Over the previous few years, the crypto Contracts for Distinction (CFD) panorama has been shifting from a speculative “wild west” towards a extremely regulated, institutional-grade surroundings. Crypto CFD on-line buying and selling platforms are rapidly turning into totally built-in monetary entities competing on transparency, safety, and multi-asset versatility.

What’s a Crypto CFD?

A crypto CFD is a monetary spinoff that allows merchants to take a position on the value actions of cryptocurrencies, reminiscent of Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), amongst others, with out proudly owning the underlying cryptocurrencies.

For example, as a substitute of shopping for Bitcoin and storing it in a digital pockets, you enter right into a contract with a dealer to alternate the distinction within the value of BTC from while you open the commerce to while you shut it.

When buying and selling a crypto CFD, you might be principally attempting to foretell what path the value of the underlying cryptocurrency will transfer from the time you open a place.

- An extended place (purchase commerce) predicts that the value will enhance, and thus you revenue if the value of the asset goes up.

- A brief place (promote commerce) predicts that the value will lower, and thus you revenue if the value of the asset goes down.

Key parts of crypto CFDs

When buying and selling crypto CFDs, merchants don’t personal the underlying cryptocurrency, which suggests they don’t want a digital pockets to carry the asset.

Nonetheless, there are a number of parts of crypto CFDs that merchants should be totally alert about, which isn’t essentially the case when buying and selling in spot markets.

Leverage: This permits trades to work with more cash than they’ve of their buying and selling account. The multiples range from as little as 2:1, that means you theoretically work with double the capital in your account, to even 10:1, that means you may work with ten occasions the quantity in your account. For example, a $1,000 capital can management $10,000 price of Bitcoin in a leveraged account.

However working with such excessive leverage is just not solely helpful, however also can enlarge your danger publicity, which is why merchants should discover the proper steadiness primarily based on their danger urge for food.

In a single day Charges: Merchants should even be cautious of protecting positions open in a single day. It is because brokers cost “swap” or financing charges for positions left open in a single day, which is why holding CFDs long-term may be dearer.

Prime 5 Crypto CFD Buying and selling Platforms in 2026

With out additional ado, let’s start.

Capital.com is famend for its high-tech, user-centric interface

Acknowledged for its high-tech, user-centric interface, Capital.com is a zero-commission on-line CFD buying and selling platform that boasts one of many largest digital asset choices within the trade, with over 450 cryptocurrency pairs.

The platform boasts a mean execution pace of about 0.024 seconds, minimizing slippage throughout unstable market swings.

Capital.com has built-in in style third-party buying and selling platforms, together with TradingView and MetaTrader 4 (MT4), thus offering entry to superior charting and automatic buying and selling scripts. It additionally gives one of many richest data sources when it comes to schooling supplies, buying and selling guides, information, and evaluation reviews.

Retail merchants qualify for a leverage of two:1, with larger multiples out there for the extra refined merchants.

Capital.com can also be probably the most broadly regulated CFD buying and selling platforms, with its CySEC license giving it entry to the European Union retail merchants underneath MiFID II pointers with commonplace retail protections.

In Australia, the corporate has obtained the (ASIC) & International (SCB) licenses, granting worldwide shoppers entry to CFDs, albeit with various leverage limits.

Though Capital.com does have an FCA license for its UK operations, it solely covers different property like shares, commodities, and foreign exchange.

Extra not too long ago, Capital.com was granted a license by Kenya’s Capital Markets Authority to supply CFD brokerage providers. Nonetheless, the license doesn’t cowl crypto CFDs.

eToro is famend for its social and duplicate buying and selling options

eToro is a hybrid multi-asset funding platform that gives each direct possession of cryptocurrencies and Crypto CFDs. Like many crypto CFD buying and selling platforms, leverage for retail shoppers is about at 2:1 in lots of areas.

Nonetheless, eToro does have some key variations in comparison with rivals, with the platform famend for its copy buying and selling options, which permit merchants to repeat the trades of others. Rookies can choose which trades to repeat primarily based on their danger appetites, success charges, and most drawdowns, in addition to asset classes.

Due to its hybrid standing, eToro permits customers to handle each CFDs and “Actual” crypto property in a single dashboard.

This additionally implies that in areas just like the UK and the US, the place crypto CFDs aren’t allowed, merchants can commerce the actual underlying cryptocurrency, with the asset being saved of their crypto pockets.

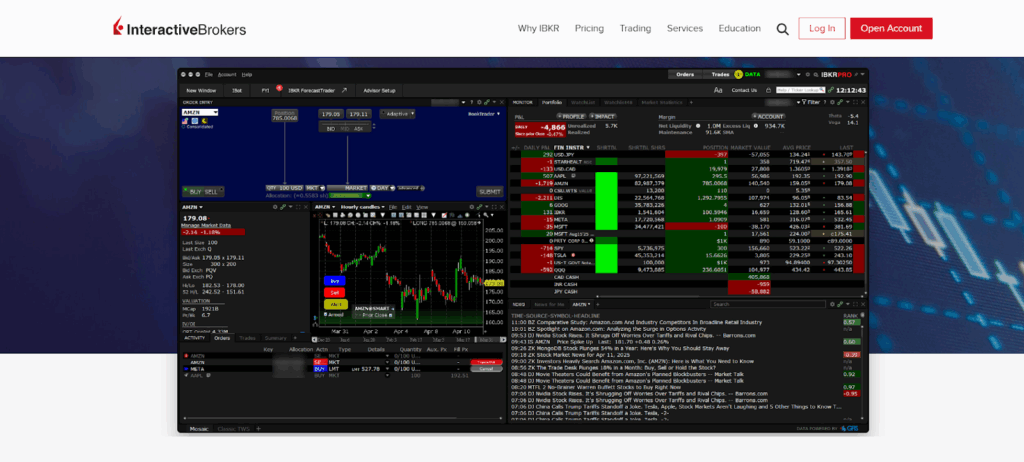

Interactive Brokers is famend for its institutional-grade standing

Like eToro, Interactive Brokers gives two distinctive methods to commerce cryptocurrencies: direct spot buying and selling (proudly owning the asset) and CFDs. And identical to eToro, merchants within the UK and the US can solely commerce cryptocurrencies through spot markets, with actual possession.

Crypto CFD buying and selling on the platform is offered to customers in eligible jurisdictions by means of buying and selling through IBKR Australia or IBKR Eire.

The record of tradable CFD cryptocurrencies is just not so long as Capital.com’s or eToro’s, with IB prioritising main cash like cash together with Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Money (BCH), amongst others.

Nonetheless, not like most crypto CFD buying and selling platforms, Interactive Brokers sometimes prices a clear fee somewhat than only a unfold markup.

Merchants additionally pay a every day swap or in a single day charges for holding their place previous the market shut.

Additionally, for merchants to commerce crypto CFDs on IBKR, they need to fulfill particular “refined investor” or “suitability” necessities. As soon as permitted, they’ll then commerce crypto CFDs on the Dealer Workstation (TWS), IBKR Cell, or the Shopper Portal by looking for the particular ticker image (e.g., “IBTC” for Bitcoin CFD).

Plus500 is famend for its simplicity of use

Like most CFD brokerage platforms, Plus500 doesn’t cost commissions on crypto CFDs. As a substitute, they generate income by means of the Unfold. Nonetheless, trades that stay open in a single day entice financing charges due to margin buying and selling. Cryptocurrencies can be found to commerce 24/7, together with weekends.

The platform gives a choice of in style cryptocurrencies, together with Bitcoin, Ethereum, Cardano, and Solana, amongst others. Additionally they provide a Crypto 10 Index, which tracks the highest 10 cryptocurrencies concurrently.

Leverage for retail merchants is often 2:1, like in lots of crypto CFD buying and selling platforms. Crypto CFDs aren’t supplied in some jurisdictions, such because the UK, as a result of regulatory restrictions.

XTB is famend for its proprietary buying and selling platform

Not like most crypto CFD buying and selling brokers, which supply a wide range of buying and selling platforms like MT4, MT5, or integrations with TradingView, XTB has constructed its personal proprietary buying and selling platform, the xStation 5, which is offered on Internet, Desktop, and cellular apps.

However like many platforms, leverage is often 2:1 for retail shoppers in lots of areas, as much as 5:1 or larger for skilled/worldwide accounts, relying on jurisdiction. The platform doesn’t provide actual possession of the underlying asset, so that you don’t want personal keys or chilly storage.

For traditional account holders, buying and selling charges are embedded into the unfold and are variable, ranging from as little as 0.22% – 2.5% of the market value, relying on the coin’s liquidity. Nonetheless, like all crypto CFD buying and selling platforms, positions that stay open in a single day entice extra charges. Professional accounts may entice some commissions, whereas inactivity attracts €10 or $10 per 30 days if there isn’t any buying and selling exercise for 12 months and no deposit within the ultimate 90 days of the 12 months.

Though XTB has been increasing its record of tradable cryptocurrencies, it’s nonetheless considerably smaller in comparison with platforms like Capital.com, which boasts one of many largest with 450, or eToro, which has about 70.

Conclusion

Buying and selling cryptocurrencies through CFDs is among the best methods to get began in crypto investing. With as little as $500, merchants can management $1000 of Bitcoin or different altcoins by means of leverage.

Nonetheless, leverage is a double-edged sword and ought to be used with warning. Even when your dealer gives leverage of as much as 10:1 or 20:1, it’s best to start out with as little as 2:1 to know volatility higher.

Watch out for margin calls. If the market strikes in opposition to you and your account steadiness falls beneath a sure stage, the dealer will shut your positions until you add extra funds. This turns a floating loss right into a realized loss, thus doubtlessly wiping out accounts.

Additionally, attempt to handle your danger per commerce by making certain you don’t wager greater than 1% or 2% of your account steadiness on one commerce.

Make use of laborious cease loss orders the place attainable. As a result of in CFDs, “gapping” can occur (the place a value skips your stage), take into account assured stop-losses to make sure an exit at your precise value for a small charge.