- Monero surged to a brand new all-time excessive close to $798 earlier than pulling again.

- A $1,000 funding at XMR’s 2015 low could be price about $3.6 million.

- Current features have been fueled by renewed curiosity in privateness cash and sector rotation.

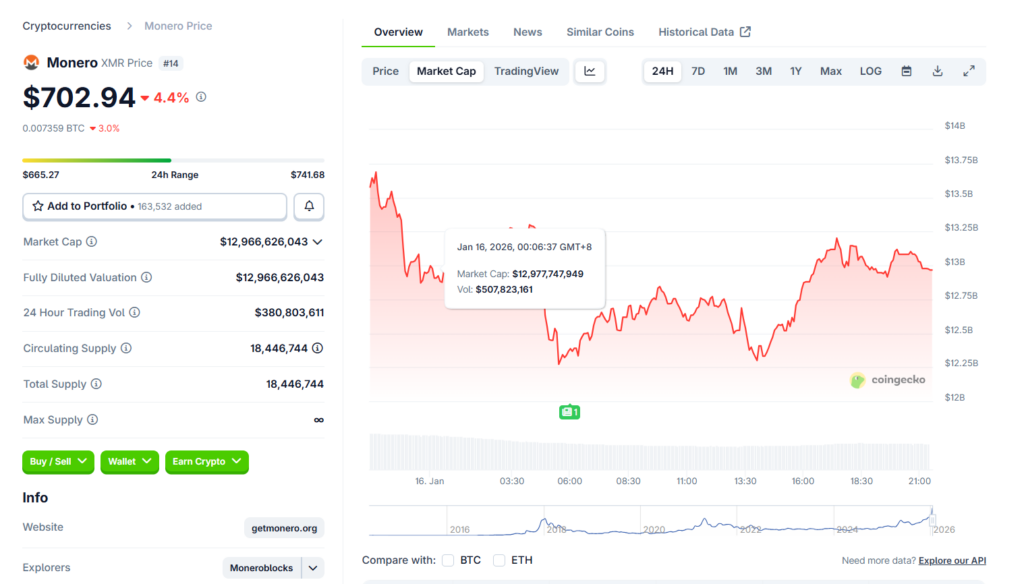

Monero has been one of many standout performers in crypto over the previous yr, delivering features that few belongings can match. The privacy-focused coin lately surged to a brand new all-time excessive close to $797.73, capping off a robust rally that noticed XMR climb greater than 220% since January 2025. Whereas momentum has cooled barely, with the worth pulling again about 16% from its peak, the broader transfer has already cemented Monero’s place among the many top-performing belongings of the cycle.

In accordance with CoinGecko information, XMR gained roughly 47% over the past week, 60% over two weeks, and greater than 56% over the previous month earlier than the most recent correction set in. Even after a 4.8% dip within the final 24 hours, the size of the rally stays exhausting to disregard. For long-term holders, the numbers inform a a lot greater story.

How a $1,000 Wager Grew to become a $3.6 Million Final result

To know the magnitude of Monero’s rise, it helps to rewind. Again in January 2015, XMR traded as little as $0.2162. A $1,000 funding at that value would have purchased roughly 4,629 XMR tokens. Quick ahead to January 2025, when Monero reached its peak close to $797.73, and that very same stash would have been price round $3.6 million.

That interprets to a acquire of greater than 369,000%, a reminder of what early adoption and long-term conviction can ship in crypto. In fact, these sorts of returns are uncommon and infrequently solely seen in hindsight, however Monero’s journey stays one of many extra placing examples.

What Drove Monero’s Newest Surge

Monero’s latest momentum wasn’t random. Curiosity in privacy-focused belongings picked up sharply in late 2025 as regulatory strain and surveillance debates intensified throughout the business. XMR, lengthy thought to be the benchmark privateness coin, benefited immediately from that shift.

The rally was additionally amplified by turmoil elsewhere within the privateness sector. Inner conflicts throughout the Zcash ecosystem, together with the departure of its core growth workforce, possible pushed some buyers to rotate capital into Monero. As confidence in competing initiatives wavered, XMR absorbed a lot of that demand.

Indicators of Cooling Are Beginning to Present

Regardless of its spectacular run, Monero is now displaying early indicators of exhaustion. The pullback from latest highs suggests profit-taking is underway, particularly because the broader crypto market stays fragile following the late-2025 crash. Danger urge for food remains to be uneven, and belongings that rallied the toughest typically appropriate the quickest as soon as momentum slows.

For present buyers, the query isn’t whether or not Monero has already delivered life-changing features — it has. The actual query is whether or not privateness tokens can maintain demand in a market that’s nonetheless cautious. Within the close to time period, additional consolidation or draw back wouldn’t be stunning as merchants reassess danger and lock in income.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.