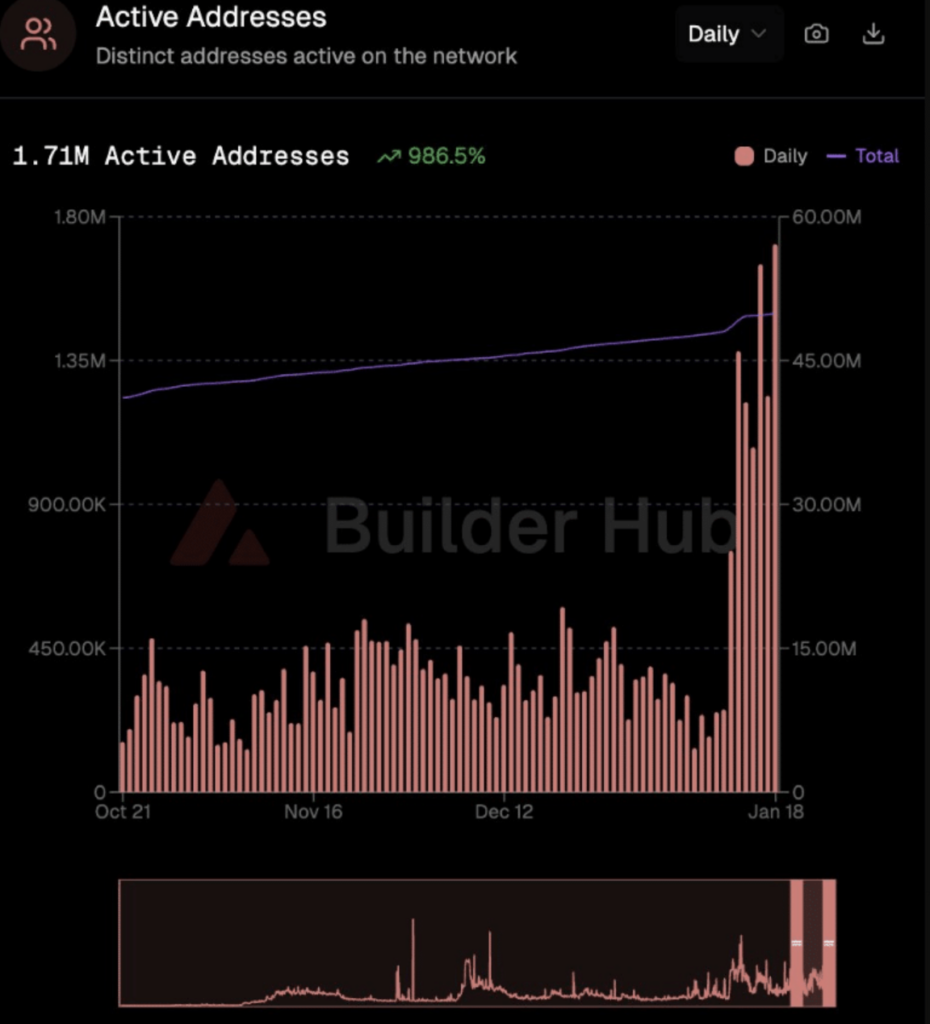

- Avalanche’s progress is being pushed by actual on-chain utilization, with Every day Energetic Addresses reaching 1.7 million throughout DeFi, tokenization, and RWAs

- Robust Taker Purchase dominance and whale accumulation close to $12 sign conviction slightly than short-term hypothesis

- AVAX stays structurally bullish above $12, with upside potential if key resistance ranges are reclaimed

Investor consideration has shifted away from fast worth spikes and towards one thing extra sturdy, precise challenge progress. Avalanche (AVAX) sits proper in the course of that shift. The community not too long ago crossed 1.7 million Every day Energetic Addresses, a quantity pushed much less by hype and extra by utilization throughout DeFi, tokenization, and real-world asset exercise. That form of participation doesn’t present up in a single day, and it’s one cause AVAX worth responded positively.

What makes this cycle really feel totally different is the standard of demand. As a substitute of speculative bursts, Avalanche’s progress is being backed by institutional filings, regular capital allocation, and actual deployments. As blockchain demand expands, Avalanche is quietly positioning itself as infrastructure constructed for scale, not simply pace. The larger query now’s whether or not this traction can maintain as AVAX seems forward into 2026.

Taker Purchase Stress Retains Bulls in Management

One of many clearer alerts supporting AVAX’s energy has been persistent Taker Purchase dominance. All through January 2026, aggressive consumers continued stepping in, particularly throughout dips. When worth slipped beneath $12, shopping for strain didn’t disappear. It truly elevated.

That habits issues. Rising Taker Purchase quantity throughout pullbacks often factors to conviction, not hesitation. Merchants weren’t ready for good entries, they had been committing capital. Even with short-term volatility, this regular circulation of buy-side aggression helped preserve AVAX supported and prevented deeper breakdowns. It’s not explosive momentum, however it’s constant, and that tends to age higher.

Why Whales Hold Defending the $12 Zone

On-chain information provides one other layer to the story. Whales have proven a transparent curiosity within the $12 area. When AVAX briefly dipped to $11.32, massive holders stepped in aggressively, absorbing provide and pushing worth again above help.

That form of habits often alerts long-term confidence slightly than short-term buying and selling. Whales don’t chase energy, they purchase the place they consider worth sits. Their exercise round $12 means that this stage is being handled as a structural ground, at the same time as broader market situations stay uneven. So long as that zone holds, draw back threat stays extra contained.

Can AVAX Carry This Momentum Ahead?

From a technical standpoint, AVAX has been holding its floor. Worth stays above $12, and the every day chart hints at an ascending triangle forming. That construction typically favors continuation, however provided that resistance offers means. The primary main hurdle sits close to $15.36. A clear break there may open the trail towards $18.52, with extension targets stretching as excessive as $24.18 if momentum builds.

Nonetheless, it’s not a one-way road. RSI and MACD have proven early indicators of cooling, suggesting the rally might must breathe. If help fails and AVAX drops beneath $11, the chart opens up draw back threat towards $8.60. For now, the setup leans constructive, however affirmation issues.

As AVAX strikes deeper into 2026, merchants and buyers alike shall be watching the identical factor: whether or not actual utilization, whale conviction, and sustained purchase strain can preserve tempo with rising worth expectations.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.