West Virginia lawmakers launched laws this week that will authorize the state treasurer to take a position a portion of public funds in bitcoin, valuable metals, and controlled stablecoins, marking a big step towards integrating digital belongings into state-level finance.

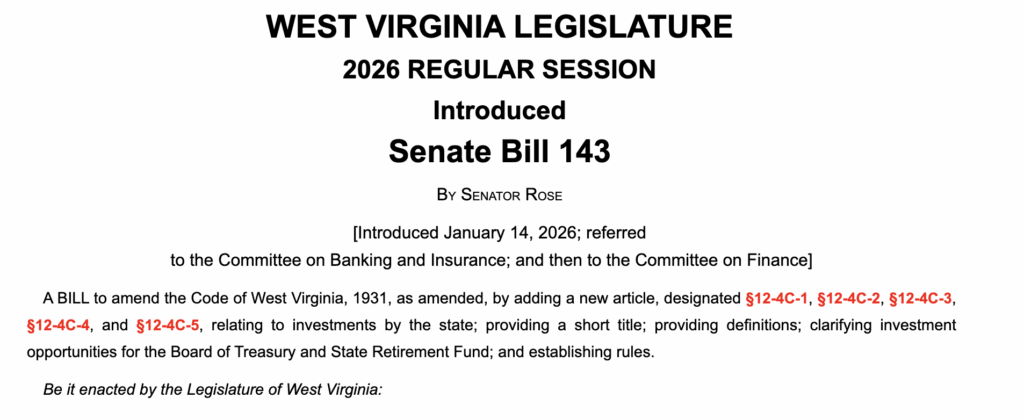

West Virginia Senate Invoice 143, launched by Sen. Chris Rose in the course of the 2026 common legislative session, would create a brand new part of state regulation titled the “Inflation Safety Act of 2026.” The measure permits the Board of Treasury Investments to allocate as much as 10% of funds it oversees into gold, silver, platinum, and sure digital belongings, topic to present funding guidelines.

Beneath the invoice, the West Virginia might spend money on digital belongings that maintained a median market capitalization above $750 billion over the prior calendar 12 months. That threshold presently limits eligibility to solely bitcoin, with out naming the asset immediately in statute.

On the finish of the digital invoice, there’s textual content that claims “The aim of this invoice is to empower the Treasurer to spend money on gold, silver, and bitcoin.”

The invoice additionally permits investments in stablecoins which have acquired regulatory approval at both the federal or state stage.

The proposed 10% cap would apply on the time an funding is made. If asset costs rise and push the allocation above that threshold, the board wouldn’t be required to promote holdings, although it might be barred from making extra purchases till the allocation falls again beneath the restrict.

The laws contains detailed custody necessities for digital belongings. Holdings would should be secured both immediately by the West Virginia treasurer by way of an outlined safe custody system, by a professional third-party custodian, or by way of a registered exchange-traded product.

The invoice outlines requirements for key management, geographic redundancy, entry controls, audits, and catastrophe restoration.

Along with holding digital belongings, the invoice would enable the treasurer to pursue yield-generating actions. Digital belongings might be staked utilizing third-party suppliers if authorized possession stays with West Virginia. The treasurer might additionally mortgage digital belongings underneath guidelines designed to keep away from added monetary threat.

Treasured metals investments might be held by way of exchange-traded merchandise, by certified custodians, or immediately by West Virginia in bodily type. The invoice permits for cooperative custody preparations with different states, topic to guidelines established by the treasurer.

West Virginia retirement funds would face tighter limits. Beneath the proposal, retirement methods might make investments solely in exchange-traded merchandise registered with federal or state regulators, slightly than holding digital belongings immediately.

The invoice grants the treasurer authority to suggest implementing guidelines, which might require legislative approval.

The proposal displays a rising curiosity amongst U.S. states in utilizing bitcoin and arduous belongings as long-term shops of worth for public funds.

West Virginia and different states exploring bitcoin

A number of states have explored or enacted related measures permitting restricted publicity to digital belongings, although most have relied on exchange-traded merchandise slightly than direct custody.

Most just lately, Rhode Island lawmakers reintroduced Senate Invoice S2021, which might quickly exempt small Bitcoin transactions from state revenue and capital positive aspects taxes, permitting as much as $5,000 per 30 days and $20,000 yearly to be tax-free.

Launched January 9 by Senator Peter A. Appollonio, the invoice was referred to the Senate Finance Committee and is framed as a pilot program to scale back tax friction for on a regular basis Bitcoin use.

This marks the second consecutive 12 months Rhode Island legislators have proposed a focused Bitcoin tax exemption.

West Virginia Senate Invoice 143 has been referred to the Senate Committee on Banking and Insurance coverage, with a subsequent referral to the Committee on Finance.

On the time of writing, Bitcoin is buying and selling at $95,494 with a 24-hour quantity of $52 billion, down 1% on the day and roughly 1% beneath its seven-day excessive of $96,933. The asset’s market cap stands at $1.91 trillion, supported by a circulating provide of 19.98 million BTC out of a most 21 million.