- BlackRock ended 2025 with $14 trillion in belongings after report inflows.

- Digital asset AUM reached $78 billion, supported by sturdy ETF demand.

- Non-public markets and platform integration are driving development into 2026.

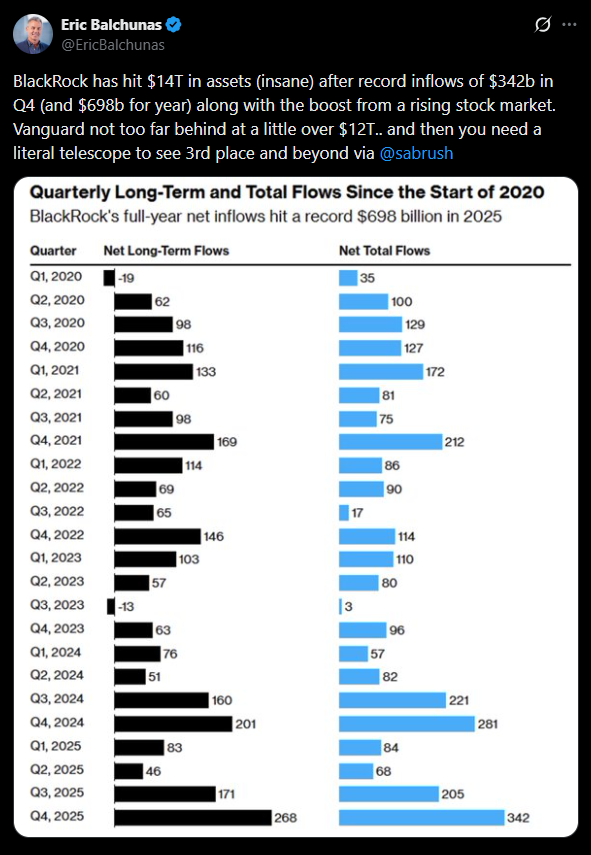

BlackRock closed out 2025 with a significant milestone, reporting complete belongings underneath administration of $14 trillion following a report 12 months for inflows. The asset administration large mentioned annual internet inflows reached $698 billion, marking the strongest 12 months and quarter within the agency’s historical past. Buyers reacted shortly to the outcomes, pushing BlackRock shares up roughly 5% after the earnings launch.

Digital Property Quietly Achieve Scale

Whereas conventional markets proceed to anchor BlackRock’s enterprise, digital belongings have gotten a extra significant contributor. The agency reported about $78 billion in digital asset AUM at year-end, supported by $35 billion in full-year ETF inflows for the class. Although nonetheless small relative to the broader platform, the expansion alerts rising institutional consolation with crypto-linked merchandise, particularly inside regulated ETF buildings.

Non-public Markets Develop After HPS Deal

Non-public markets additionally performed a central position in BlackRock’s enlargement. Property underneath administration within the phase climbed to $323 billion following the acquisition of HPS, strengthening the agency’s presence in personal credit score and different investments. CEO Larry Fink mentioned consumer exercise is increasing throughout each private and non-private markets, supported by a rising pipeline and robust fundraising momentum heading into 2026.

A Platform Constructed for New Development Channels

Fink emphasised that BlackRock’s unified platform is positioning the agency on the middle of a number of long-term development developments. These embody personal markets, lively ETFs, wealth administration, retirement options, and rising areas like digital belongings and tokenization. Based on Fink, the agency is more and more capable of cross-connect expertise, knowledge, and funding merchandise in ways in which drive deeper consumer engagement.

Income and Payment Development Reinforce Momentum

The earnings report additionally highlighted sturdy monetary efficiency throughout the enterprise. Natural base charges grew at a 12% annualized price within the fourth quarter, reflecting energy in iShares ETFs, systematic lively equities, personal markets, outsourcing, and money administration. For the total 12 months, BlackRock posted a 19% enhance in income, pushed by favorable markets, natural charge development, transaction-related earnings, and better expertise and subscription income.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.