- The Altcoin Season Index has dropped to 35, signaling a transition section relatively than full altcoin season

- Ethereum is holding key ETH/BTC assist and appearing as the primary driver of altcoin sentiment

- Choose altcoins, particularly privacy-focused belongings, are already displaying robust momentum

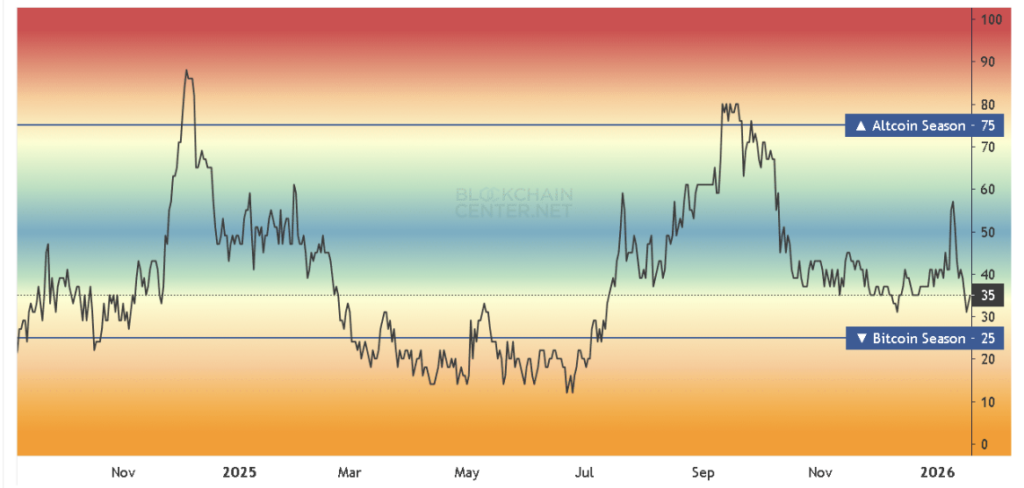

The altcoin market has quietly slipped right into a extra delicate section. The Altcoin Season Index has dropped to 35, a degree that doesn’t scream panic, however positively alerts transition. Bitcoin dominance has softened a bit, and that shift is encouraging capital to rotate into various belongings, even when the transfer nonetheless feels selective relatively than explosive.

Beneath the floor, market construction suggests altcoins could also be making ready for an growth section. Ethereum, as soon as once more, is doing a lot of the heavy lifting in the case of sentiment.

Ethereum Holds Agency as Bitcoin Dominance Eases

Ethereum has proven notable resilience in opposition to Bitcoin throughout current volatility. On the time of writing, ETH/BTC was buying and selling close to 0.03484, holding above its 2025 lows and a well-defined assist zone. That alone issues. In moments the place the broader market feels shaky, relative energy tends to face out extra clearly.

On the longer-term chart, Ethereum continues to be urgent up in opposition to its descending trendline that has been in place since 2017. It hasn’t damaged by means of but, but it surely’s testing it once more. Momentum indicators are beginning to stir too. The MACD is flashing early indicators of a possible bullish crossover, which might trace that Ethereum’s relative energy is constructing as Bitcoin dominance continues to fade, slowly.

Complete Altcoin Market Construction Seems Constructive

Zooming out, the full crypto market cap excluding Bitcoin has been holding regular round $1.29 trillion. On the weekly timeframe, the construction seems to be like an ascending triangle, a sample that often displays constant accumulation strain relatively than distribution.

This sort of setup usually precedes a breakout that pulls extra capital into altcoins. That mentioned, it’s not assured. If the rising assist trendline fails to carry, short-term draw back strain might nonetheless present up earlier than any broader transfer larger takes form. For now, although, the construction leans constructive.

Altcoin Season Index Indicators Transition, Not Euphoria

With the Altcoin Season Index sitting at 35, the market is clearly not in full altcoin season territory. Bitcoin continues to be outperforming most belongings general. Nonetheless, this degree has traditionally marked durations the place choose altcoins start to achieve traction forward of broader participation.

In previous cycles, related readings usually got here earlier than extra widespread altcoin energy. It’s often a gradual handoff, not a sudden swap, and that appears to be what’s unfolding once more.

Choose Altcoins Are Already Transferring

As consideration shifts, a number of altcoins have already posted outsized beneficial properties. Monero surged greater than 85%, Chiliz climbed roughly 85% as effectively, and MYX jumped over 82%. Sprint superior round 70%, Zcash gained about 60%, and Bitcoin Money moved up near 24%.

A transparent theme has emerged right here. Privateness-focused belongings are displaying notable energy, suggesting that capital is rotating with intent, not randomly.

The place the Market Goes From Right here

As Bitcoin dominance continues to ease, the market seems extra open to altcoin management, not less than on the margins. Ethereum stays central to that narrative. Its skill to carry assist on the ETH/BTC pair might find yourself shaping how far and how briskly this rotation develops.

If altcoins can hold constructing momentum with out Bitcoin reasserting full management, Ethereum’s function as a pacesetter turns into much more essential. For now, the market feels balanced on a knife’s edge. Whether or not this turns right into a broader altcoin growth or stays selective is dependent upon what occurs subsequent, and who steps as much as lead.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.