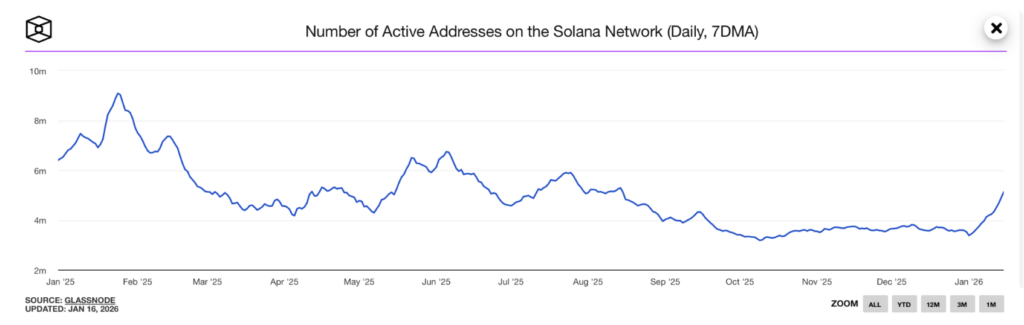

- Solana’s energetic addresses are rebounding after a protracted interval of decline

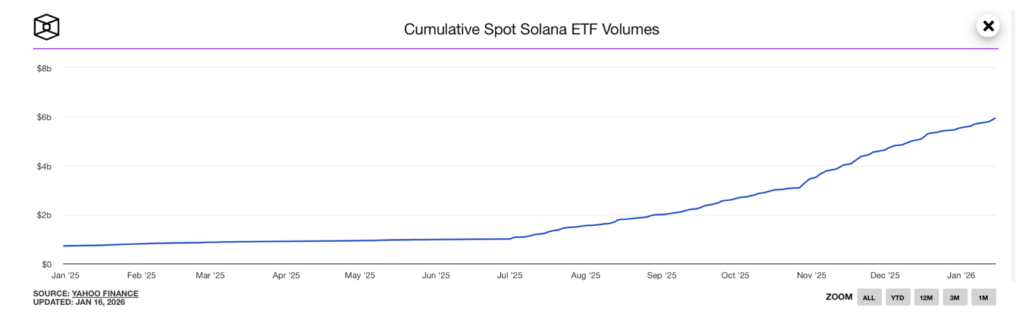

- Spot ETF volumes close to $6 billion sign regular institutional participation

- A breakout above $152 might unlock increased targets, whereas $140 stays key assist

Solana’s value is beginning to present early indicators of a reset after months of cooling exercise throughout the community. New on-chain information suggests energetic addresses are ticking increased once more, hinting that participation could also be returning after a protracted, quiet second half of final yr. On the identical time, spot Solana ETF volumes have continued to grind increased towards the $6 billion mark, pointing to rising institutional curiosity, even with out the noise of a retail-driven rush.

Solana’s Community Exercise Is Slowly Waking Up

All through a lot of 2025, Solana’s energetic deal with depend trended decrease, reflecting a gentle drop in on-chain engagement. That development seems to be shifting as 2026 will get underway. After remaining principally flat in This autumn, energetic addresses have rebounded meaningfully, suggesting merchants and customers are paying consideration once more.

Information reveals a transfer from roughly 3.4 million energetic addresses to above 5 million, which isn’t a trivial bounce. It indicators that demand is resurfacing instantly on the community, not simply by alternate buying and selling. That mentioned, that is nonetheless an early sign. It factors to potential restoration, not a full-blown reacceleration simply but.

ETF Volumes Counsel Quiet Institutional Demand

Solana’s spot ETF, which launched in late October 2025, has seen constant inflows since going dwell. Cumulative buying and selling volumes have steadily climbed and at the moment are approaching $6 billion. Reasonably than sharp spikes, the information reveals repeated, measured engagement, a sample typically related to institutional positioning.

ETFs present a clear entry level for traders preferring to not work together with exchanges instantly. Rising volumes right here recommend sustained curiosity, not one-off hypothesis. This regular demand helps the concept that SOL is being accrued quietly, which might matter if value motion begins to substantiate the transfer increased.

SOL Value Construction Stays Constructive

Whereas Solana’s longer-term chart could look uneventful at first look, the shorter-term construction tells a special story. On the four-hour chart, SOL continues to commerce inside a rising parallel channel, retaining the broader bullish development intact. After briefly slipping beneath the channel, value reclaimed it rapidly, a transfer that always indicators energy relatively than exhaustion.

Momentum indicators are combined, however not alarming. RSI is hovering close to impartial whereas staying throughout the higher vary, and the MACD is flattening as promoting stress fades. This mixture often factors to consolidation inside an uptrend, not a transparent reversal. Value is tightening, which frequently precedes a bigger directional transfer.

Key Ranges That Might Resolve the Subsequent Transfer

The instant resistance zone sits between $150 and $152. Beneath that, the $143 to $144 vary might act as a short-term barrier if momentum stalls. A decisive break above $152, backed by stronger quantity, would possible open the door towards increased targets, doubtlessly close to $170.

On the draw back, a rejection that pushes SOL beneath $140 would weaken the channel construction and improve the chances of a deeper pullback. Even then, a transfer towards $138 or $140 wouldn’t essentially break the broader development, however it might delay any upside continuation.

The Larger Image

Solana isn’t organising for a hype-driven surge, a minimum of not but. As a substitute, the image appears extra measured. Energetic addresses are recovering, ETF flows level to regular institutional involvement, and value is holding a rising construction whereas momentum cools in impartial territory.

The set off is easy. SOL wants a clear break and maintain above the $150–$152 zone, with quantity, to substantiate the subsequent leg increased. Till that occurs, this stays a affected person bullish setup, the place short-term pullbacks are nonetheless very a lot a part of the method.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.