- Institutional Bitcoin demand now exceeds new provide by roughly six instances

- Rising world liquidity and ETF entry are reinforcing long-term accumulation

- Sustained ETF inflows are appearing as a stabilizing pressure close to key value ranges

Institutional capital is absorbing Bitcoin at a tempo that miners merely can’t sustain with, and the imbalance is beginning to look structural relatively than non permanent. From ETF inflows to world liquidity developments, the indicators are stacking up in a approach that feels acquainted, however sharper this time.

Establishments Are Shopping for Bitcoin Sooner Than It Can Be Mined

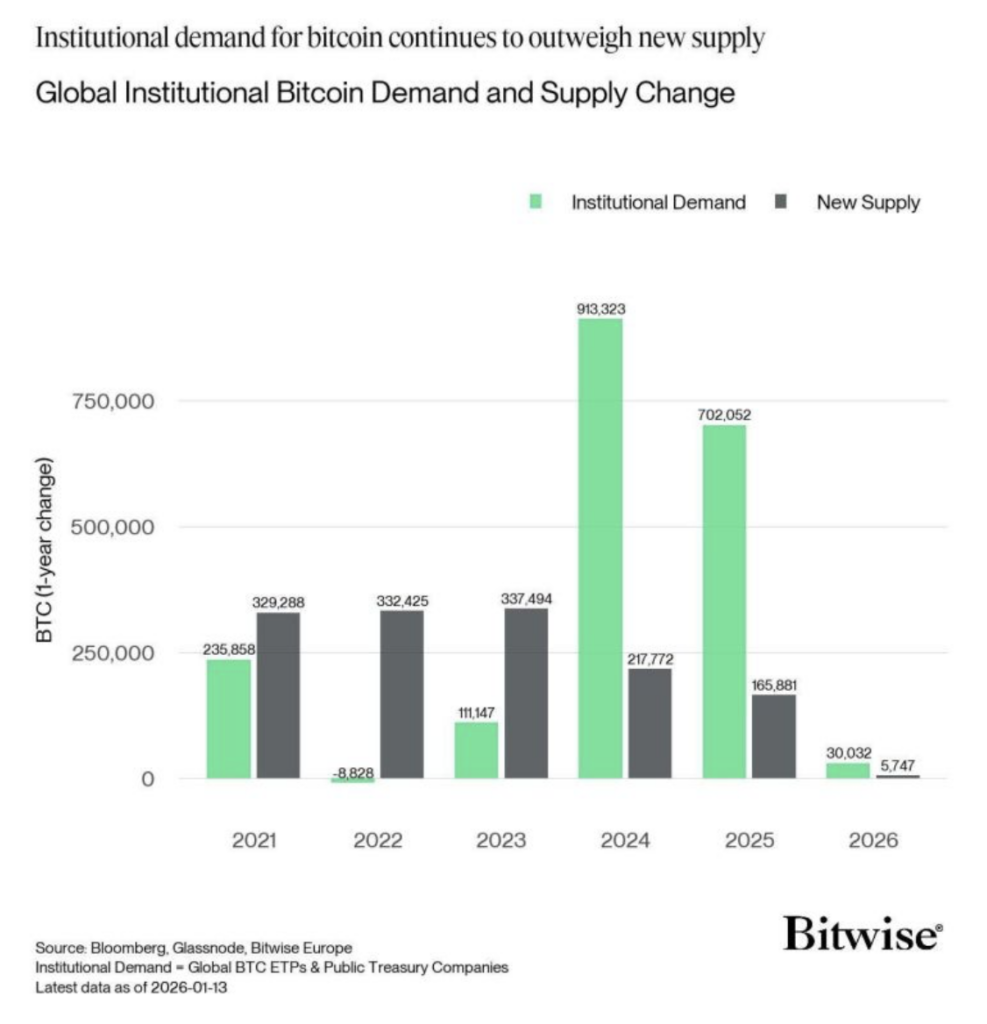

Bitcoin is being absorbed by establishments at a charge by no means seen earlier than. Again in 2021, institutional demand sat round 236,000 BTC, which was nonetheless beneath the roughly 330,000 BTC mined that 12 months. The market was heated, certain, however provide was not but being overwhelmed.

Issues flipped briefly in 2022 through the drawdown, then normalized once more in 2023. That 12 months noticed round 111,000 BTC bought by establishments whereas miners produced about 337,000 BTC. Demand was current, however it wasn’t dominant, not but anyway.

The true shift arrived in 2024. Institutional demand surged to roughly 913,000 BTC, whereas new provide fell sharply to round 218,000 BTC. That hole was exhausting to disregard. In 2025, momentum stayed robust with about 702,000 BTC bought towards simply 166,000 mined. By 2026, establishments are shopping for Bitcoin at roughly six instances the speed of latest issuance, a dynamic that feels much less cyclical and extra intentional.

ETF Adoption and Shortage Are Quietly Reshaping the Market

This sort of imbalance normally doesn’t seem with out deeper drivers. ETF acceptance has clearly modified the entry layer for big capital, making allocation easier and, frankly, extra palatable. On high of that, post-halving provide dynamics are tightening circumstances additional, even when the market hasn’t absolutely priced that in but.

Lengthy-term allocation methods are additionally enjoying a job. Establishments are not treating Bitcoin as a short-term commerce, however extra like a structural asset with outlined shortage. Traditionally, related demand-supply mismatches have preceded aggressive value expansions and bolstered bullish cycles throughout a number of market phases. It doesn’t assure outcomes, however it does tilt the percentages.

International M2 Progress Is Rising, and Bitcoin Often Follows

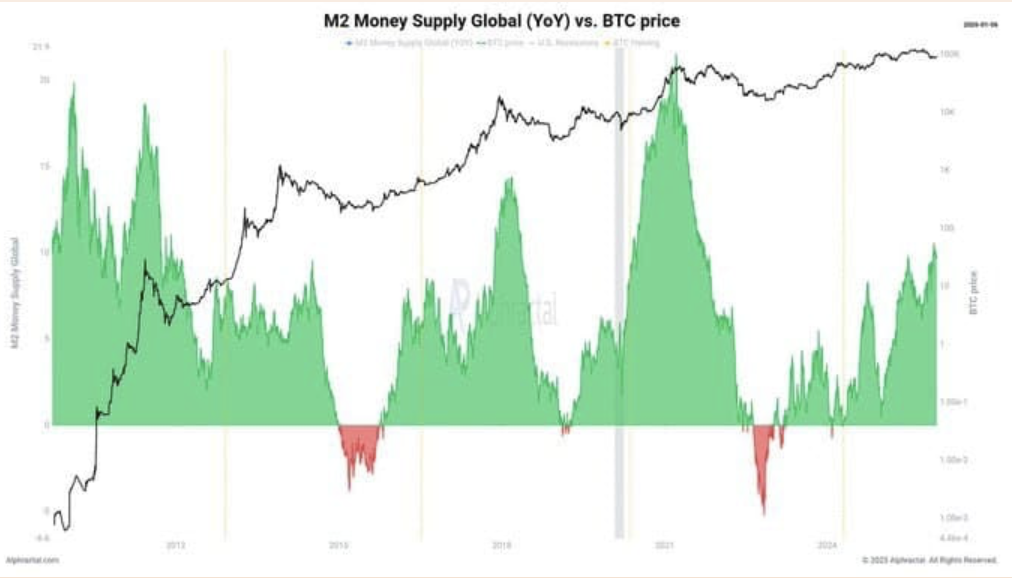

One other macro layer price watching is world M2 cash provide development, which is now climbing at its quickest tempo since post-2020. Central financial institution easing, increasing fiscal deficits, and renewed liquidity injections have relaxed monetary circumstances throughout markets. Threat urge for food, unsurprisingly, has improved too.

Bitcoin has a behavior of lagging these shifts at first. In earlier cycles, together with 2017, 2020, and 2021, sustained M2 enlargement ultimately coincided with robust Bitcoin bull runs. The connection isn’t linear although, and liquidity development tends to reach in uneven waves relying on the broader cycle.

Nonetheless, extra liquidity tends to chase scarce property. Bitcoin’s fastened provide, world accessibility, and portability make it a pure outlet as soon as liquidity turns persistently optimistic. If M2 development continues accelerating, the long-term bias probably stays in Bitcoin’s favor. That mentioned, any slowdown or reversal in cash provide development deserves consideration, since previous rallies have weakened rapidly as soon as liquidity momentum rolled over.

ETF Inflows Are Anchoring Bitcoin Close to Key Ranges

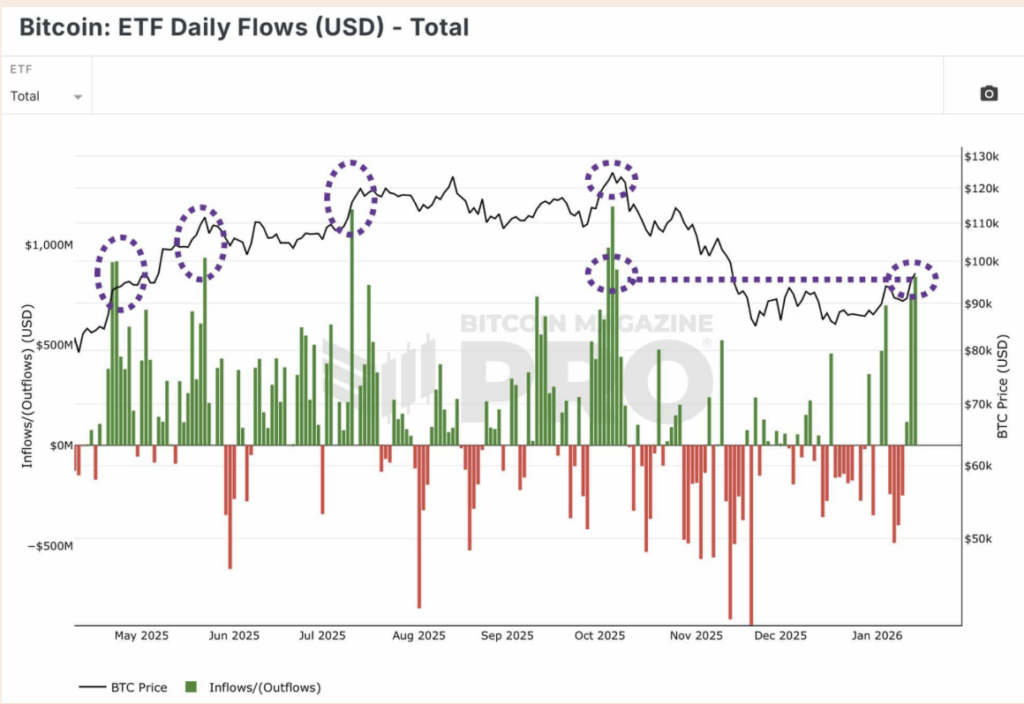

On the time of writing, Bitcoin is buying and selling close to $96,000 after rebounding from latest weak point. Brief-term value swings have been pushed by macro uncertainty, shifting charge expectations, and ongoing threat rotation. However beneath the noise, institutional positioning is changing into the extra essential sign.

Spot Bitcoin ETF inflows have proven repeated surges since Might 2025, typically aligning carefully with native value advances. Giant inexperienced influx bars usually mirror aggressive institutional accumulation, whereas prolonged purple durations are likely to coincide with corrective phases.

One standout second was January 15, when ETF inflows reached roughly $840 million in a single day. That transfer echoed accumulation waves seen earlier in July and October. These flows didn’t simply take up promote strain, they actively pushed Bitcoin into increased ranges. Clustered shopping for additionally lowered draw back volatility, suggesting construction relatively than random noise. The message is straightforward, sustained inflows stabilize value motion, whereas reversals reopen threat.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.