- Bitcoin briefly reclaimed $97,000 for the primary time since November 2025.

- Analysts count on additional upside however see $100K extra doubtless in early February.

- Lengthy-term forecasts nonetheless level to a brand new all-time excessive in 2026.

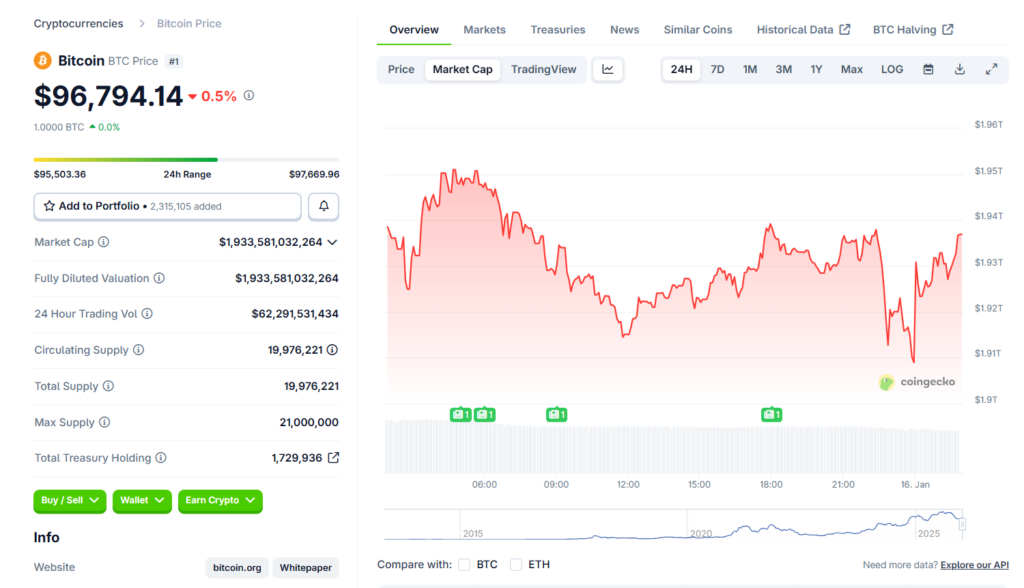

Bitcoin briefly climbed again above the $97,000 stage on January 15, marking its first go to to that vary since mid-November 2025. The transfer added gasoline to rising hypothesis that momentum could also be rebuilding after months of uneven value motion. In response to CoinGecko, BTC is up 0.3% during the last 24 hours, 5.5% on the week, greater than 9% over the previous two weeks, and roughly 11.5% during the last month. With these beneficial properties stacking up, consideration is now turning to a well-known psychological milestone: can Bitcoin reclaim $100,000 by January 20?

A Restoration Nonetheless Preventing Heavy Resistance

Bitcoin’s present place is formed by its sharp reversal from October 2025, when it printed an all-time excessive close to $126,080 earlier than coming into a steep correction. Broader market sentiment turned defensive quickly after, pushed by macro uncertainty and danger aversion that also lingers right now. The $97,000 stage has emerged as a key resistance zone, and BTC is now testing whether or not it could possibly maintain above it. A clear break and consolidation above this space would considerably enhance the chances of a push towards $100,000.

What Analysts Anticipate within the Close to Time period

Brief-term forecasts stay cautious. CoinCodex analysts count on Bitcoin to proceed grinding increased within the coming days however don’t see $100,000 arriving by January 20. Their present mannequin factors to a reclaim of the six-figure stage nearer to February 1, 2026. Whereas the timing might disappoint some merchants, a confirmed transfer above $100,000 would strengthen the broader bullish case and reopen discussions round a brand new cycle excessive.

Lengthy-Time period Outlook Stays Sturdy

Zooming out, main establishments stay constructive on Bitcoin’s trajectory. Bernstein and Grayscale each count on 2026 to be a robust yr, arguing that Bitcoin is following a five-year cycle slightly than the standard four-year halving sample. Underneath that framework, BTC can be positioned to set a brand new all-time excessive this yr. Bernstein has floated a $150,000 goal for 2026 and sees the potential of Bitcoin pushing past $200,000 in 2027 if adoption and macro situations align.

Warning Nonetheless Shapes the Market

Regardless of the optimistic projections, the market stays fragile. The October 2025 crash left a long-lasting mark on investor confidence, and lots of contributors are nonetheless avoiding high-risk publicity. Contemporary volatility tied to macroeconomic developments may problem Bitcoin’s restoration within the brief time period. For now, BTC’s skill to defend latest beneficial properties and construct help above $97,000 will doubtless decide whether or not the trail to $100,000 accelerates or stalls.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.