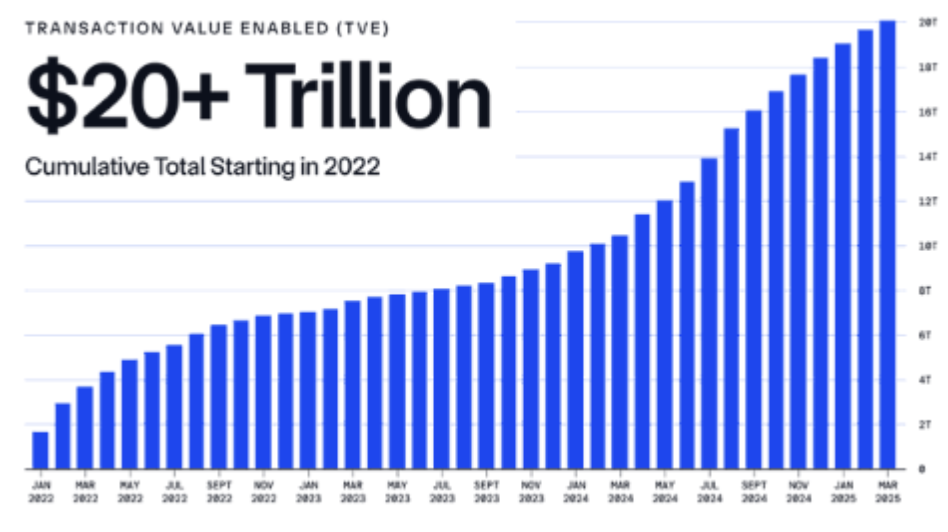

- Chainlink has facilitated over $27.6 trillion in verified transaction worth, positioning itself as core monetary infrastructure

- Main banks and establishments are transferring from pilots to actual integrations utilizing Chainlink’s knowledge and interoperability instruments

- The platform has developed right into a full computing atmosphere, aiming to simplify cross-chain and offchain workflows

Chainlink has spent years carving out a task that sits someplace between conventional finance and blockchain, and these days, that place is getting more durable to disregard. The decentralized computing community has now enabled greater than $27.6 trillion in transaction worth, a quantity that places it in a really completely different class from most crypto tasks.

Relatively than chasing narratives, Chainlink has targeted on plumbing. Knowledge verification, interoperability, and safe execution. That focus is why each monetary establishments and decentralized protocols proceed to depend on it because the connective tissue between previous programs and new ones. Whether or not it’s banking rails, capital markets, or DeFi platforms, Chainlink retains displaying up within the background.

Tapping Right into a $867 Trillion Alternative

The dimensions of what Chainlink is focusing on is difficult to wrap your head round. International monetary property are estimated at round $867 trillion, but solely about 0.1% of that worth exists onchain as we speak. The remainder stays locked inside legacy infrastructure that was by no means designed to speak to blockchains.

That is the place Chainlink matches in. Its oracle and verification programs present the safe knowledge layer wanted to maneuver real-world property onchain with out breaking belief assumptions. To date, the community has facilitated over $27.6 trillion in verified transaction worth and delivered greater than 19 billion cryptographically verified messages to blockchains.

That’s not summary exercise. Every message represents knowledge that good contracts can really depend on. As we speak, greater than 2,500 tasks combine Chainlink throughout DeFi, gaming, provide chains, and monetary companies, displaying how broadly its infrastructure is getting used.

Banks and Establishments Are Shifting Past Experiments

Chainlink’s institutional footprint has expanded rapidly, and never simply by way of pilot packages. Main gamers like Swift, J.P. Morgan, and Constancy are already utilizing the community to discover tokenization and settlement workflows. Euroclear, UBS, and ANZ have adopted, alongside digital asset banks comparable to Sygnum and SBI Digital Markets.

Latest reporting reinforces that momentum. CoinDesk highlighted Trump-backed World Liberty Monetary choosing Chainlink’s knowledge companies. FinTech Futures coated Brazil’s central financial institution working with Chainlink and Microsoft on a CBDC commerce finance pilot. Yahoo! Finance reported on Sygnum and Constancy Worldwide partnering by way of the community.

Even funds giants are circling nearer. Watcher.Guru famous Visa and PayPal increasing stablecoin initiatives alongside Chainlink and Swift milestones, whereas Crypto Briefing reported Colombia’s largest financial institution tapping Chainlink for stablecoin transparency. These aren’t fringe experiments anymore. They’re early indicators of production-grade adoption.

From Easy Oracles to a Full Computing Platform

Chainlink as we speak appears very completely different from what it was at launch. Again in 2019, it began with primary knowledge feeds, Any API, and Flux Monitor. That was sufficient to resolve early oracle issues, however it didn’t cease there.

Over time, the platform added Verifiable Random Operate for gaming, Proof of Reserve for asset verification, Off-Chain Reporting, and automation instruments. In 2023, the launch of Cross-Chain Interoperability Protocol pushed issues additional by creating a normal for transferring worth throughout chains.

Newer upgrades embody Chainlink Capabilities, Knowledge Streams, the Transporter bridging app, and the Digital Belongings Sandbox. Options just like the Privateness Suite and VRF 2.5 are clearly geared toward establishments that want confidentiality alongside transparency.

The subsequent step is the Chainlink Runtime Setting. CRE is designed to let builders coordinate workflows throughout onchain contracts and offchain programs in a single atmosphere. The objective is velocity and ease, chopping growth cycles from weeks right down to hours. An upcoming bootcamp on January 21–22 will showcase this by strolling builders by way of constructing prediction markets utilizing CRE.

Chainlink isn’t flashy, and it doesn’t must be. Its worth exhibits up within the programs that hold working, quietly, as extra of the monetary world inches onchain.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.