- Bitcoin is approaching the 365-day transferring common close to $100K–$101K

- A reclaim might sign pattern continuation, whereas rejection raises draw back danger

- Momentum suggests stabilization, not a confirmed breakout but

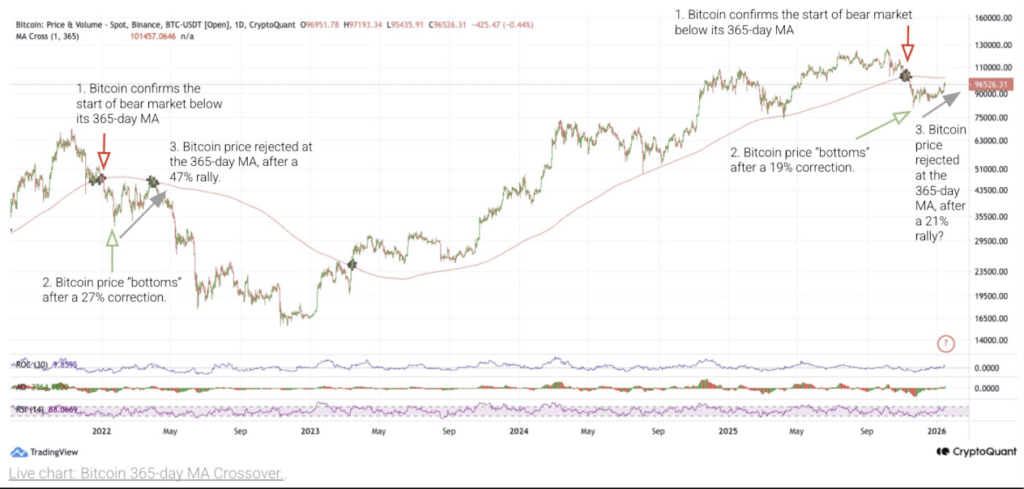

Bitcoin is drifting again towards a stage that merchants don’t ignore, even when they fake to generally. Value is as soon as once more approaching the 365-day transferring common, a long-term pattern line that carries actual weight throughout cycles. In accordance with CryptoQuant knowledge, this zone is sitting simply above present value, and historical past says it’s not one thing Bitcoin crosses casually.

Why the 365-Day Shifting Common Is a Large Deal

Throughout the 2022 bear market, this identical transferring common acted like a tough ceiling. Bitcoin rallied into it, stalled, didn’t reclaim it, after which rolled over right into a a lot deeper drawdown. That second marked the distinction between a short lived bounce and a chronic downtrend. It’s why this stage nonetheless issues right this moment, perhaps greater than most individuals need to admit.

Proper now, the 365-day MA sits across the $100,000 to $101,000 vary. Bitcoin is buying and selling under it, which retains the market in a defensive posture. In long-term pattern evaluation, reclaiming this line often alerts power and continuation. Failing to take action retains rallies weak.

How This Setup Compares to Previous Cycles

Trying again at earlier cycles, the sample is fairly clear. In 2022, Bitcoin dropped under the 365-day MA, staged a restoration rally of about 47%, after which acquired rejected. Solely after a a lot deeper correction did value lastly carve out a sturdy backside.

This time round, Bitcoin has already pulled again roughly 20% from current highs. That form of transfer strains up extra with mid-cycle corrections than full capitulation occasions. The open query is whether or not that pullback was sufficient, or if the market nonetheless must work by means of extra provide earlier than transferring larger.

What Occurs Subsequent Relies on This Zone

This isn’t simply one other technical line. Lengthy-term holders, funds, and systematic methods all watch this stage intently. When Bitcoin trades under it, rallies are likely to get bought into. When value holds above it, dips often discover patrons.

In the mean time, Bitcoin is caught in between. The bounce is there, however affirmation just isn’t. A rejection close to $100K–$101K would begin to resemble the early phases of the 2022 construction. On the flip facet, a clear day by day and weekly shut above the 365-day MA would critically weaken the bearish argument and counsel that promoting stress has been absorbed.

Momentum Alerts Name for Persistence

Momentum indicators aren’t screaming in both path. RSI has recovered from oversold ranges however isn’t displaying robust bullish divergence. Quantity through the rebound has been first rate, although removed from explosive. That often factors to stabilization relatively than acceleration.

Markets that appear like this usually chop round and frustrate each side earlier than selecting a path. It’s not thrilling, but it surely’s sincere value conduct.

A Balanced View of the Threat

This chart doesn’t assure a bear market. It does, nevertheless, justify warning.

Bitcoin is sitting at a call level. Bulls have to reclaim and maintain the 365-day transferring common. Bears are watching intently for an additional rejection to verify that this transfer is corrective, not structural. Till a kind of outcomes performs out, sharp strikes in both path stay very a lot on the desk.

In easy phrases, this isn’t a spot for complacency. How Bitcoin interacts with this stage might form not simply the following few weeks, however the broader pattern for the remainder of the 12 months.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.