- ProShares has launched a 2x leveraged Cardano ETF, signaling deeper institutional curiosity in ADA

- ADA continues to be working by a wave (2) correction, with $0.438 performing as a key set off degree

- Tight EMA convergence and impartial RSI recommend consolidation forward of a possible breakout

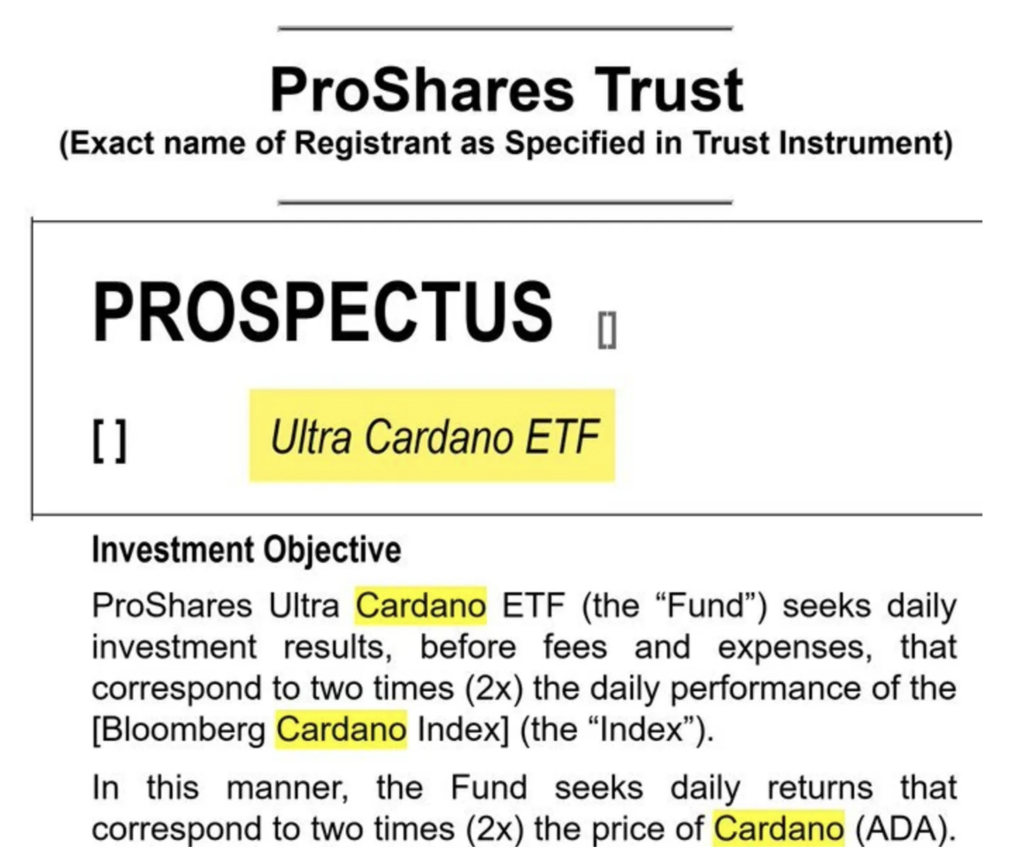

Cardano simply picked up a brand new, and pretty severe, piece of market infrastructure. ProShares has launched a 2x leveraged Cardano (ADA) ETF, marking one other step towards deeper institutional involvement within the altcoin area. It’s not a small sign. Leveraged merchandise have a tendency to point out up solely as soon as there’s sufficient demand, liquidity, and confidence to help them.

A Leveraged ETF Places ADA Again on Institutional Radar

The brand new ProShares ETF permits merchants to achieve amplified publicity to ADA’s value strikes, successfully doubling positive factors throughout sturdy uptrends, and losses too, after all. This type of instrument is normally geared toward extra subtle gamers, hedge funds, lively desks, and establishments operating short-term or tactical methods.

Its launch suggests Cardano is being taken extra significantly as a tradable asset, not only a long-term tech wager. Leveraged ETFs usually enhance visibility as properly. Even buyers who don’t use them instantly have a tendency to concentrate as soon as they exist, and that may pull ADA again into broader market conversations.

ADA Navigates a Textbook Correction Section

From a technical angle, the timing is attention-grabbing. Crypto analyst Man of Bitcoin identified that ADA is presently testing the 50% Fibonacci retracement degree as a part of a wave (2) correction. In Elliott Wave phrases, that is fairly regular conduct. Wave (2) corrections are hardly ever clear or fast, they usually usually embody a number of swings earlier than lastly resolving.

The expectation, no less than for now, is that ADA may make another low earlier than the correction is full. Which may not sound bullish on the floor, however it suits the sample. What issues extra is what comes subsequent. A transfer above the $0.438 degree could be a significant sign, probably marking the beginning of wave (3), which is often the strongest and most aggressive part of an Elliott Wave cycle.

That’s the extent many merchants are watching intently. If ADA can push by it with conviction, the tone adjustments quick.

Worth Stabilizes as Indicators Cool Off

On the time of writing, Cardano is buying and selling round $0.397, displaying early indicators of stabilization after slipping under short-term exponential transferring averages. What stands out is how tightly clustered the EMAs have develop into. The 20, 50, 100, and 200 EMAs are all converging close to $0.396, which normally alerts consolidation reasonably than panic.

ADA briefly pushed above $0.420 earlier, however couldn’t maintain that floor. Since then, value motion has appeared extra like quiet accumulation than aggressive promoting. RSI sits proper round 50, virtually completely impartial. That tells the identical story. Neither consumers nor sellers are in management but, however that stability can break shortly as soon as momentum returns.

For now, help sits close to $0.393, whereas resistance stays across the prior excessive at $0.420. A break both method will probably resolve the following short-term transfer. With a leveraged ETF now in play and technicals tightening, ADA could not keep this quiet for lengthy.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.