Bitcoiners tip ‘bullish pump’ in Q1

Bitcoin’s worth look set to tear early in 2026, however the pump could also be short-lived, in accordance with Bitcoin OG analyst Willy Woo.

“The development to this point paints a bullish pump in Q1,” Woo tells Journal, including that the “long run construction is bearish.”

He provides his conviction is “loosely held, no crystal ball.”

January is usually a quieter month for Bitcoin, averaging simply 4.28% beneficial properties since 2013, whereas February and March have traditionally produced stronger returns of 13.12% and 12.21%, in accordance with CoinGlass.

Woo says Bitcoin’s efficiency within the near-term relies on investor flows, which he says has been in a “six-month down development.” Bitcoin is buying and selling at $95,520 on the time of publication, up 4.34% over the previous seven days, in accordance with CoinMarketCap.

Bitcoin has “good odds”of heading to $108,000

Capriole Investments founder Charles Edwards stated Bitcoin’s current worth surge “opens up good odds of a development to $108K from right here.”

“Bitcoin simply has its first promising technical transfer shortly,” Edwards stated. He defined that he would wish to see Bitcoin shut this week above $93,500 to “verify draw back fakeout.” Crypto analyst Rekt Capital stated “it’s doubtless” that Bitcoin will be capable of shut above that worth degree.

Edwards declared that now “could be a good time to show this ship round.”

A fast transfer to $108,000 might wipe over $673 million in Bitcoin brief positions.

XRP might falter upon “surprises” from CLARITY Act: Analysts

XRP’s worth might face near-term stress if there are “any disagreeable surprises” across the US CLARITY Act voting course of, in accordance with Swyftx analyst Pav Hundal.

Members of the US Senate Banking Committee had been scheduled to markup the CLARITY Act on Thursday, however this was postponed after the draft invoice confronted backlash from some crypto business executives apprehensive lawmakers have been giving an excessive amount of floor to TradFi .

Coinbase CEO Brian Armstrong, one of many executives criticizing the draft invoice, nonetheless expects a markup within the subsequent few weeks.

Hundal added that political or macro shocks — together with an escalation in geopolitical tensions — would create a troublesome backdrop, elevating the danger of sentiment and worth shortly flipping towards the token.

XRP is buying and selling at $2.06 on the time of publication, down 2.91% over the previous seven days, in accordance with CoinMarketCap.

From a technical perspective, Hundal says that XRP has “efficiently” discovered consumers round its 50-day shifting common, however current makes an attempt to push larger have been rejected on the 200-day shifting common close to $2.39.

“That is perhaps a technical space that sellers once more get busy,” Hundal says.

“My warning on XRP is that additional upside turns into too reliant on narrative,” he provides.

Hundal believes that XRP is at a “main take a look at of precise conviction” as XRP spot demand has been weakening because the center of December.

Nansen analyst Jake Kennis tells Journal that he additionally believes that the upcoming CLARITY Act Senate vote might have an effect on XRP’s worth.

Kennis additionally factors to different key near-term catalysts to look at, together with Ripple’s RLUSD stablecoin enlargement, which has reached a $1.33 billion market cap and is launching in Japan by means of SBI, in addition to continued ETF inflows and the progress of Ripple Nationwide Belief Financial institution.

ETH about to begin subsequent “multi-year cycle,” an analyst says

Ether and altcoins could also be getting into their subsequent multi-year cycles, with a possible worth breakout towards all-time highs, crypto analysts say.

“The underside was This autumn 2025 for each,” crypto analyst Matthew Hyland stated. Hyland stated that this marked Ethereum’s fourth cycle, with its low coming simply three months after reaching all-time highs of $4,953 in month 38 of the earlier cycle.

“The subsequent cycle low is due in Q2 2029,” Hyland stated.

Learn additionally

Options

Hanko’s Time To Go? Blockchain as a Answer to Japan’s Distant Working Subject

Options

How do you DAO? Can DAOs scale and different burning questions

Pseudonymous crypto dealer Titan of Crypto says an ETH breakout is already underway.

“If confirmed, the sample goal is $4,200,” he stated, which might be a 27.56% improve from its present worth of $3,292, in accordance with CoinMarketCap.

In the meantime, institutional forecasts have gotten extra conservative for Ether’s worth.

Customary Chartered lowered its Ether worth forecast to $7,500 for the top of 2026, down from its beforehand forecast $12,000, whereas decreasing its end-2028 forecast to $22,000 from $25,000.

Nonetheless, the financial institution expects Ether to surpass $40,000 by 2030, elevating its long-term forecast from the earlier $30,000 goal.

The most important Ethereum public treasury firm, BitMine, simply staked one other enormous batch of Ether, bringing its complete quantity staked to over 1.5 million ETH.

Bitcoin sentimentis turning bearish…or bullish

Bitcoin sentiment on social media has turned more and more pessimistic even because the asset has climbed roughly 5% over the previous seven days, in accordance with crypto sentiment platform Santiment.

Learn additionally

Options

THORChain founder and his plan to ‘vampire assault’ all of DeFi

Options

Crypto within the Philippines: Necessity is the mom of adoption

“The commentary towards Bitcoin throughout social media has curiously turned increasingly more bearish as costs have bounced this week,” Santiment stated on Thursday.

Santiment stated rising FUD throughout social media over the previous ten days might be the gas Bitcoin must push again towards $100,000, noting that markets usually transfer towards retail sentiment.

Nonetheless, different indicators counsel that sentiment amongst market contributors is shifting upwards.

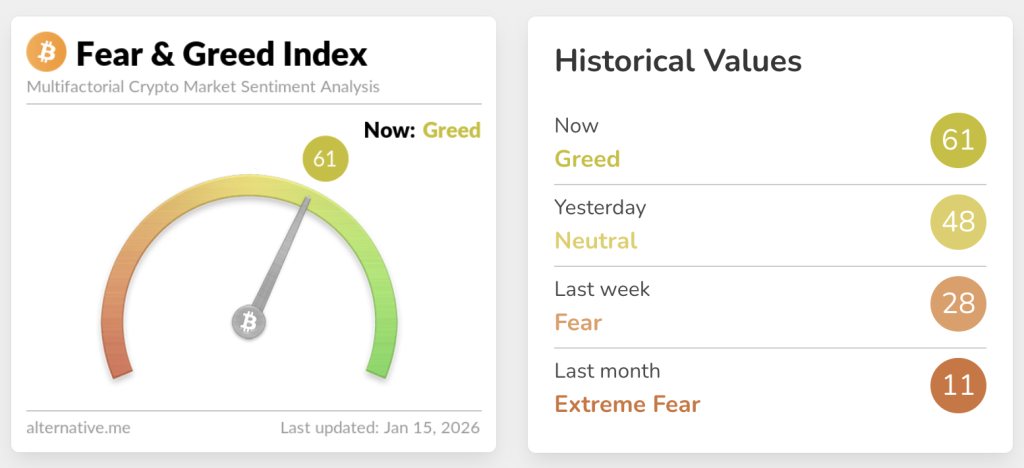

The Crypto Worry & Greed Index, which measures total crypto market sentiment, returned to “greed” on Thursday, with a rating of 61, after hovering between “worry” and “excessive worry” territory since early November.

In the meantime, the Altcoin Season Index, which relies on the efficiency of the highest 100 altcoins relative to Bitcoin over the previous 90 days, means that market contributors are nonetheless in “risk-off” mode, with the index studying a “Bitcoin Season” rating of 27 out of 100.

What are the prediction markets saying?

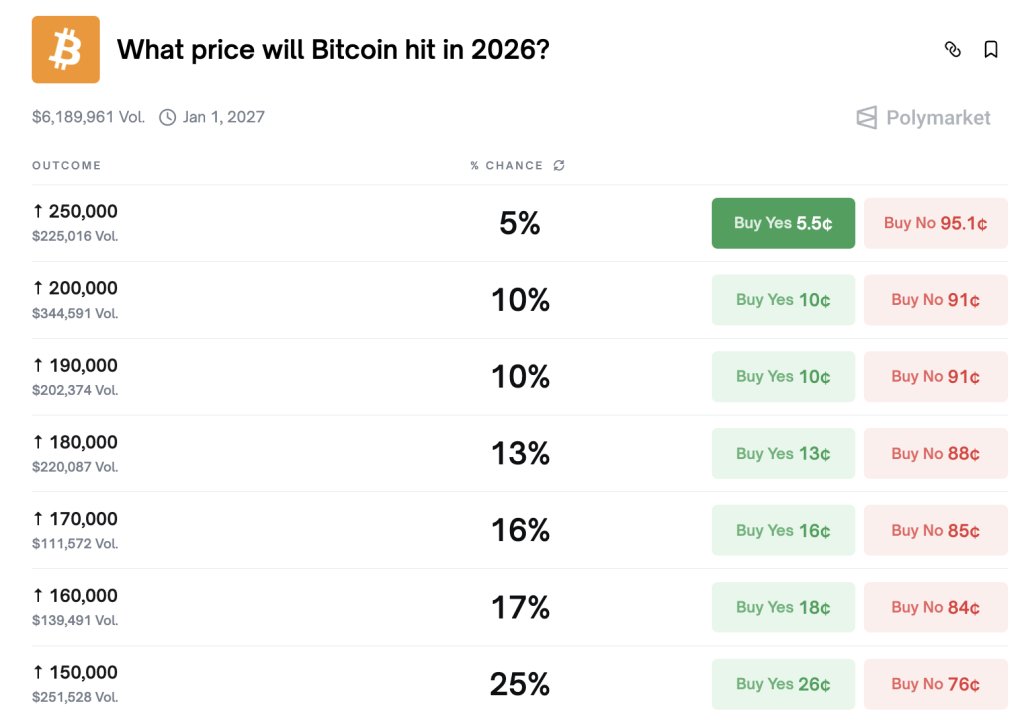

Prediction market contributors are rising extra assured that Bitcoin can reclaim six-figure ranges by the top of the month, however how the 12 months in the end performs out stays far much less sure.

The chances of Bitcoin ending January above $100,000 stand at 54%, in accordance with crypto predictions platform Polymarket.

Longer-term, the market sees a 91% probability of Bitcoin ending the 12 months above $100,000, however only a 54% chance of revisiting all-time highs above $120,000.

The chances of the bold $200,000 worth degree are low, with odds at 10%, whereas draw back fears nonetheless persist, with a drop under $75,000 holding a 63% chance.

Prediction markets present growing skepticism round ETH’s January efficiency, with the percentages of ending the month above $3,600 falling 14% to 36%.

The chance of Ether buying and selling above $3,800 in January is simply 16%.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is a Cointelegraph employees author protecting cryptocurrency markets and conducting interviews throughout the digital asset business. He has a background in mainstream media and has beforehand labored in Australian broadcast journalism, together with roles in nationwide radio and tv. Previous to becoming a member of Cointelegraph, Lyons was concerned in media tasks throughout information, documentary, and leisure codecs. He holds Solana, Ski Masks Canine, and AI Rig Advanced above Cointelegraph’s disclosure threshold of $1,000.