Market situations are signaling a pause throughout crypto, with Shiba Inu value reflecting a cautious stance as capital clusters round main belongings and away from speculative danger.

Day by day timeframe (D1): the macro bias for Shiba Inu value

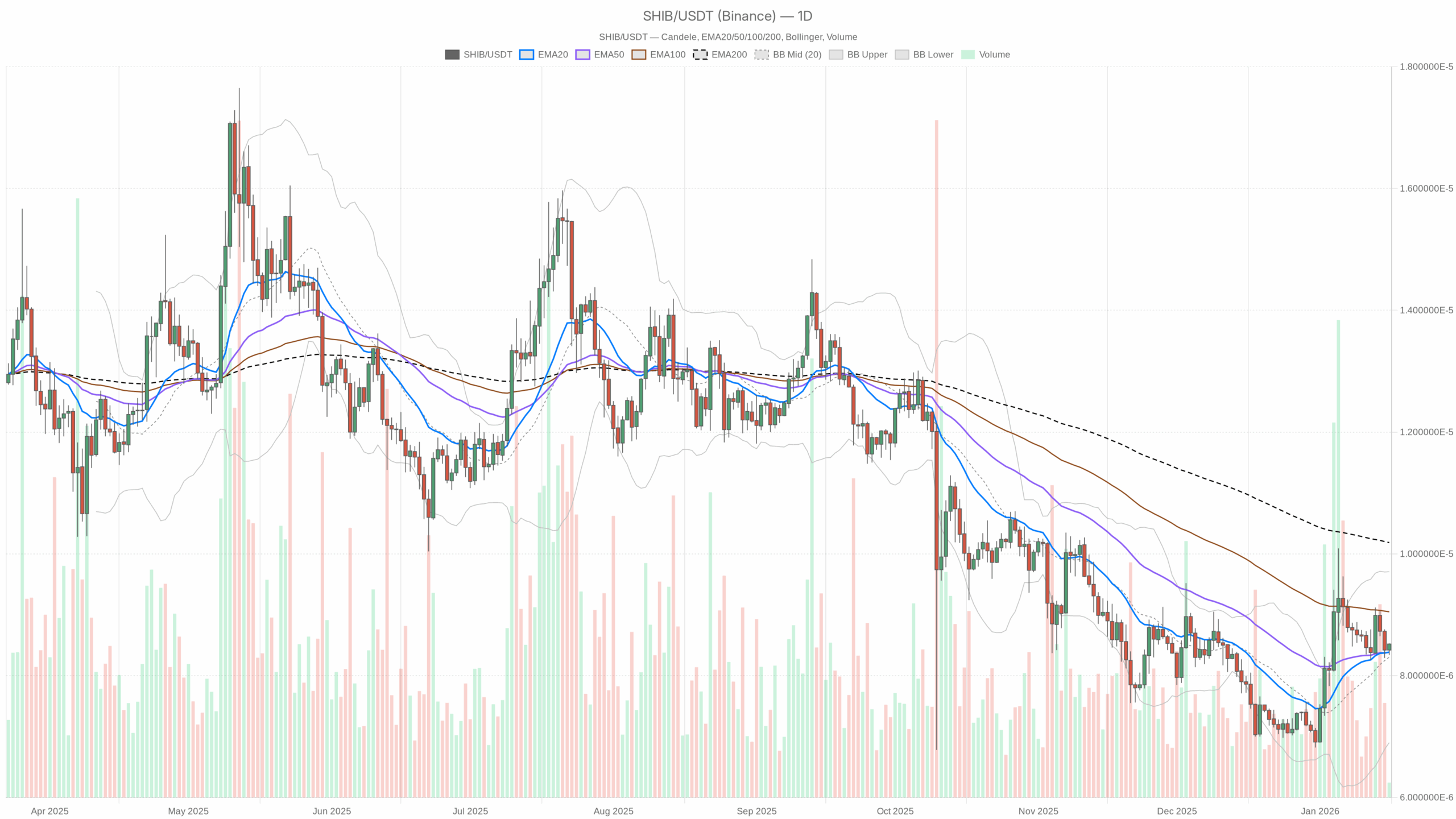

On the day by day chart, the system flags SHIBUSDT in a impartial regime. That’s in keeping with the indications we are able to see.

RSI (D1)

RSI (14): 53.33

Shiba Inu’s day by day RSI is sitting simply above the midline. That’s neither overbought nor oversold. It’s the type of studying you get when value is consolidating after a transfer quite than beginning a brand new pattern. In observe, it means dip consumers and revenue takers are roughly balanced, and the market is ready for a contemporary catalyst.

MACD (D1)

MACD line ≈ sign, histogram ≈ 0

The MACD is actually flat on the day by day. That tells you pattern momentum has light. Bulls are usually not urgent a bonus, however bears haven’t seized management both. It’s basic late-stage vary habits: strikes can nonetheless be sharp intraday, however trend-following indicators are usually not aligned for a sustained run but.

EMAs (D1)

EMA20 / EMA50 / EMA200: regime tagged as impartial

The mannequin’s impartial regime on D1 implies Shiba Inu value is buying and selling near its key transferring averages, with no clear slope or separation between the 20, 50, and 200-day EMAs. In different phrases, the market has not determined whether or not the final greater transfer was a pause in a bigger uptrend or simply noise inside a broader sideways construction. When EMAs bunch up like this, the subsequent decisive break above or beneath that cluster often units the tone for weeks.

Bollinger Bands (D1)

Bollinger Bands: compressed / mid-range habits

With the system displaying a impartial volatility regime and no robust directional bias, day by day Bollinger Bands are successfully performing as a containment zone quite than a trending channel. Shiba Inu value is probably going oscillating across the center band, with neither band being examined aggressively. That type of construction typically precedes an enlargement in volatility. The bottom line is to observe which aspect is breached first.

ATR (D1)

ATR (14): low / normalized

The automated feed treats day by day ATR as a part of a impartial regime. Virtually, meaning latest day by day swings in Shiba Inu are usually not excessive relative to its personal historical past. Place sizing on this atmosphere can simply develop into complacent. Merchants begin assuming the latest tight ranges will maintain, which might make any breakout transfer extra violent when it lastly arrives.

Day by day pivot ranges (D1)

Pivot construction: impartial bias

The system’s impartial tag round day by day pivots suggests Shiba Inu value is chopping close to its central pivot quite than leaning right into a clear transfer towards R1 or S1. That’s typical for a spread day profile. Intraday reversals close to the pivot are frequent, and breakout merchants get repeatedly light except there’s a clear catalyst within the broader market.

Day by day takeaway: the upper timeframe bias for Shiba Inu value is impartial with no confirmed pattern. Bulls should not have management, however bears additionally lack affirmation. That units the stage for the decrease timeframes to matter greater than traditional for timing.

1-hour timeframe (H1): native construction backing the impartial view

The 1-hour Shiba Inu chart is broadly echoing the day by day image, which will increase the credibility of the impartial bias.

RSI (H1)

RSI (14): 52.67

On the hourly, RSI hovering simply above 50 says the intraday battle is balanced. There’s a slight lean to the upside, however nothing that qualifies as robust momentum. Intraday pops usually tend to be offered into except they coincide with a macro push in BTC or a meme rotation wave.

MACD (H1)

MACD line ≈ sign, histogram ≈ 0

MACD on H1 can be flat, which traces up with a market that’s chopping quite than trending. When each D1 and H1 MACD go flat, you often get a liquidity-hunting atmosphere. Value spikes above native highs and beneath native lows to set off stops, however fails to construct follow-through.

EMAs (H1)

EMA20 / EMA50 / EMA200: clustered

The system’s impartial regime on H1 implies value is gravitating across the brief and medium EMAs. That’s the definition of a mean-reversion intraday construction: strikes away from the EMAs have a better likelihood of snapping again quite than extending. For Shiba Inu scalpers, that favors fading extremes over chasing breakouts, a minimum of till EMAs begin to fan out once more.

Bollinger Bands & ATR (H1)

Bollinger Bands: mid-band magnet

ATR: subdued intraday volatility

On the hourly, impartial volatility plus a mid-band bias means Shiba Inu value is oscillating inside a comparatively tight envelope. That is the place short-duration volatility methods thrive, however directional merchants get chopped up. A clear hourly shut outdoors the bands, backed by rising ATR, could be the primary signal that the market is selecting a course.

Hourly pivots (H1)

Pivot regime: vary habits

H1 pivot motion is in keeping with vary buying and selling. Value repeatedly interacts with the pivot level, with R1 and S1 performing extra as outer magnets than as launchpads for traits. This typically continues till exterior information, or an enormous transfer in BTC, supplies the shove wanted to interrupt that stability.

15-minute timeframe (M15): execution context for Shiba Inu value

The 15-minute chart is the place Shiba Inu lastly exhibits a little bit of rigidity in opposition to the upper timeframes.

RSI (M15)

RSI (14): 67.18

On M15, RSI is leaning into overbought territory. That doesn’t outline a pattern by itself, however it does trace at short-term consumers getting forward of themselves in comparison with the flat day by day backdrop. In plain phrases, the very short-term transfer is a bit sizzling, whereas the larger image stays undecided. That could be a basic setup for both a shallow pullback or a squeeze larger if shorts step in too early.

MACD, EMAs, Bands & pivots (M15)

MACD: flat

EMAs: domestically supportive

Bands & pivots: intraday ranges

Regardless of the upper RSI, the 15-minute MACD is just not displaying robust momentum, which suggests this uptick could also be extra of a grind than a breakout. EMAs on M15 are probably performing as a rising intraday help, however with the broader regime impartial, that help is fragile. It holds till it doesn’t, and reversals could be sharp. Bollinger Bands on this timeframe are most likely being examined on the higher aspect, making it a poor spot to provoke contemporary longs except larger timeframes take part.

Multi-timeframe rigidity: day by day and hourly are impartial, whereas 15-minute is mildly stretched to the upside. That mixture typically resolves with a short-term cool-off quite than a direct pattern change.

Market context: why Shiba Inu is drifting

The broader market backdrop explains a variety of this indecision. Bitcoin dominance above 57% exhibits capital is clustered in BTC, whereas complete market cap is barely down with volumes dropping over 20% on the day. That isn’t the atmosphere the place meme cash often lead.

International sentiment at impartial (49) confirms this isn’t a panic section; it’s a endurance check. Macro headlines are centered round FX, resembling yen and greenback, and regulatory chatter round stablecoin payments. None of those are particularly catalyzing meme flows. On this local weather, Shiba Inu is buying and selling as a beta play on broader danger quite than operating its personal story.

Bullish state of affairs for Shiba Inu value

For a bullish path to develop from right here, Shiba Inu wants alignment throughout timeframes and a nudge from the broader market.

• Step one could be turning at this time’s M15 overbought push into a real pattern. Meaning 15-minute and 1-hour MACD beginning to develop positively, with value holding above the hourly EMA20 and EMA50 cluster as a substitute of snapping again.

• On the day by day, Shiba Inu value would want to construct a sequence of upper lows across the present EMA cluster, with RSI grinding from the low 50s towards the 60–65 space. That may sign a shift from random chop to constructive accumulation.

• Volatility must develop in the correct course. Day by day Bollinger Bands ought to open up with value hugging the higher band, and ATR ticking larger whereas the market trades larger, not simply whipping each methods.

If that alignment occurs, meme-coin rotation might kick in, particularly if BTC stabilizes and merchants go trying to find larger beta. In that case, rallies would begin to stick quite than absolutely mean-revert, and dips into hourly EMAs could be purchased aggressively.

What invalidates the bullish case?

The bullish state of affairs fails if SHIB cannot maintain above its hourly transferring common cluster and the day by day RSI rolls again towards 45 with MACD turning extra decisively adverse. In value habits phrases, that may seem like repeated failed breakouts above native resistance adopted by deeper and sooner selloffs on every rejection.

Bearish state of affairs for Shiba Inu value

On the bearish aspect, the chance is that this impartial regime is solely a pause earlier than a rotation out of meme danger.

• If BTC extends draw back whereas dominance stays excessive, capital tends to flee peripheral belongings first, SHIB included. In that atmosphere, the present impartial readings can shortly flip right into a draw back pattern as soon as key helps break.

• Technically, that may present up as day by day RSI slipping underneath 50 and grinding towards the low 40s, with MACD crossing extra clearly bearish and EMAs beginning to slope down with value caught beneath.

• On decrease timeframes, you’ll see hourly and 15-minute makes an attempt to rally being capped on the EMA20 and EMA50, with Bollinger higher bands performing as agency resistance quite than increasing into an up-move.

That type of construction often results in a stair-step decline. Shallow bounces, heavy promoting on each check of resistance, and ATR beginning to tick larger on pink days as volatility expands to the draw back.

What invalidates the bearish case?

Bears lose the sting if Shiba Inu begins closing persistently again above intraday resistance, resembling hourly EMAs and prior swing highs, and the day by day RSI refuses to remain beneath 50. If every dip shortly recovers and MACD flattens once more as a substitute of accelerating decrease, then the transfer was probably only a shakeout inside an prolonged vary.

Impartial / rangebound state of affairs (present base case)

Given the info, the base case for Shiba Inu value remains to be impartial.

• Day by day RSI round 53 and flat MACD sign a market with out clear directional conviction.

• Hourly indicators mirror that stability, reinforcing the concept of vary habits and imply reversion.

• Solely the 15-minute chart exhibits stretched situations, that are usually short-lived.

Below this state of affairs, Shiba Inu continues to oscillate inside a broad horizontal band, with rallies fading close to resistance and dips getting purchased close to help, however with no decisive pattern. It’s an atmosphere extra suited to short-term merchants who can adapt intraday than to place merchants on the lookout for clear swings.

Positioning, danger, and what issues subsequent

With Shiba Inu sitting in a impartial pocket on each day by day and hourly charts, the important thing for merchants is accepting that sign high quality is low proper now. Pattern-followers will discover it exhausting to justify heavy publicity till D1 momentum picks a aspect. Imply-reversion merchants might lean into fading extremes on the decrease timeframes, however they’re taking part in a brief sport that is determined by tight danger controls.

The principle variables to observe:

• Bitcoin and complete market cap: a decisive transfer in both course will probably drag SHIB with it, given present dominance ranges.

• Day by day volatility: a shift from compressed Bollinger Bands and subdued ATR into an enlargement section will mark the subsequent section for Shiba Inu value, whether or not that could be a breakout or breakdown.

• Construction of pullbacks and rallies: are dips shallow and shortly reclaimed, or are bounces weak and offered aggressively? That habits will reveal which aspect is definitely in management beneath the impartial indicators.

What is evident is that uncertainty and headline danger stay excessive throughout the macro panorama, and volumes are lighter than they had been over the last impulsive strikes. In that type of tape, over-leveraging right into a coin that’s technically impartial is much less a method and extra a raffle. Deal with this section as a time to look at how Shiba Inu behaves at its key intraday and day by day ranges. The subsequent clear pattern will probably come out of this present indecision.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee at no further price to you.

Disclaimer: This text is a market evaluation and displays a technical view of present situations for Shiba Inu value based mostly on the info accessible on the time of writing. It’s not funding recommendation, and it shouldn’t be used as the only foundation for any monetary choice. Crypto belongings are extremely risky, and any buying and selling or investing exercise entails important danger, together with the attainable lack of capital. At all times conduct your individual analysis and think about your danger tolerance earlier than coming into the market.