Jefferies strategist Chris Wooden has eliminated Bitcoin from his long-term mannequin portfolio, citing quantum computing as a danger that weakens Bitcoin’s store-of-value framing for pension-style allocations. VanEck head of analysis Matthew Sigel flagged the change on X, calling it a notable “downgrade” from one of many Road’s most generally adopted international strategists.

Veteran Strategist Chris Wooden Exits Bitcoin

Wooden wrote that he’s not positioning for an imminent value shock, however that the long-duration mandate is the place the quantum query bites. “Whereas GREED & concern doesn’t imagine that the quantum subject is about to hit the Bitcoin value dramatically within the close to time period, the shop of worth idea is clearly on much less strong basis from the standpoint of a long-term pension portfolio,” Wooden wrote. “For that cause, GREED & concern will take away the ten% allocation to Bitcoin this week with 5% reallocated to gold and 5% reallocated to gold-mining shares.”

The transfer is framed as danger administration slightly than a retrospective efficiency critique. Wooden famous that regardless of gold’s current outperformance versus Bitcoin, Bitcoin remained effectively forward since his mannequin first added it: Bitcoin had risen 325% since December 17, 2020, whereas gold bullion was up 145% over the identical interval.

In a be aware dated January 15, 2026, Wooden described how the quantum dialogue has moved from summary concept into one thing asset allocators are being requested to underwrite. “GREED & concern isn’t any pure mathematician,” he wrote, including that he has discovered himself pulled into conversations about “elliptic curves” due to “the rising focus in current months on the menace posed to the Bitcoin system by the arrival of quantum computing.”

His core declare is that the perceived timeline is compressing. He referenced rising concern that cryptographically related quantum computer systems may arrive “just a few years away slightly than a decade or extra,” and argued that any credible menace to Bitcoin’s safety mannequin is “probably existential” as a result of it undermines the store-of-value idea that underpins the “digital various to gold” narrative.

Wooden’s mechanism is easy: what’s computationally infeasible right this moment may grow to be tractable below CRQCs. He wrote that the present asymmetry, straightforward to derive a public key from a non-public key, successfully inconceivable to reverse, may collapse, with the time to derive a non-public key from a public key shrinking to “mere hours or days.”

Wooden stated the business is already debating potential responses, together with whether or not to “burn” quantum-vulnerable cash to guard system integrity or to do nothing and settle for the likelihood that weak cash may very well be stolen by entities with CRQCs. He introduced the dispute as a battle between preserving Bitcoin’s property-rights ethos and avoiding a coverage alternative that appears confiscatory, including that one pc scientist he spoke with described the do-nothing stance as a “suicidal delusion.”

Wooden stated his considering was knowledgeable by discussions with educated events and pointed to a Chaincode report as background studying, with out treating it as a near-term buying and selling set off.

VanEck’s Sigel Responds

Sigel’s takeaway was much less about whether or not quantum danger exists and extra about how totally different programs reply. When one person argued that quantum would wipe out financial institution accounts, e mail, and brokerage programs as effectively, Sigel dismissed that as “not a enough take anymore,” drawing a pointy distinction between improve paths and reversibility.

“Banks improve top-down; BTC requires years of consensus,” Sigel wrote. “Banks have an ‘undo’ button; BTC is finality-first.”

Sigel additionally linked the talk to a well-known fault line inside Bitcoin governance. Requested how consultant Wooden’s view is likely to be, Sigel stated that within the “Adam Again vs. Nic Carter” debate he’s “on Nic’s aspect,” and described Wooden’s determination as supporting proof. On the similar time, Sigel emphasised course of: he met Wooden in New York earlier than the be aware was printed and stated that though he disagreed with the conclusion, Wooden “got here to it actually.”

On positioning, Sigel stated he has “added quantum publicity” beforehand to VanEck’s Onchain Economic system ETF (NODE) and made small hedges, with a desire for “diversified” AI miners over “DATs / leveraged BTC,” whereas holding spot BTC by way of an ETF as the biggest holding. He framed the quantum subject as “solvable” and akin to a “wall of fear like blocksize wars,” slightly than a thesis-breaker.

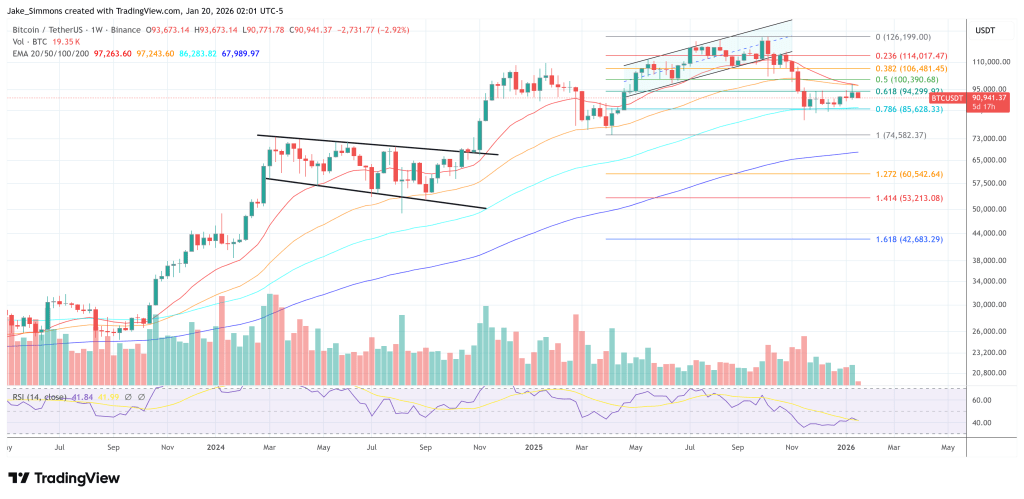

At press time, BTC traded at $90,941.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.