- Bermuda plans to pilot a totally on-chain nationwide monetary system

- Stablecoins like USDC will substitute conventional fee rails

- Schooling and phased adoption are central to the rollout

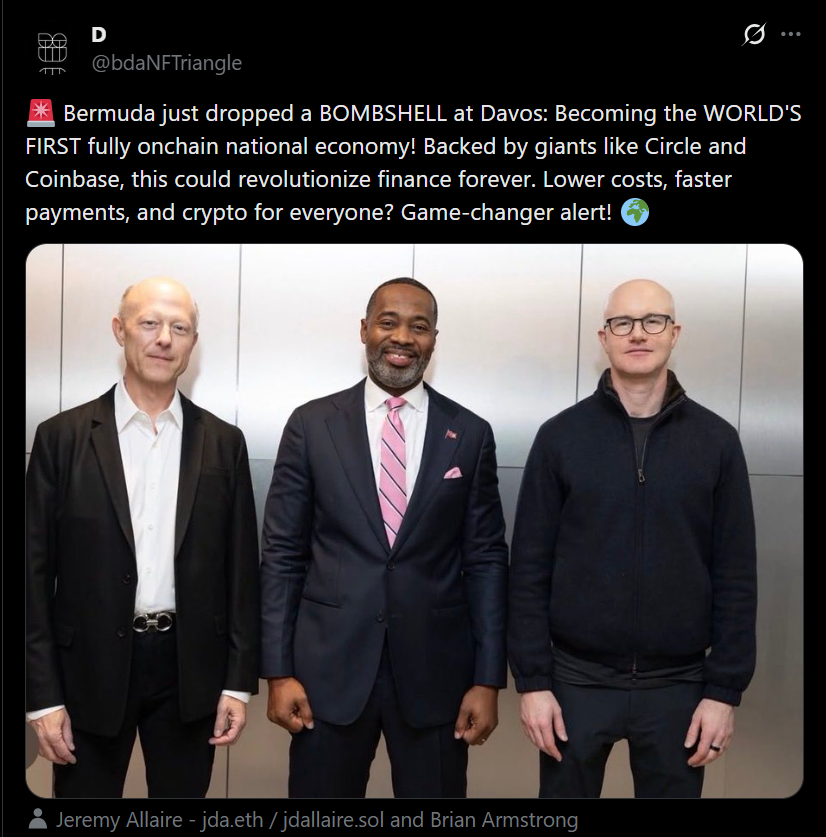

On the World Financial Discussion board in Davos, Bermuda quietly laid out one of many boldest monetary experiments tried by any nation to date. The island nation introduced a partnership with Coinbase and Circle geared toward pushing its total financial system onto blockchain rails. This isn’t a branding train or a pilot hidden in a sandbox. The objective is to make on-chain infrastructure a core a part of how cash strikes throughout the nation, from authorities funds to on a regular basis commerce.

Stablecoins Are the Spine, Not the Bonus

What makes Bermuda’s plan stand out is its specificity. Fairly than obscure guarantees about innovation, the initiative focuses on stablecoins, significantly USDC, as a alternative for conventional fee rails. Authorities departments will start piloting stablecoin funds, whereas native retailers are inspired to just accept USDC immediately. Banks and insurers are additionally being introduced into the combination, with tokenization instruments designed to modernize asset issuance and settlement.

For an island financial system that routinely absorbs excessive card charges and gradual settlement instances, the attraction is apparent. Stablecoins transfer quicker, value much less, and don’t depend on layers of intermediaries that quietly tax each transaction.

Schooling Comes Earlier than Full Adoption

Bermuda’s management seems to grasp that know-how alone doesn’t assure success. Belief, familiarity, and value matter simply as a lot. Earlier than any nationwide rollout, the nation plans to speculate closely in digital finance training and onboarding. Pilot applications are designed to ease residents into the system somewhat than forcing abrupt change. Even the USDC giveaways at Davos have been a sign of that phased strategy, testing habits earlier than scaling infrastructure.

A Sensible Experiment With Actual Dangers

There’s no denying the ambition right here. Bermuda is leveraging its crypto-friendly regulatory atmosphere to check whether or not decentralized techniques can help actual financial exercise at a nationwide stage. On the similar time, changing acquainted banking rails with blockchain-based instruments introduces danger. Not everyone seems to be snug with digital wallets, non-public keys, or stablecoin mechanics, and adoption gaps may shortly flip into social friction if not dealt with rigorously.

Why This Really Issues

The true measure of success gained’t be the announcement or the companions concerned. Will probably be whether or not this technique delivers cheaper funds, smoother settlement, and broader entry with out excluding individuals who battle to adapt. If Bermuda succeeds, it gives a working blueprint for different small nations and even bigger economies exploring alternate options to legacy finance. If it fails, it’s going to nonetheless present useful classes concerning the limits of on-chain techniques in the actual world.

The Greater Image

This transfer isn’t about chasing crypto hype cycles. It’s about rethinking the monetary spine of a rustic from the bottom up. Bermuda is betting that stablecoins and tokenization can do what conventional rails battle with in small, fee-sensitive economies. Whether or not that wager pays off will rely much less on know-how and extra on individuals, belief, and execution.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.