% within the final 24 hours and three.4% over the previous week, whereas sitting practically 65% under its January 2025 ranges. On the identical time, it stays up near 50% on the 14-day chart and greater than 53% over the previous month. That break up highlights the present pressure — sturdy short-term rebounds layered on prime of a a lot bigger drawdown.

Bearish Forecasts Add to Uncertainty

Some analysts are leaning cautious. CoinCodex projections counsel PEPE might fall towards $0.000004471 by January 26, 2026, implying a possible correction of practically 27% from present ranges. Whereas forecasts aren’t ensures, they reinforce the concept volatility is much from over. Wynn’s exit doesn’t verify a crash is coming, but it surely does take away a symbolic layer of confidence that many merchants had leaned on.

For now, PEPE sits at a crossroads. Group optimism, current features, and daring long-term narratives are colliding with fragile market situations and visual danger discount by a high-profile investor. Whether or not that results in consolidation or a sharper pullback remains to be unclear — however the questions are getting louder.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.