- A protracted-term XRP forecast shifts focus from short-term worth motion to infrastructure and adoption

- XRP’s worth thesis facilities on utility, funds, and institutional integration moderately than shortage

- A $100 goal is feasible however is dependent upon sustained adoption and regulatory readability over time

In a market that’s often obsessive about short-term worth swings and fast-moving narratives, long-range projections are inclined to land in a different way. They sluggish the dialog down. When analysts cease watching every day candles and begin speaking in years, consideration shifts away from momentum and towards fundamentals, infrastructure, and whether or not an asset can realistically develop into its valuation over time.

A current XRP worth forecast has finished precisely that, reopening debate round XRP’s long-term potential moderately than its subsequent short-term transfer.

Why This Forecast Gained Consideration

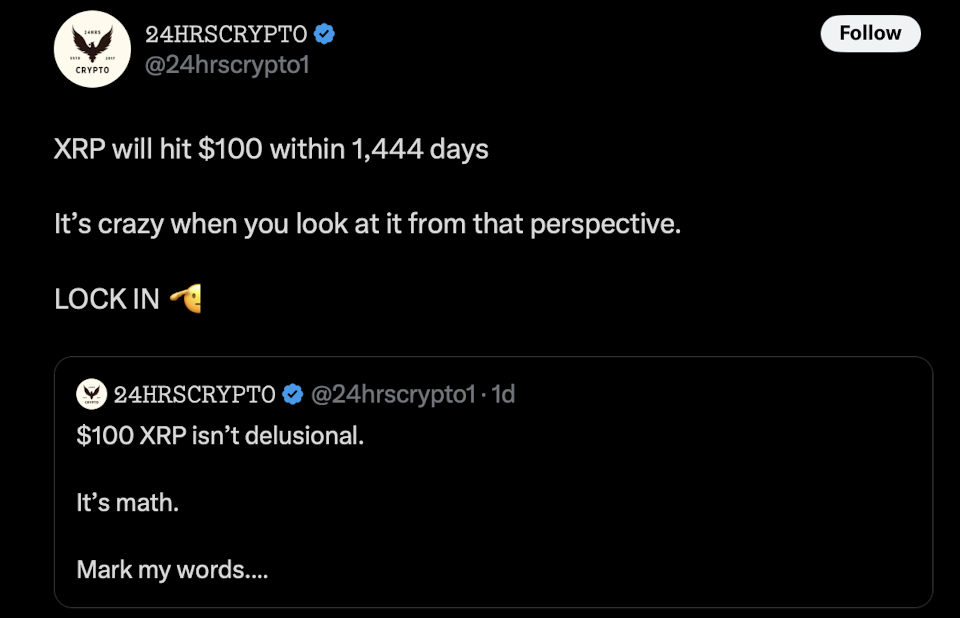

The dialogue picked up momentum after an X publish by 24HOURSCRYPTO, which referenced commentary attributed to an XRPL validator. As an alternative of pushing urgency or near-term targets, the publish framed XRP’s outlook round an outlined timeline, 1,444 days. That framing mattered. It inspired traders to zoom out and reassess XRP’s future with out reacting to short-term volatility.

The thought resonated exactly as a result of it didn’t promise velocity. It emphasised endurance.

Why the Timeline Itself Issues

A projection spanning 1,444 days focuses on course of moderately than prediction. Traditionally, crypto belongings that skilled significant revaluations didn’t accomplish that in a single day. They spent years constructing infrastructure, navigating regulation, and integrating with establishments earlier than worth mirrored these adjustments.

This timeframe aligns extra intently with actual market cycles. It permits house for cost rails to scale, liquidity techniques to deepen, and enterprise blockchain options to mature organically, moderately than forcing development right into a speculative acceleration narrative.

XRP’s Utility-Pushed Worth Proposition

XRP’s long-term thesis has by no means leaned closely on shortage. As an alternative, Ripple positions XRP as a bridge asset for real-time, low-cost cross-border settlements, concentrating on inefficiencies within the world correspondent banking system.

Supporters argue that as transaction volumes develop and institutional utilization expands, worth accrual can be tied to precise community demand, not hype-driven hypothesis. It’s a slower path, however one which goals to be structurally sound.

The XRP Ledger Continues to Evolve

Below the hood, the XRP Ledger has grown past easy funds. Tokenization, on-chain liquidity instruments, and decentralized infrastructure designed for enterprise use are actually a part of the ecosystem. Low charges, power effectivity, and a built-in decentralized alternate proceed to face out, particularly for establishments that prioritize reliability over experimentation.

Validators, who assist safe and preserve the community, typically level to those fundamentals when assessing long-term valuation potential. From that perspective, worth turns into one thing that follows progress, not leads it.

Conviction Is Not the Identical as Certainty

Even with rising confidence round projections like a $100 XRP, there isn’t any information that ensures such an final result inside a hard and fast window. Attaining that degree would require sustained world adoption, deep liquidity, favorable macro situations, and continued regulatory readability throughout main jurisdictions. All are attainable. None are assured.

That distinction issues. A powerful thesis doesn’t eradicate threat, it simply reframes it.

A Longer Lens on XRP’s Trajectory

At its core, the attitude shared by 𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 displays a mindset that’s changing into extra frequent amongst long-term XRP advocates. Time, infrastructure, and real-world utilization are seen because the true drivers of worth, not short-term worth noise.

Whether or not XRP reaches $100 inside 1,444 days stays unsure. However the forecast itself reinforces a rising emphasis on endurance, fundamentals, and letting the story develop naturally.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.