- TRX is holding above former resistance close to $0.300, signaling energy

- Worth construction favors continuation with $0.32 as the important thing stage to flip

- Lengthy positioning and rising energetic addresses assist a bullish short-term outlook

TRON is exhibiting a bit extra spine than most proper now. After pushing increased earlier this week, TRX didn’t fade or rush to provide again its features. As an alternative, value settled into a better vary, with consumers quietly stepping in and absorbing provide. That form of conduct normally hints at rising confidence, a minimum of within the brief time period.

TRX Holds Its Floor as Consumers Keep Lively

Whereas momentum throughout the broader market stays selective, TRX continues to draw capital that seems keen to stay round. This isn’t the standard hit-and-run stream. The token has managed to carry above the previous resistance zone close to $0.300, a stage that capped value motion for months. Now, it’s performing extra like a base, which factors to rising demand reasonably than short-lived positioning.

To see whether or not this shift has legs, it helps to look beneath the floor. Each the technical construction and on-chain indicators are beginning to line up in TRON’s favor.

Worth Construction Indicators a Continuation, Not a Bounce

TRX’s latest transfer suggests it has transitioned out of consolidation and right into a recovery-driven enlargement section. After spending months trapped beneath a descending trendline, value lastly pushed by way of a number of resistance layers. That form of breakout normally carries extra weight than a easy reduction rally.

The $0.32 space is now the important thing zone to observe. It beforehand acted as resistance, and TRX is presently testing whether or not it could flip that stage into assist. A clear maintain above it might open the door to a transfer towards $0.3680, roughly a 20% upside from present ranges. So long as value stays above the breakout base, the construction favors continuation over exhaustion. Nonetheless, a drop again beneath $0.30 might invite profit-taking and pull TRX towards the $0.2900 area.

On-Chain Metrics Level to Rising Participation

On-chain information provides one other layer of assist to the bullish case. In line with Coinglass, positioning is leaning closely lengthy. Round 63% of accounts are presently holding lengthy positions, in comparison with simply 37% on the brief facet. That creates a long-to-short ratio close to 1.76, a transparent signal that merchants are leaning optimistic.

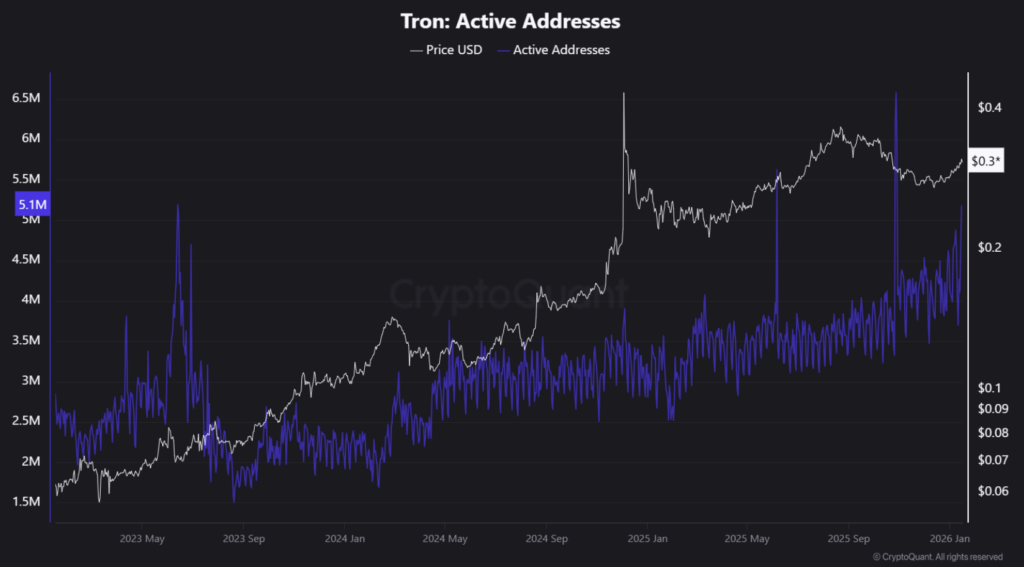

Past derivatives, community exercise is selecting up as nicely. The variety of energetic addresses is climbing, and extra importantly, lots of these addresses are holding balances. That means actual participation is growing, not simply speculative churn. As community engagement expands, it tends to strengthen demand, giving TRX’s value motion a stronger basis.

If this development holds, TRON might be establishing for additional features, although short-term pullbacks are all the time a part of the method.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.